Printable Budget Worksheet For Young Adults: A Guide to Financial Success

In the realm of personal finance, budgeting serves as a cornerstone for young adults embarking on their financial journeys. It’s not just about tracking numbers; it’s about taking control of your financial well-being, setting goals, and paving the way for a secure future.

This guide delves into the intricacies of creating a printable budget worksheet, empowering you with the tools and knowledge to manage your finances effectively. By understanding the key components, incorporating technology, and implementing smart strategies, you’ll gain the confidence to navigate the financial landscape with ease.

Understanding the Importance of Budgeting for Young Adults

Budgeting is a crucial skill for young adults to master, as it empowers them to take control of their financial future. By creating a budget, young adults can track their income and expenses, identify areas where they can save money, and make informed financial decisions.

Financial literacy is essential for young adults to achieve financial stability and avoid common pitfalls. According to a study by the National Endowment for Financial Education, only 38% of young adults have a basic understanding of personal finance. This lack of knowledge can lead to poor financial decisions, such as accumulating excessive debt or failing to save for the future.

Challenges Faced by Young Adults

Young adults often face unique financial challenges, including:

- Low income: Many young adults are just starting out in their careers and may have limited earning potential.

- High expenses: Young adults may have high expenses, such as rent, transportation, and entertainment.

- Lack of financial knowledge: Young adults may not have received adequate financial education and may not understand how to manage their money effectively.

Common Financial Mistakes

Common financial mistakes made by young adults include:

- Overspending: Spending more money than they earn, leading to debt.

- Not saving: Failing to set aside money for future goals, such as a down payment on a house or retirement.

- Using credit unwisely: Using credit cards to make purchases they cannot afford, resulting in high interest charges.

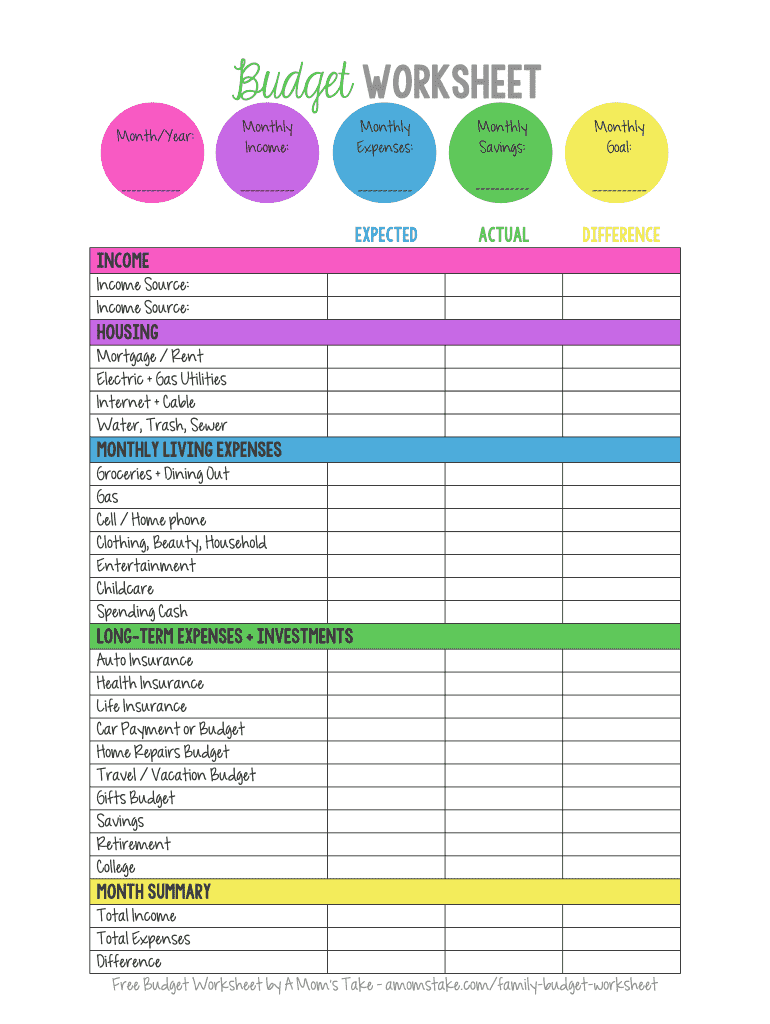

Key Components of a Printable Budget Worksheet

Yo, check it! A printable budget worksheet is like your financial roadmap, helping you keep track of your bread and butter. It’s got all the essential sections to get your dough sorted, so you can smash your money goals like a boss.

