Printable 8332 Tax Form: A Comprehensive Guide to Filing and Troubleshooting

Navigating the intricacies of tax filing can be daunting, but understanding the purpose and proper completion of Form 8332 is crucial for accurate tax reporting. This guide will provide a comprehensive overview of Form 8332, including its significance, who needs to file it, the key information required, step-by-step instructions for completion, filing methods, common errors to avoid, and troubleshooting tips. Additionally, we’ll explore additional resources and tools available to assist you in completing this form with confidence.

Whether you’re a seasoned taxpayer or filing Form 8332 for the first time, this guide will empower you with the knowledge and resources necessary to ensure accurate and timely filing. By understanding the nuances of this form, you can avoid common pitfalls and ensure compliance with tax regulations.

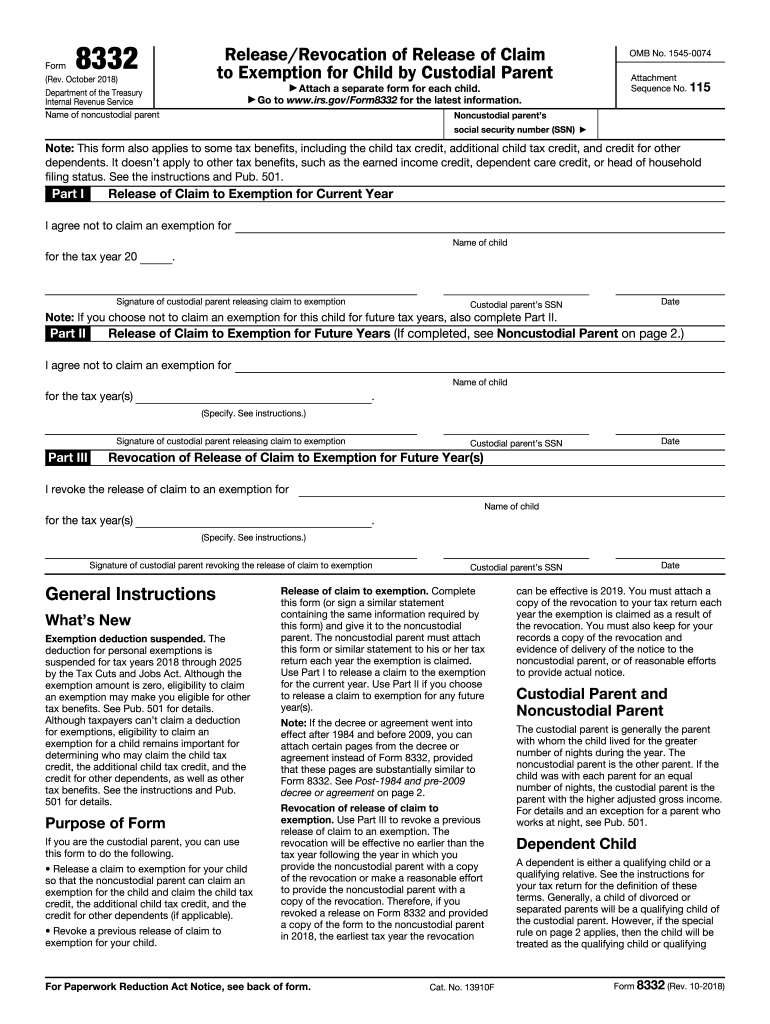

Form Overview

Yo, Form 8332 is the biz when it comes to tax. It’s like the snitch that tells the taxman how much you’ve earned and where you’ve splashed the cash. It’s a must-file for self-employed peeps and small biz owners who wanna keep the taxman off their backs.

Inside, you’ll spill the beans on your earnings, expenses, and all that jazz. It’s the lowdown on your financial year, innit? So, if you’re a freelancer, contractor, or the boss of your own show, get ready to fill in the blanks.

Who Needs to File?

If you’re one of these lot, you better not skip Form 8332:

- Self-employed peeps

- Contractors

- Small business owners

- Partnerships

- LLPs (Limited Liability Partnerships)

Key Info on Form 8332

Form 8332 wants the nitty-gritty on your finances. Make sure you’ve got these bits to hand:

- Your earnings from all sources

- Your allowable expenses

- Your capital allowances

- Your trading losses

- Your personal allowances

s for Completion

Filling out Form 8332 is a breeze, blud. Here’s a step-by-step guide to sort it out, fam:

Before you get started, grab a copy of the form from the IRS website or your local tax office. You can also find the form’s instructions there, which will come in handy if you’re feeling lost.

Part I: Personal Information

This section is where you spill the beans about who you are, init. Enter your name, address, and Social Security number. If you’re filing jointly with your other half, include their info too.

Part II: Income

Time to show off your earnings, mate. List all your income sources, including wages, self-employment income, and investments. Don’t forget to include any income from your side hustle or part-time gig.

Part III: Deductions and Credits

This is where you get to claim your deductions and credits, which can lower your tax bill. Common deductions include mortgage interest, charitable contributions, and state and local taxes. As for credits, you can claim the child tax credit or the earned income credit, among others.

Part IV: Tax and Payments

Now it’s time to calculate your tax liability. Use the tax table or the tax software to figure out how much you owe Uncle Sam. If you’ve overpaid, you’ll get a refund. If you owe more, you’ll need to pay up.

Filing Methods

There’s more than one way to skin a cat when it comes to filing your Form 8332. You can do it electronically or on paper. Each method has its own pros and cons, so it’s up to you to decide which one is best for you.

If you’re a bit of a tech whizz, electronic filing is the way to go. It’s quick, easy, and you can do it from the comfort of your own home. Plus, you’ll get your refund faster than if you file by paper.

