Blank W9 Printable Form: A Comprehensive Guide

In the realm of financial transactions, the W9 form stands as a crucial document, facilitating the seamless exchange of information between individuals and entities. It empowers taxpayers to certify their identity and tax status, ensuring accurate reporting and compliance with regulations. With the advent of printable W9 forms, the process of obtaining and completing these essential documents has become more convenient and accessible than ever before.

This comprehensive guide delves into the intricacies of blank W9 printable forms, exploring their types, benefits, and proper completion methods. By providing valuable insights and practical tips, we aim to empower you with the knowledge and resources necessary to navigate the W9 form landscape with ease and confidence.

Definition of Blank W9 Printable Form

A W9 form is a document used in the United Kingdom to collect information from individuals or businesses for tax purposes. It is a requirement for independent contractors, freelancers, and self-employed individuals to provide their personal and business details to the person or company they are working for. The W9 form is crucial as it enables the payer to report payments made to the contractor to Her Majesty’s Revenue and Customs (HMRC). It helps ensure that the correct amount of tax is deducted and paid.

Using a blank W9 printable form is essential because it provides a standardized format for collecting the necessary information. It ensures that all the required details are captured and that the form is completed accurately. The printable form can be easily downloaded from HMRC’s website or various online sources, making it convenient for both the payer and the contractor.

There are several situations where a W9 form is required. Some common examples include:

- When an individual is hired as an independent contractor or freelancer.

- When a business hires a self-employed individual to provide services.

- When a company makes payments to a foreign contractor.

- When a person receives payments for prizes, awards, or scholarships.

Completing a W9 form is a straightforward process. The form typically includes sections for personal information, such as name, address, and contact details. It also includes sections for business information, such as business name, address, and taxpayer identification number. The form should be completed accurately and signed by the individual or business providing the services.

Types of Blank W9 Printable Forms

Blank W9 printable forms come in various types, each tailored to specific purposes and use cases. Understanding the different types available will help you choose the most suitable form for your needs.

Types of Forms

- W-9 Form (General): The standard W-9 form, also known as the “Request for Taxpayer Identification Number and Certification,” is used to collect taxpayer information for various tax-related purposes, such as reporting income and withholding taxes.

- W-9S Form (Simplified): The W-9S form is a simplified version of the W-9 form, designed for use in specific situations, such as when the recipient is a sole proprietor or single-member LLC with no employees. It requires less information compared to the W-9 form.

- W-8BEN Form (Non-U.S. Citizens): The W-8BEN form is used to collect tax information from non-U.S. citizens or residents who receive income from U.S. sources. It helps determine the appropriate tax withholding rate and provides certification that the recipient is eligible for reduced withholding.

- W-8ECI Form (E-Commerce): The W-8ECI form is specifically designed for use by e-commerce sellers who receive payments from online platforms. It simplifies the tax reporting process for these sellers and helps determine the appropriate tax treatment.

Benefits of Using a Blank W9 Printable Form

Using a blank W9 printable form offers numerous advantages, making it a valuable tool for businesses and individuals.

Time-saving and Effortless

The pre-formatted layout of a blank W9 printable form eliminates the need for manual data entry, saving significant time and effort. The standardized structure ensures consistency and accuracy, reducing the risk of errors and the need for rework.

Streamlined Processes and Enhanced Accuracy

By providing a standardized format, a blank W9 printable form streamlines the process of collecting and managing taxpayer information. The clear instructions and designated fields guide users through the form, minimizing the likelihood of missing or incomplete information. This ensures the accuracy and reliability of the data collected.

