Debt Payoff Printable Worksheet: A Comprehensive Guide to Financial Freedom

Navigating the labyrinth of debt can be daunting, but with the right tools, you can emerge victorious. A Debt Payoff Printable Worksheet is your compass, guiding you towards financial liberation. This invaluable resource empowers you to organize your debts, create a realistic payment plan, and monitor your progress towards a debt-free future.

By leveraging this worksheet, you’ll gain clarity and control over your financial obligations. It provides a structured framework for tracking your debts, prioritizing them, and developing a customized plan that aligns with your unique circumstances. With each payment you make, the worksheet will serve as a tangible reminder of your progress, fueling your motivation and keeping you accountable.

Introduction

Blud, don’t get caught slippin’ with your bread. You need to have a plan, fam. That’s where this wicked debt payoff printable worksheet comes in, yeah?

Trust me, it’s like having a peng road map for getting rid of your dosh worries. It’ll keep you on track and stop you from blowing your hard-earned cash on useless stuff.

Benefits of using a printable worksheet

-

It’s like a personal finance cheat code. You can track your debts, set goals, and see how you’re smashing it.

-

It’s portable, so you can take it with you everywhere. No more excuses for not staying on top of your money.

-

It’s free, fam. No need to spend a penny to get your finances in check.

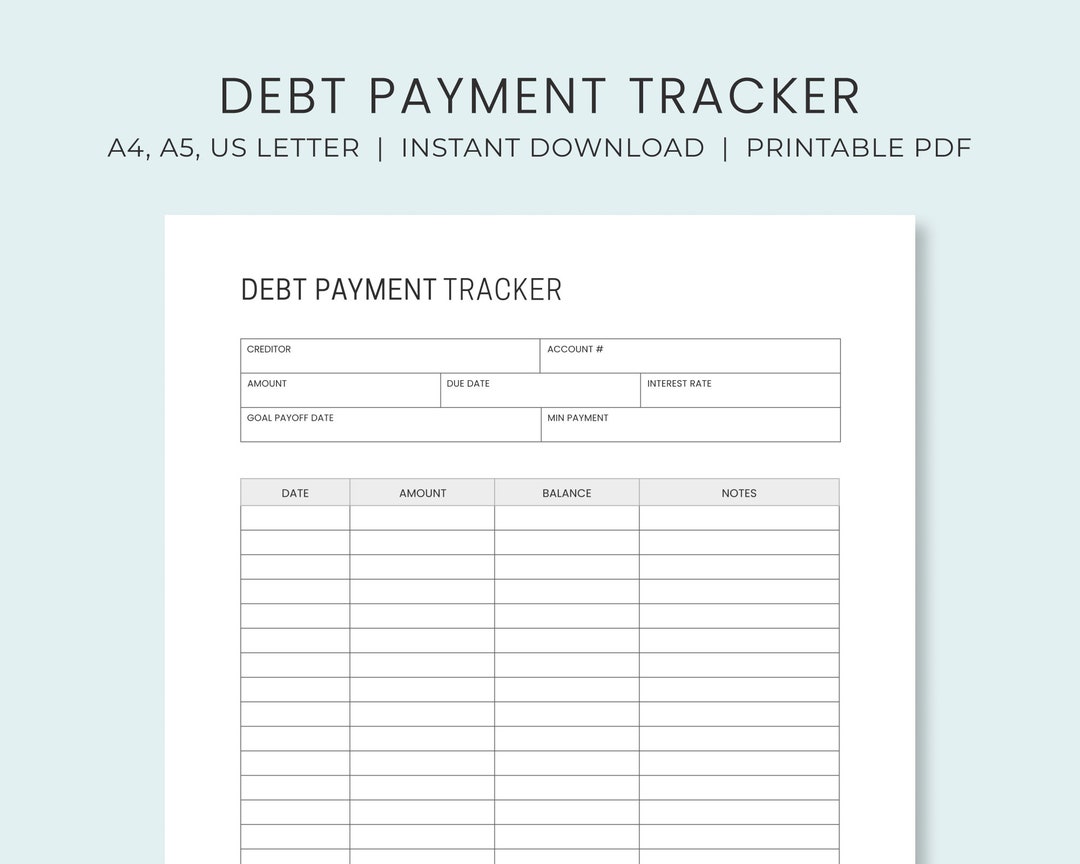

Worksheet Design

Our debt payoff worksheet is meticulously crafted to assist you in tackling your debts with ease. It features a user-friendly layout, ensuring you can track your progress effortlessly.