However, if you’re not so comfortable with computers, or if you don’t have access to a computer, then paper filing is still an option. It’s not as convenient as electronic filing, but it’s still a valid way to get your taxes done.

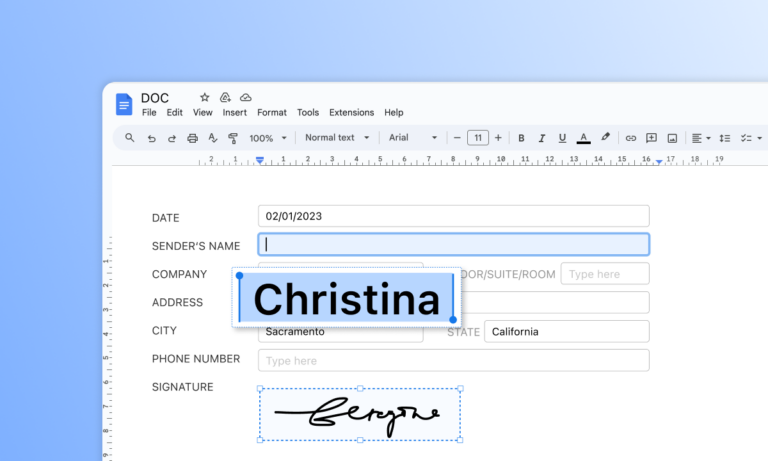

Electronic Filing

To file electronically, you’ll need to use tax software or a tax preparer. Tax software is available for both PCs and Macs, and it can help you prepare your taxes quickly and easily. Tax preparers can also help you file your taxes electronically, but they will charge a fee for their services.

Once you have your tax software or tax preparer, you can start the electronic filing process. You’ll need to enter your personal information, your income information, and your deductions and credits. Once you’ve entered all of your information, you can review your return and file it electronically.

There are several advantages to electronic filing. First, it’s quick and easy. You can file your taxes in minutes, and you don’t have to worry about mailing your return or waiting for it to be processed.

Second, electronic filing is more accurate than paper filing. Tax software can help you avoid mistakes, and it will automatically calculate your refund or balance due.

Finally, electronic filing is more secure than paper filing. Your tax return is encrypted when you file it electronically, so it’s less likely to be intercepted by identity thieves.

Paper Filing

To file by paper, you’ll need to download the Form 8332 from the IRS website. Once you have the form, you can fill it out by hand or using a typewriter. You’ll need to enter your personal information, your income information, and your deductions and credits.

Once you’ve filled out the form, you can mail it to the IRS. You can find the mailing address on the IRS website.

There are several disadvantages to paper filing. First, it’s not as convenient as electronic filing. You have to print out the form, fill it out, and mail it in. This can take a lot of time, especially if you’re not used to filing taxes.

Second, paper filing is more prone to errors. If you make a mistake on your return, it could delay your refund or even result in you owing more taxes.

Finally, paper filing is less secure than electronic filing. Your tax return is not encrypted when you mail it in, so it’s more likely to be intercepted by identity thieves.

Common Errors and Troubleshooting

Innit, filling out the 8332 form can be a bit of a mare, but don’t stress, fam. Let’s go through some of the common errors peeps make and how to dodge ’em.

First off, make sure you’re using the right version of the form. They change ’em up every now and then, so double-check the year on the one you’ve got.

Entering Incorrect Information

Watch out for entering the wrong info, like your name, address, or tax details. This can lead to delays in processing your form or even getting it rejected.

To avoid this, double-check everything before you submit it. Make sure you’re using the right format for your address and that your tax info is up to date.

Missing Required Information

Don’t leave any sections blank, even if you think they don’t apply to you. If a section is marked as required, fill it out or put “N/A” if it’s not relevant.

Missing info can also delay processing or rejection, so make sure you’ve ticked off everything on the checklist.

Incorrect Calculations

Get your calculator out and double-check your maths. Any errors in your calculations can mess up your tax bill and lead to penalties.

If you’re not confident in your maths skills, ask a friend or family member to give it a once-over before you submit it.

Troubleshooting Issues

If you’re having trouble with your 8332 form, here’s what to do:

- Check the IRS website: They’ve got a ton of info on the 8332 form and how to fill it out.

- Call the IRS helpline: Give ’em a ring if you’re stuck or need clarification on something.

- Seek professional help: If you’re really struggling, you can always reach out to a tax advisor or accountant.

Additional Resources

Need extra help with Form 8332? Check out these official resources and support materials.

The Internal Revenue Service (IRS) provides a wealth of information on Form 8332 on their website. You can find instructions, FAQs, and other helpful resources to guide you through the completion and filing process.

Contact Information

If you have any questions or need assistance with Form 8332, you can contact the IRS by phone, mail, or online. The IRS website also provides a list of local IRS offices where you can get in-person assistance.

Software and Tools

There are several software programs and online tools available that can help you complete Form 8332. These tools can automate calculations, check for errors, and generate completed forms that you can print and mail or file electronically.

Questions and Answers

Who is required to file Form 8332?

Form 8332 is required for taxpayers who receive non-cash charitable contributions, such as property or services, valued at $5,000 or more.

What is the deadline for filing Form 8332?

Form 8332 must be filed by the same deadline as your income tax return, typically April 15th.

Where can I obtain Form 8332?

Form 8332 can be downloaded from the IRS website or obtained by mail by calling 1-800-TAX-FORM (1-800-829-3676).

What are some common errors to avoid when completing Form 8332?

Common errors include failing to provide a complete description of the non-cash contribution, overvaluing the contribution, and not attaching the required documentation.