Printable 941 Form 2022: A Comprehensive Guide to Filing Quarterly Federal Taxes

Navigating the intricacies of tax filing can be daunting, but understanding and completing the Printable 941 Form 2022 is crucial for businesses and individuals alike. This comprehensive guide will provide you with a clear understanding of the form’s purpose, sections, and filing requirements. Whether you’re a seasoned tax professional or new to the process, this guide will empower you to file your 941 Form accurately and efficiently.

The 941 Form, also known as the Employer’s Quarterly Federal Tax Return, is a vital document used to report and pay federal income taxes, Social Security taxes, and Medicare taxes. By understanding the form’s structure and the information it requires, you can ensure timely and accurate tax filing, avoiding potential penalties and ensuring compliance with tax regulations.

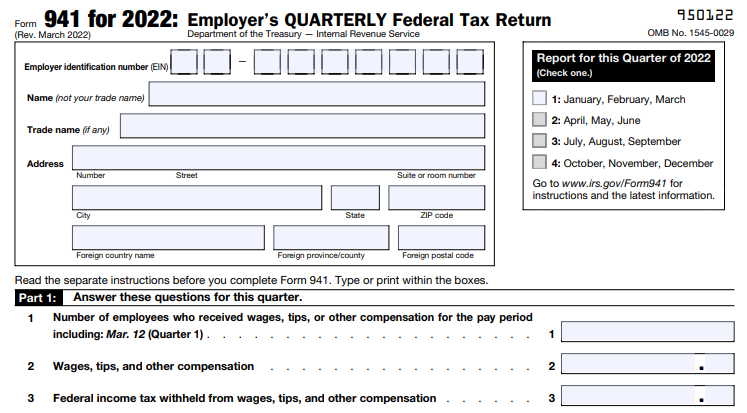

Printable 941 Form 2022 Overview

The 941 Form is a vital tax document for businesses in the United States, playing a crucial role in reporting and paying federal taxes. It’s designed to simplify the process of filing quarterly federal income tax returns, social security taxes, and Medicare taxes.

The 941 Form consists of several sections, each catering to specific tax-related information. The main sections include:

Employer Information

This section gathers basic details about the business, including its name, address, and Employer Identification Number (EIN).

Tax Period

This section specifies the specific quarter for which the taxes are being reported.

Tax Liability

Here, businesses calculate and report their tax liabilities, including income tax, social security tax, and Medicare tax.

Payments and Credits

This section records any payments made towards taxes, as well as any applicable tax credits.

Deposits

This section provides a summary of tax deposits made throughout the quarter.

Who Must File Form 941?

Businesses that meet certain criteria are required to file Form 941. These criteria include:

- Businesses that pay wages to employees

- Businesses that withhold federal income tax, social security tax, or Medicare tax from employee wages

- Businesses that are subject to the Federal Unemployment Tax Act (FUTA)

2. Steps for Downloading and Printing the Form

Downloading the IRS Form 941 is a straightforward process. Follow these steps to get started:

- Navigate to the IRS website.

- In the search bar, type “Form 941”.

- Click on the result that says “Form 941, Employer’s Quarterly Federal Tax Return”.

- On the Form 941 page, scroll down to the “Forms and Instructions” section.

- Click on the link for the version of Form 941 you need. The current version is Form 941 (Rev. January 2022).

- The form will open in a new tab. Click on the “Download” button to save the form to your computer.

Once you have downloaded the form, you can print it out using your preferred printer settings. Make sure to select the correct paper size and orientation before printing.

Filling Out the 941 Form

Filling out the 941 Form is a vital task for businesses with employees. To ensure accuracy and avoid errors, it’s crucial to follow the instructions carefully and gather the necessary information beforehand. This guide will provide you with a step-by-step breakdown of each section, tips for gathering information, and examples of how to fill out the form correctly.

Part 1: Employer Information

In this section, you’ll provide basic information about your business, including your legal name, address, Employer Identification Number (EIN), and contact details. Double-check that all information is accurate and up-to-date to avoid delays in processing.

Part 2: Tax Period and Payment Information

Indicate the tax period for which you’re filing (e.g., quarterly) and the due date. Calculate the total amount of taxes owed based on the wages and tips paid to employees during that period. Remember to include any applicable penalties or interest.

