8840 Printable Form: A Comprehensive Guide to Understanding and Utilizing

In the realm of financial documentation, the 8840 Printable Form stands as a crucial instrument, facilitating various transactions and providing essential information to relevant parties. This guide delves into the intricacies of the 8840 Printable Form, exploring its purpose, usage, and the benefits it offers. By understanding the nuances of this form, individuals can navigate the financial landscape with confidence and efficiency.

The 8840 Printable Form serves as a vital tool for individuals and organizations alike. Its versatility extends to a wide range of financial transactions, making it an indispensable resource in today’s complex financial environment. This guide will provide comprehensive insights into the form’s structure, completion process, and submission requirements. By mastering the intricacies of the 8840 Printable Form, readers will gain the knowledge and skills necessary to utilize it effectively, ensuring accuracy, compliance, and successful outcomes.

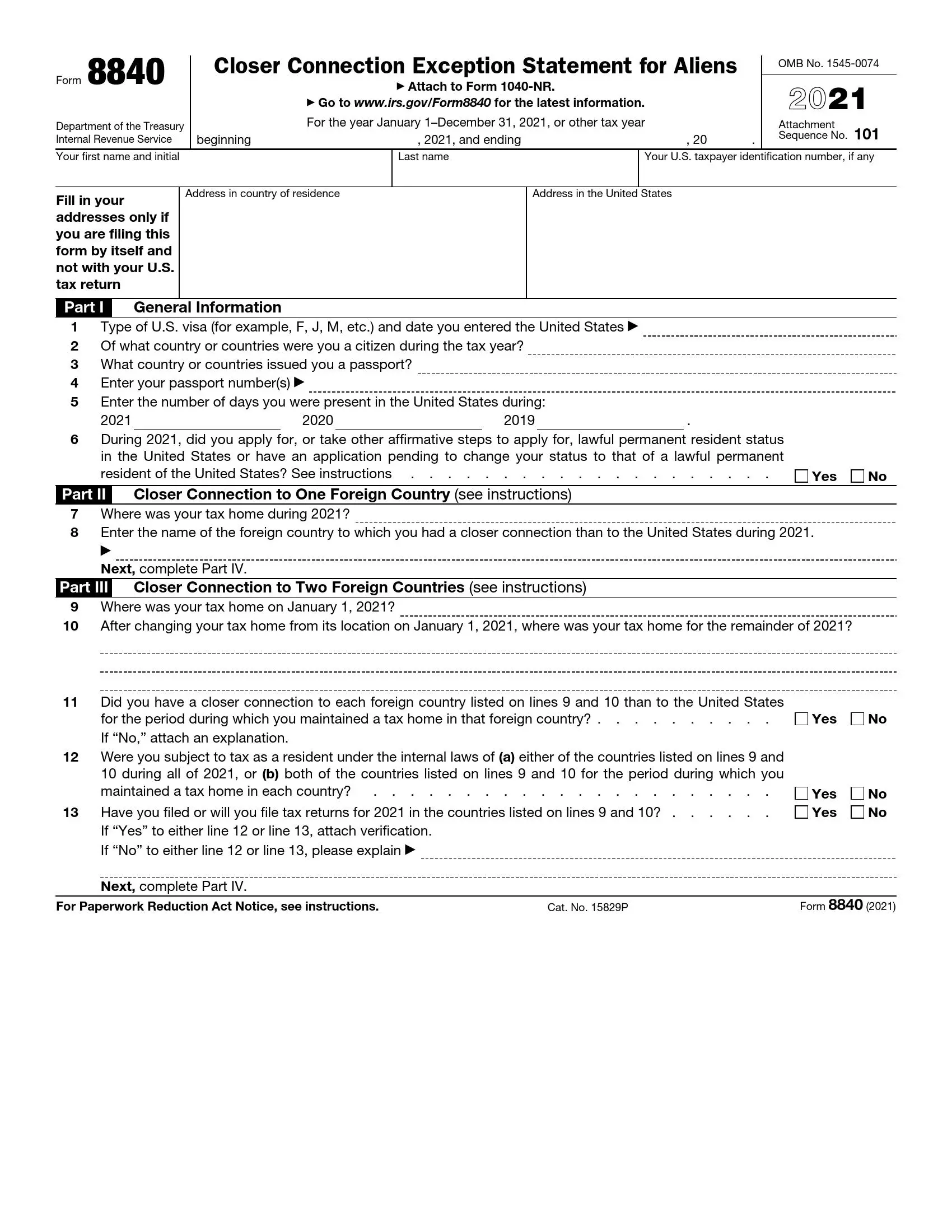

8840 Printable Form

The 8840 Printable Form is an official document issued by the Inland Revenue (IR) of the United Kingdom. It is a tax return form used by individuals to declare their income and calculate their tax liability for the previous tax year. The form is available online on the IR website and can be downloaded and printed for completion.

The 8840 Printable Form is designed to be easy to use and understand, even for those who are not familiar with the UK tax system. The form includes clear instructions and guidance on how to complete each section. It is important to note that the 8840 Printable Form is not the same as the 8840 Online Form. The Online Form is an electronic version of the Printable Form that can be completed and submitted online.

Benefits of using the 8840 Printable Form

There are several benefits to using the 8840 Printable Form, including:

- Convenience: The Printable Form can be downloaded and printed at any time, making it convenient for those who do not have access to a computer or the internet.

- Flexibility: The Printable Form can be completed at the individual’s own pace and in their own time.

- Accuracy: The Printable Form includes clear instructions and guidance, which helps to ensure that the form is completed accurately.

- Security: The Printable Form can be kept in a safe place, which helps to protect the individual’s personal and financial information.