The worksheet is divided into clear sections, each serving a specific purpose. Let’s delve into each section and its significance:

Debt List

- List your debts: Jot down all your outstanding debts, including credit cards, loans, and overdrafts.

- Provide details: For each debt, record the balance, interest rate, and minimum payment.

Debt Repayment Plan

- Choose a debt repayment method: Select a debt repayment strategy that aligns with your financial goals, such as the debt snowball method or the debt avalanche method.

- Allocate extra payments: Determine how much extra money you can allocate towards debt repayment each month.

- Set realistic goals: Establish achievable targets for debt repayment, ensuring you stay motivated and on track.

Progress Tracker

- Track your payments: Record all debt payments made, including extra payments and interest charges.

- Monitor your balance: Keep a running total of your debt balances to visualize your progress.

- Stay accountable: Use the progress tracker to hold yourself accountable and stay committed to your debt repayment journey.

Debt Tracking

Tracking your debts is crucial for managing them effectively. This worksheet allows you to keep tabs on various types of debt, including credit cards, personal loans, and student loans.

To use the worksheet, simply list each debt you owe in the designated section. Include details such as the creditor, account number, balance, interest rate, and minimum payment. This comprehensive overview will help you understand your debt situation and make informed decisions about repayment.

Prioritizing Debts

Once you’ve listed your debts, you can prioritize them based on interest rate or urgency. High-interest debts, such as credit cards, should be tackled first to minimize interest charges. Alternatively, you may choose to focus on debts with smaller balances to gain momentum and build confidence.

Payment Planning

![]()

The key to successful debt repayment is to create a realistic payment plan. This involves assessing your income, expenses, and debt obligations to determine how much you can afford to pay towards your debt each month.

To create a payment plan, start by listing all of your debts, including the balance, interest rate, and minimum payment. Then, calculate your total monthly income and expenses. The difference between your income and expenses is the amount of money you can allocate towards debt repayment.

Allocating Funds

Once you know how much money you can afford to pay towards your debt, you need to decide how to allocate those funds. There are two main methods of debt repayment: the debt avalanche method and the debt snowball method.

- Debt avalanche method: With this method, you focus on paying off the debt with the highest interest rate first. This will save you the most money on interest in the long run.

- Debt snowball method: With this method, you focus on paying off the smallest debt first. This can help you stay motivated and make it easier to see progress.

Which method you choose is a matter of personal preference. The best method is the one that you can stick to consistently.

Determining Payment Amounts

Once you have chosen a debt repayment method, you need to determine how much to pay towards each debt each month. To do this, you can use a debt repayment calculator or create a budget. A budget is a plan that shows how you will allocate your income each month.

When creating a budget, be sure to include all of your essential expenses, such as housing, food, and transportation. You should also include some money for savings and entertainment.

Once you have created a budget, you can use it to determine how much money you can afford to pay towards your debt each month. Be sure to be realistic about how much you can afford to pay. If you try to pay too much, you may end up getting discouraged and giving up.

By following these tips, you can create a realistic payment plan and start to get out of debt.

Progress Monitoring

Tracking your progress towards debt payoff is crucial. It helps you stay motivated and on track, and allows you to make adjustments as needed.

Use the worksheet to monitor your payments and balances. Record each payment made, along with the date, amount, and balance remaining. This will give you a clear picture of your progress and help you identify any areas where you can improve.