Income

First up, you’ve got income. This is the loot you’re bringing in, whether it’s from your job, side hustle, or any other way you’re earning dough. It’s crucial to list down all your income sources to get a clear picture of what you’re working with.

Expenses

Now, let’s talk expenses. This is where you’re spending your hard-earned cash. It can be anything from rent to bills, groceries to nights out. Break down your expenses into categories to see where your money’s going and where you can cut back if needed.

Savings

Saving is like putting money away for a rainy day or future goals. It’s essential to set aside some of your income for savings, even if it’s just a small amount. Every little bit helps!

Debt

If you’ve got any debts, like student loans or credit card bills, make sure to include them in your budget. List down the amount you owe, the interest rates, and any repayment plans you have in place. This will help you stay on top of your debts and avoid getting overwhelmed.

Designing a User-Friendly Budget Worksheet

To make your budget worksheet a breeze to use, consider the principles of user experience and design. Create a visually appealing, easy-to-navigate, and customizable worksheet. Use colors, fonts, and layout to boost readability and accessibility.

Visual Appeal

Use vibrant colors to highlight important categories and sections. Choose fonts that are clear and easy to read, avoiding fancy or overly decorative styles. Ensure a clean and uncluttered layout with ample white space to prevent visual fatigue.

Navigation

Organize the worksheet logically, with clear headings and subheadings. Use tabs or sections to separate different parts of the budget, such as income, expenses, and savings. Provide a legend or glossary to explain any unfamiliar terms or symbols.

Customizability

Allow users to tailor the worksheet to their specific needs. Include editable fields for income and expense categories, and provide options for adding custom categories. Consider offering different templates or themes to suit different preferences and styles.

Incorporating Technology and Automation

Intro paragraph

Budgeting can be made easier with the help of technology. There are a number of budgeting apps and software programs available that can help young adults track their spending, create budgets, and even automate certain financial tasks.

Explanatory paragraph

Using technology to manage finances has a number of advantages. First, it can help young adults stay organized and on top of their finances. Second, it can help them identify areas where they can save money. Third, it can help them make better financial decisions.

Budgeting Apps

There are a number of budgeting apps available that are tailored to the needs of young adults. Some of the most popular apps include:

- Mint: Mint is a free budgeting app that helps users track their spending, create budgets, and get personalized financial advice.

- YNAB (You Need A Budget): YNAB is a paid budgeting app that helps users create a zero-based budget. This means that every dollar that comes in is assigned to a specific category, so users can see exactly where their money is going.

- Goodbudget: Goodbudget is a free budgeting app that uses the envelope method. This means that users create virtual envelopes for each of their spending categories, and then allocate their money to those envelopes.

Strategies for Effective Budgeting

Budgeting is like a superpower for your money. It helps you control your spending, save for the future, and reach your financial goals. Here are some top tips to make budgeting a breeze:

Set clear financial goals. What do you want to save for? A new car? A down payment on a house? Having a goal will keep you motivated.

Track your expenses. Use a budgeting app or spreadsheet to keep tabs on where your money goes. This will help you identify areas where you can cut back.

Make adjustments as needed. Your budget is not set in stone. As your income and expenses change, you’ll need to adjust your budget accordingly.

Financial Education

Financial education is key to making smart money decisions. There are plenty of resources available to young adults, including online courses, workshops, and books.

Taking advantage of these resources can help you learn about budgeting, investing, and other important financial topics.

FAQs

What are the benefits of using a printable budget worksheet?

Printable budget worksheets provide a tangible and customizable way to track your income, expenses, savings, and debt. They offer a clear snapshot of your financial situation, allowing you to identify areas for improvement and make informed decisions.

How can I design a user-friendly budget worksheet?

Consider using visually appealing colors, fonts, and layout to enhance readability and accessibility. Keep it simple and organized, with clear sections for different categories. Customize it to meet your specific needs and preferences.

What are some tips for effective budgeting?

Set realistic financial goals, track your expenses diligently, and make adjustments as needed. Don’t be afraid to seek professional guidance if required. Remember, budgeting is a journey, not a destination.