Part 3: Social Security and Medicare Taxes

Calculate and report the Social Security and Medicare taxes withheld from employees’ wages. Use the provided tables to determine the correct tax rates. Double-check your calculations to ensure accuracy.

Part 4: Federal Income Tax Withheld

Determine the amount of federal income tax withheld from employees’ wages. Refer to the provided tax tables to find the appropriate withholding amounts based on employees’ income and withholding allowances.

Part 5: Advance Earned Income Credit Payments

If applicable, report the amount of advance Earned Income Credit payments made to eligible employees. Refer to the instructions for details on calculating this amount.

Part 6: Nontaxable Payments

List any nontaxable payments made to employees, such as reimbursements for expenses or certain fringe benefits. This information is used to determine the correct tax liability.

Part 7: Adjustments and Credits

Report any adjustments or credits that affect the amount of taxes owed. This could include overpayments from previous quarters or tax credits claimed.

Part 8: Signature and Verification

An authorized representative of your business must sign and date the form. This verifies the accuracy of the information provided and indicates that you’re responsible for the contents of the return.

Filing and Submission Options

You have multiple options for filing your Form 941. You can choose the method that’s most convenient for you, whether it’s mailing it in, filing it electronically, or using a tax professional.

No matter which method you choose, it’s important to file your return on time. The deadline for filing Form 941 is the last day of the month following the end of the quarter. For example, the deadline for filing Form 941 for the first quarter of 2022 is April 30, 2022.

If you file your return late, you may be subject to penalties and interest. The penalty for late filing is 5% of the unpaid tax for each month or part of a month that your return is late, up to a maximum of 25%. The interest rate on unpaid taxes is the federal short-term rate plus 3%.

Electronic Filing

Electronic filing is the fastest and most accurate way to file your Form 941. When you e-file, your return is transmitted directly to the IRS, which reduces the chances of errors. You can also track the status of your return online.

There are several different ways to e-file Form 941. You can use the IRS’s e-file system, or you can use a tax software program that offers e-filing. If you use a tax software program, make sure that the program is IRS-approved.

To e-file Form 941, you will need to have a valid email address and a bank account number. You will also need to create an e-file account with the IRS.

Common Errors and Troubleshooting

Filling out the 941 Form can be a breeze, but it’s not immune to the occasional slip-up. Here’s a heads-up on some common pitfalls and how to steer clear of them:

First up, double-check that you’re using the correct form for your business. The 941 Form is meant for employers who pay wages, so if you’re self-employed or don’t have any employees, you’ll need a different form.

Next, make sure you’re entering all the required information accurately. Missing or incorrect information can delay the processing of your return or even lead to penalties.

Finally, be sure to file your return on time. The deadline for filing Form 941 is generally the last day of the month following the end of the quarter. Filing late can result in penalties and interest charges.

To help you out, we’ve put together a handy table summarizing some common errors and their corresponding solutions:

Common Errors and Solutions

| Error | Solution |

|---|---|

| Using the wrong form | Use the correct form for your business type (e.g., 941 Form for employers who pay wages) |

| Missing or incorrect information | Double-check that you have entered all the required information accurately |

| Filing late | File your return by the deadline (generally the last day of the month following the end of the quarter) |

Additional Resources and Support

If you need further assistance, here are some additional resources and support channels.

For more information and guidance, visit the official IRS website at www.irs.gov.

Contact Information

- You can reach the IRS helpline at 1-800-829-1040 for assistance with your tax-related queries.

- Alternatively, you can use the “Contact Us” page on the IRS website to submit your questions or concerns.

Professional Guidance

If you encounter any complex tax situations or have specific questions that require expert advice, consider seeking guidance from a tax professional, such as a certified public accountant (CPA) or an enrolled agent (EA).

FAQ Corner

What is the purpose of the 941 Form?

The 941 Form is used to report and pay federal income taxes, Social Security taxes, and Medicare taxes on a quarterly basis.

Who is required to file Form 941?

Businesses and individuals who have employees and are subject to federal income tax withholding, Social Security tax, or Medicare tax must file Form 941.

When is Form 941 due?

Form 941 is due on the last day of the month following the end of each quarter (April 30, July 31, October 31, and January 31).

What are the penalties for late filing?

Late filing of Form 941 can result in penalties and interest charges.

Can I file Form 941 electronically?

Yes, you can file Form 941 electronically using the IRS website or through an authorized e-file provider.