1099 Printable Form 2023: A Comprehensive Guide for Independent Contractors

Navigating the complexities of tax reporting can be daunting, especially for independent contractors. The 1099 Printable Form 2023 plays a crucial role in this process, providing a standardized method for reporting income earned from self-employment. In this comprehensive guide, we will delve into the intricacies of this form, ensuring that you have a clear understanding of its purpose, types, and filing requirements.

Whether you’re a seasoned freelancer or just starting out on your entrepreneurial journey, this guide will empower you with the knowledge and confidence to complete the 1099 Printable Form 2023 accurately and efficiently. So, let’s dive right in and unravel the mysteries surrounding this essential tax document.

Definition of 1099 Printable Form 2023

The 1099 Printable Form 2023 is a tax document that reports income earned from self-employment, freelancing, or other non-employee work.

Individuals and businesses that make payments to non-employees for services rendered are required to file Form 1099 with the Internal Revenue Service (IRS) and provide a copy to the recipient.

Who is Required to File?

You are required to file Form 1099 if you made payments of $600 or more to a non-employee during the tax year for:

- Professional services (e.g., legal, medical, accounting)

- Rent

- Royalties

- Prizes and awards

- Payments to an attorney

- Medical and health care payments

Types of 1099 Forms

1099 forms are used to report various types of income that do not fall under the traditional W-2 wage reporting system. There are several different types of 1099 forms, each designed to report a specific category of income.

The most common types of 1099 forms are:

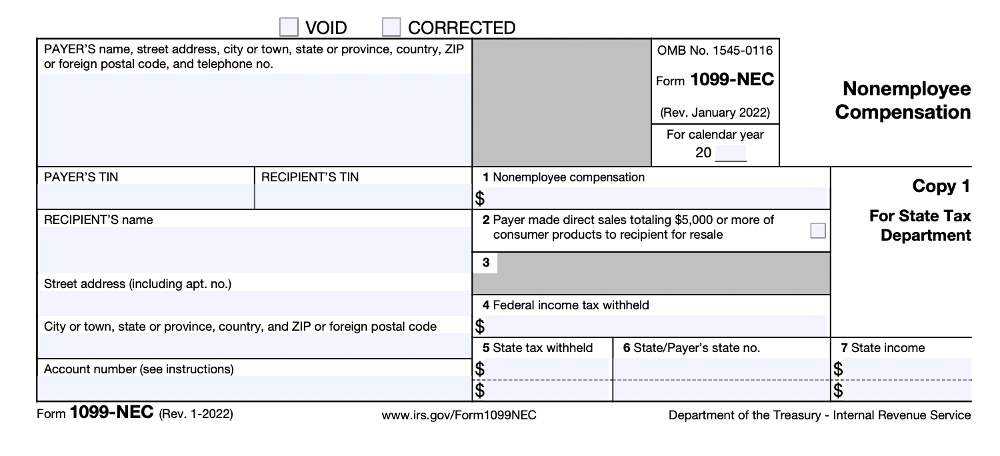

1099-NEC

Form 1099-NEC is used to report nonemployee compensation, such as payments made to independent contractors, freelancers, and gig workers. This form replaced Form 1099-MISC for reporting nonemployee compensation in 2020.

1099-MISC

Form 1099-MISC is used to report miscellaneous income, such as payments made to individuals for services performed outside the scope of their regular employment. This form can be used to report income from self-employment, prizes, awards, and other types of miscellaneous income.

1099-K

Form 1099-K is used to report payments made to individuals for the sale of goods or services through a third-party payment network, such as PayPal or Venmo. This form is required to be issued to individuals who receive payments totaling $600 or more in a calendar year.

s for Completing the Form

Completing the 1099 Printable Form 2023 is a breeze if you follow these simple steps. This guide will provide clear s for filling out each section of the form, ensuring you submit accurate information.