Payment Tracking

- Record the date of each payment.

- Note the amount of each payment.

- Update the balance remaining after each payment.

Balance Monitoring

- Track the starting balance of each debt.

- Subtract payments made from the starting balance to calculate the current balance.

- Monitor the changes in your balances over time.

Tips and Strategies

Staying motivated and debt-free is a breeze with these top tips and tricks. We’ll show you how to slash expenses, boost your income, and steer clear of those pesky debt traps.

Buckle up, get ready to smash your debt goals, and live a life free from the chains of debt.

Staying Motivated

- Visualize your debt-free future: Picture yourself basking in the glory of being debt-free. This will keep you going when the going gets tough.

- Track your progress: Seeing how far you’ve come will give you a much-needed boost.

- Reward yourself: Celebrate milestones, both big and small. It’s all about keeping that motivation fire burning.

- Stay accountable: Share your goals with a friend or family member who’ll cheer you on and keep you on track.

Avoiding Debt Traps

- Say no to unnecessary expenses: Think twice before you splurge. Does it align with your debt-free goals?

- Beware of high-interest debt: Credit cards and payday loans can be a major drag on your finances.

- Don’t borrow more than you can repay: It’s tempting to take on more debt to solve your problems, but it can quickly spiral out of control.

Reducing Expenses

- Negotiate lower bills: Call your service providers and see if you can snag a better deal on your phone, internet, or utilities.

- Shop around for insurance: Compare quotes from different insurance companies to find the best coverage at the lowest cost.

- Cut back on non-essentials: Take a hard look at your expenses and identify areas where you can trim the fat.

Increasing Income

- Ask for a raise: If you’ve been with your company for a while and have been consistently delivering, it might be time to ask for a salary bump.

- Start a side hustle: Turn your hobbies or skills into a side income stream.

- Invest in yourself: Education and training can lead to higher-paying job opportunities.

Customization

The Debt Payoff Printable Worksheet is designed to be adaptable to each user’s unique circumstances. You can modify and tailor it to suit your specific needs, ensuring it becomes an effective tool for your debt repayment journey.

Customizing the worksheet involves making changes that align with your financial situation, debt repayment goals, and preferences. This may include modifying the layout, adding or removing sections, or adjusting the payment plan to match your income and expenses.

Modification Examples

- Adjusting the layout: Change the order of sections, add extra space for notes, or modify the font size and style to enhance readability.

- Adding or removing sections: Include a section for tracking additional debts, create a space for recording progress photos, or remove sections that are not relevant to your situation.

- Tailoring the payment plan: Set up a payment schedule that aligns with your income, adjust the amount allocated to each debt, or experiment with different debt repayment methods (e.g., snowball vs. avalanche).

Accessibility and Availability

The Debt Payoff Printable Worksheet is readily accessible and available in both online and printable formats.

Online Accessibility

- The worksheet can be accessed and downloaded directly from our website, ensuring convenient and immediate access.

- You can also find the worksheet by searching for “Debt Payoff Printable Worksheet” in popular search engines.

Printable Format

- For those who prefer a physical copy, the worksheet can be downloaded as a printable PDF file.

- Simply click on the “Download Printable Worksheet” button on our website, and the PDF file will be downloaded to your device.

Common Queries

How do I customize the Debt Payoff Printable Worksheet to suit my needs?

The worksheet is designed to be adaptable to your unique situation. You can modify the categories and fields to reflect your specific debts and financial goals. Additionally, you can adjust the payment schedule and amounts to align with your budget and repayment strategy.

Where can I find and download the Debt Payoff Printable Worksheet?

The worksheet is available online in various formats, including PDF and Excel. You can download it from reputable personal finance websites, budgeting apps, or directly from the provider.

How often should I update the Debt Payoff Printable Worksheet?

Regularly updating the worksheet is crucial for tracking your progress and making necessary adjustments. It’s recommended to update it at least monthly, or more frequently if you have significant changes in your financial situation.