Bill Pay Checklist Printable: The Ultimate Guide to Staying Organized and Managing Finances Effectively

In the realm of personal finance, staying organized is paramount. One indispensable tool that can help you achieve financial tranquility is a printable bill pay checklist. This comprehensive guide will delve into the benefits, essential elements, and effective use of bill pay checklists, empowering you to take control of your finances and streamline your bill management process.

A printable bill pay checklist serves as a roadmap for managing your financial obligations. It provides a structured and convenient way to keep track of due dates, payment amounts, and account information, ensuring that you never miss a payment and avoid costly late fees.

Bill Pay Checklist Printable

Innit bruv, need a bit of help staying on top of your bills? Don’t fret, fam. We’ve got you covered with this bangin’ Bill Pay Checklist Printable. It’s the perfect way to keep track of all your payments and avoid any nasty surprises.

This checklist is a lifesaver, blud. It’s like having a personal assistant reminding you of all the important dates. Plus, it’s free, so you can save your dough for the important stuff, like a cheeky pint or a new pair of trainers.

Step 1: Get Your Bills in Order

First things first, you need to gather up all your bills. This includes everything from your rent or mortgage to your phone and internet. Once you have them all together, you can start filling out the checklist.

- Rent or mortgage

- Utilities (electricity, gas, water)

- Phone

- Internet

- Car payment

- Credit card payments

- Other (e.g., insurance, subscriptions)

Step 2: Fill Out the Checklist

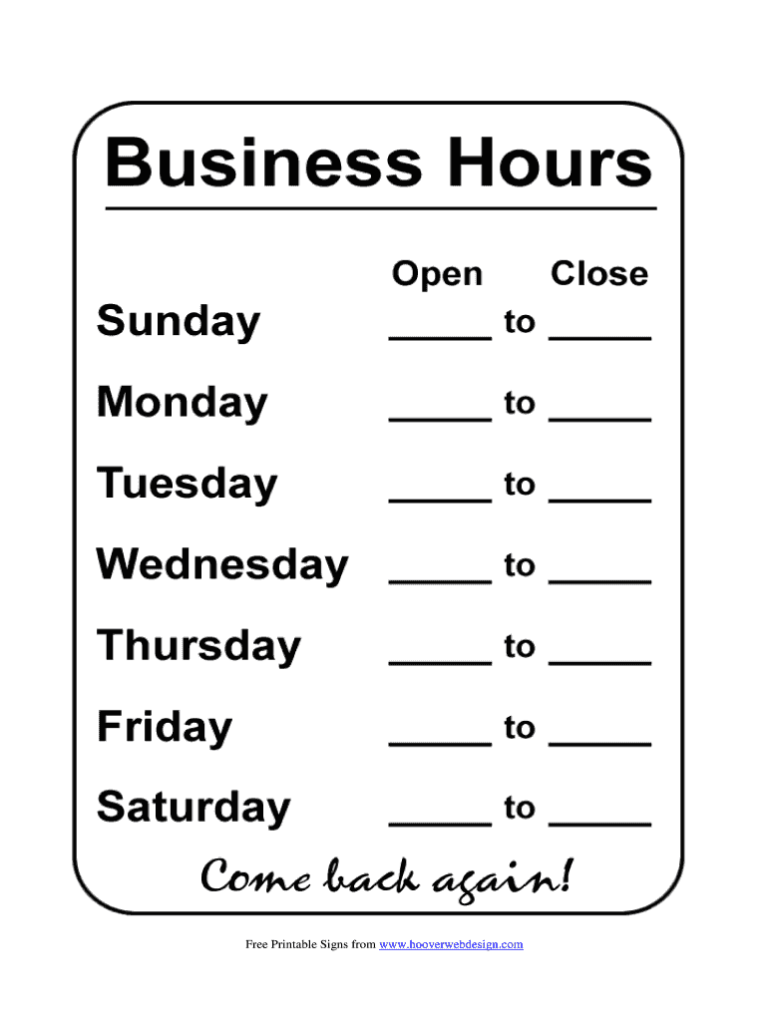

Now it’s time to fill out the checklist. For each bill, write down the following information:

- Name of the company or service

- Amount of the bill

- Due date

- Method of payment (e.g., online, mail, in person)

You can also use the checklist to track payments you’ve already made. Just put a checkmark in the “Paid” column.

Step 3: Stay Organized

Once you have filled out the checklist, keep it in a safe place where you can easily find it. This could be in a folder on your desk, in your purse, or even on the fridge.

Make sure to check the checklist regularly to make sure you’re not missing any payments. You can also use it to plan ahead and make sure you have enough money in your account to cover all your bills.

Questions and Answers

Can I customize a printable bill pay checklist to suit my specific needs?

Yes, the beauty of a printable bill pay checklist lies in its flexibility. You can tailor it to your unique requirements by adding custom categories, adjusting the layout, and incorporating notes that cater to your specific financial situation.

What are the benefits of integrating a bill pay checklist with financial tools?

Integrating your bill pay checklist with financial tools, such as budgeting apps and online banking platforms, offers enhanced convenience and streamlined bill management. This integration allows you to automatically track payments, set reminders, and access your checklist from anywhere, ensuring that you stay on top of your financial obligations.

How often should I review and update my bill pay checklist?

To maintain the effectiveness of your bill pay checklist, it’s recommended to review and update it regularly. This ensures that the information remains accurate and reflects any changes in your financial situation, such as new bills or changes in payment amounts.