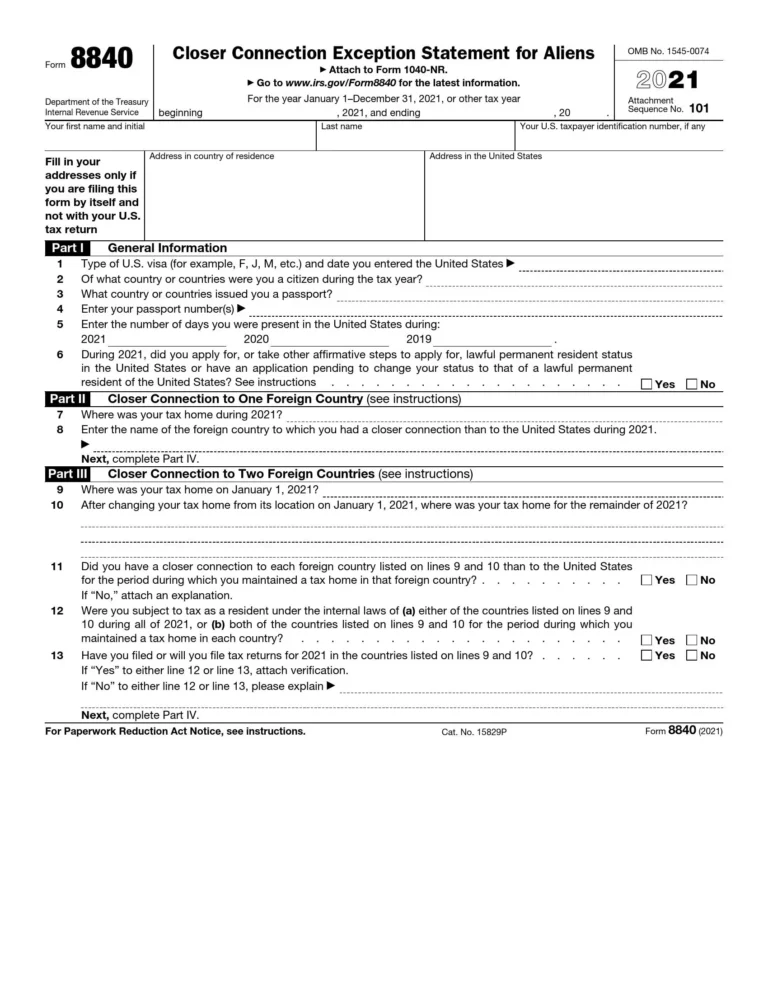

How to Fill Out a Blank W9 Printable Form

Filling out a blank W9 printable form is a straightforward process that requires accuracy to ensure proper tax reporting. Follow these steps to complete the form correctly:

Sections of the W9 Form

- Name and Address: Enter your legal name and business address.

- Taxpayer Identification Number (TIN): Provide your Social Security Number (SSN) or Employer Identification Number (EIN).

- Certification: Sign and date the form to certify the accuracy of the information provided.

Additional Tips:

- Use a blue or black pen to fill out the form.

- Write legibly and print clearly.

- If you are not sure about any information, refer to the IRS instructions or consult with a tax professional.

Where to Find Blank W9 Printable Forms

Finding blank W9 printable forms is easy, and it’s important to use official forms to ensure compliance and accuracy.

Here are some resources for finding and downloading blank W9 printable forms:

Reputable Websites

- Internal Revenue Service (IRS): https://www.irs.gov/forms-pubs/about-form-w-9

- Adobe: https://www.adobe.com/acrobat/online/pdf-forms-convert-pdf-to-form.html

- LegalNature: https://www.legalnature.com/documents/w-9-form

Government Agencies

- Social Security Administration (SSA): https://www.ssa.gov/forms/w9.pdf

- Department of Homeland Security (DHS): https://www.uscis.gov/i-9-central/form-i-9-resources/form-i-9-related-forms

Tips for Using Blank W9 Printable Forms

When using blank W9 printable forms, there are a few tips you should keep in mind to ensure accuracy and efficiency:

Complete the Form Carefully

- Make sure to fill out all required fields accurately and legibly.

- Double-check the information you provide, including your name, address, and taxpayer identification number.

- If you’re not sure about something, don’t guess – ask the person or organization requesting the form for clarification.

Keep a Copy for Your Records

Once you’ve completed the form, make a copy for your own records. This will come in handy if you need to refer to the information later or if the original is lost or damaged.

Store the Form Securely

Completed W9 forms contain sensitive information, so it’s important to store them securely. Keep them in a locked file cabinet or a secure digital location.

Be Aware of Scams

There are a number of scams that involve blank W9 forms. Be wary of any requests for your W9 information that come from unfamiliar sources. Only provide your W9 information to trusted individuals or organizations.

FAQ Summary

What is the purpose of a W9 form?

A W9 form is used to collect essential information from individuals or entities receiving payments for services rendered. It enables the payer to accurately report the payments made and withhold the appropriate amount of taxes, ensuring compliance with tax regulations.

When is a W9 form required?

A W9 form is generally required when a business or individual makes payments to independent contractors, freelancers, or other non-employees for services rendered. It is also required for certain types of payments made to corporations and other entities.

What are the different types of blank W9 printable forms available?

There are two primary types of blank W9 printable forms: the W9 form for individuals and the W9 form for businesses. Each type is designed to collect specific information relevant to the respective entity.

Where can I find blank W9 printable forms?

Blank W9 printable forms can be easily obtained from various sources, including the Internal Revenue Service (IRS) website, reputable online platforms, and financial institutions. It is important to use official forms to ensure compliance and accuracy.