How to Obtain an 8840 Printable Form

Obtaining an 8840 Printable Form is a straightforward process that can be done in various ways. Whether you prefer the convenience of online access, the personal touch of in-person assistance, or the traditional method of mail correspondence, there’s an option to suit your needs.

Online

The internet offers a quick and easy way to obtain an 8840 Printable Form. Simply visit the official website of the relevant government agency or a reputable online form provider. From there, you can download the form as a PDF file, which you can then print and fill out at your convenience.

In-Person

If you prefer face-to-face interaction, you can visit a local government office or library to obtain an 8840 Printable Form. These locations often have a supply of forms available for public use, and staff may be able to provide assistance if needed.

For those who prefer a more traditional approach, you can request an 8840 Printable Form by mail. Contact the relevant government agency and provide your name, address, and a request for the form. The form will be mailed to you within a few days.

Filling Out the 8840 Printable Form

Alright, let’s get this sorted. Filling out the 8840 Printable Form is a doddle if you know what you’re doing. We’ll break down each section so you can fill it out like a pro.

Sections of the 8840 Printable Form

The 8840 Printable Form has a few sections, each with its own purpose. There’s the personal info section, the details about your income, and the bit where you put down what you want to claim. It’s all pretty straightforward.

Filling Out the Personal Info Section

- Make sure your name and address are spot on. The taxman needs to know where to send your dosh.

- Pop in your National Insurance number. It’s like your secret code for tax.

- Tick the box that matches your relationship status. Single, married, or somewhere in between.

Filling Out the Income Details Section

- Show the taxman what you’ve earned from your job or business. It’s all about those numbers.

- Don’t forget to include any other income, like benefits or investments. Every penny counts.

Filling Out the Claims Section

- This is where you tell the taxman what you’re claiming back. It could be for expenses, allowances, or anything else you’re entitled to.

- Make sure you have the right codes and references. It’s like a secret handshake with the taxman.

Common Mistakes to Avoid

- Don’t leave any sections blank. The taxman needs all the info to do his calculations.

- Double-check your numbers. Mistakes can lead to delays or even fines.

li>Don’t try to be clever. Just fill out the form honestly and accurately.

There you have it, mate. Filling out the 8840 Printable Form is a piece of cake. Just follow these steps and you’ll be sorted in no time.

Submitting the 8840 Printable Form

Submitting the 8840 Printable Form correctly and on time is crucial to ensure your application is processed efficiently. There are several methods to submit the form:

By Mail

Send the completed form to the address provided on the form. Ensure you use the correct postage and packaging to prevent delays or damage during transit.

In Person

Visit the relevant government office or agency and submit the form directly to an authorized representative. This method allows you to receive immediate confirmation of receipt.

Online Submission

If available, you may be able to submit the 8840 Printable Form electronically through a dedicated online portal. Check the form instructions for specific details and requirements.

Importance of Correct and Timely Submission

Submitting the form correctly and on time is essential for the following reasons:

- Ensures your application is processed without delays.

- Prevents the rejection of your application due to incomplete or incorrect information.

- Allows for timely consideration of your application.

Tips for Successful Submission

To ensure the successful receipt and processing of your 8840 Printable Form, follow these tips:

- Complete all sections of the form accurately and legibly.

- Provide all necessary supporting documentation as requested.

- Keep a copy of the submitted form for your records.

- Track the status of your application using the provided tracking number or online portal.

Tracking the Status of a Submitted 8840 Printable Form

Yo, check it, once you’ve sent off that 8840 Printable Form, you’ll wanna know what’s up with it, innit? Here’s the lowdown on how to track its progress like a pro.

There are a few ways to keep tabs on your form:

Online

Hop online and visit the official website. You’ll need your form number and some other bits of info to log in and check the status. It’s like tracking your mates on Insta, but for tax forms.

By Phone

If you’re more of a chatterbox, you can give the tax office a ring-a-ding. They’ll be able to give you the goss over the blower. Just make sure you’ve got your form number handy.

By Mail

Fancy some snail mail? Send a letter to the tax office with your form number and a polite request for an update. It might take a bit longer than the other methods, but it’s still a solid option.

No matter which way you choose, it’s always a good idea to keep a copy of your form for your records. That way, if there’s any hanky-panky, you’ve got proof of what you sent.

Additional Resources

Explore a range of resources to delve deeper into the intricacies of the 8840 Printable Form.

Official Websites

- Internal Revenue Service (IRS): Provides comprehensive information, downloadable forms, and guidance on the 8840 Printable Form.

- Government Publishing Office (GPO): Offers access to the official text of the 8840 Printable Form.

Informative Articles

- TaxSlayer: A detailed article explaining the purpose, eligibility, and completion of the 8840 Printable Form.

- TurboTax: A step-by-step guide to filling out the 8840 Printable Form, with examples and tips.

Educational Videos

- YouTube (IRS): An official video tutorial from the IRS on completing the 8840 Printable Form.

- TaxAct: A comprehensive video guide to understanding the 8840 Printable Form and its implications.

These resources offer valuable insights, clarifying any doubts and empowering you to confidently navigate the complexities of the 8840 Printable Form.

FAQ Corner

What is the purpose of the 8840 Printable Form?

The 8840 Printable Form is a versatile document used for various financial transactions, including the transfer of assets, reporting of income, and claiming deductions.

How can I obtain an 8840 Printable Form?

The 8840 Printable Form can be obtained online, in-person at relevant government offices, or by mail. The most convenient method will depend on individual circumstances.

What are the common mistakes to avoid when filling out the 8840 Printable Form?

Common mistakes include incorrect or incomplete information, missing signatures, and failure to provide supporting documentation. Careful attention to detail and thoroughness are crucial.

How can I track the status of a submitted 8840 Printable Form?

The status of a submitted 8840 Printable Form can be tracked online, by phone, or by mail. The specific method will vary depending on the submission method used.