Before you start, gather all the necessary information, including your tax identification number (TIN), the recipient’s TIN, and the total amount of income paid. With these details at hand, let’s dive into the step-by-step guide.

Step 1: Identifying the Form

- Select the appropriate 1099 form based on the type of income you’re reporting. There are different forms for various income categories, such as nonemployee compensation, dividends, and interest.

- Fill in the tax year for which you’re reporting the income.

Step 2: Payer’s Information

- Enter your name, address, and TIN as the payer.

- Indicate whether you’re an individual or a business.

Step 3: Recipient’s Information

- Provide the recipient’s name, address, and TIN.

- Indicate the recipient’s status, whether they’re an individual, business, or other entity.

Step 4: Income Details

- Enter the total amount of income paid to the recipient.

- Specify the income type, such as wages, rent, or royalties.

Step 5: Additional Information

- Complete any additional sections or boxes that apply to the specific 1099 form you’re using.

- Provide any necessary explanations or notes.

Step 6: Signing and Submitting

- Sign and date the form.

- Make copies for your records and submit the original to the recipient by the specified deadline.

By following these s carefully, you can ensure your 1099 Printable Form 2023 is filled out accurately and submitted on time.

Where to Obtain the Form

Acquiring the 1099 Printable Form 2023 is a breeze, innit? You can nab it online or offline, no sweat.

Online Sources

- IRS Website: The official IRS website is your go-to spot for all things tax-related, including the 1099 Printable Form 2023. Just head over to irs.gov and search for “1099 Printable Form” to download it straight to your comp.

- Tax Software Providers: If you’re using tax software like TurboTax or H&R Block, you can usually download the 1099 Printable Form 2023 right from their website or software interface. Sorted!

Offline Sources

- Local IRS Office: Pop into your local IRS office and ask for a copy of the 1099 Printable Form 2023. They’ll be happy to oblige.

- Libraries and Post Offices: Some libraries and post offices also stock the 1099 Printable Form 2023. Worth checking out if you prefer a physical copy.

Filing Deadlines

The 1099 Printable Form 2023 filing deadlines vary depending on the type of income being reported. It’s crucial to adhere to these deadlines to avoid penalties and ensure timely processing of your tax return.

General Deadline

For most types of income, the filing deadline for the 1099 Printable Form 2023 is April 18, 2023. This includes income from self-employment, independent contracting, and prize winnings.

Exceptions

There are some exceptions to the general filing deadline. For example, if you file your taxes using the cash basis method, you have until October 15, 2023, to file Form 1099-MISC. Additionally, if you live in Maine or Massachusetts, the filing deadline is April 15, 2023.

Penalties

Failure to file Form 1099-MISC by the deadline can result in penalties. The penalty for late filing is $50 per day, up to a maximum of $250,000. Additionally, you may be required to pay interest on any unpaid taxes.

Penalties for Late Filing

Late filing of the 1099 Printable Form 2023 can result in severe penalties. Failure to file the form by the specified deadline may incur substantial fines.

Consequences of Non-compliance

The Internal Revenue Service (IRS) imposes significant penalties for late filing of 1099 forms. These penalties vary depending on the number of days the form is late and the number of forms not filed on time.

– Failure to File Penalty: For each 1099 form not filed by the deadline, the IRS may impose a penalty of up to £325.

– Late Filing Penalty: An additional penalty of up to £5 per day may be charged for each day the form is late, up to a maximum of £26,250 per year.

– Intent to Evade Penalty: If the IRS determines that the late filing was intentional, a penalty of up to 50% of the taxes owed may be imposed.

Common Mistakes to Avoid

When completing the 1099 Printable Form 2023, individuals often make common mistakes that can lead to delays in processing or penalties. Here are some of the most common mistakes to avoid:

Inaccurate Information

Ensure that all the information provided on the form is accurate and up-to-date. This includes your personal information, the recipient’s information, and the income details. Mistakes in any of these fields can delay the processing of your form.

Missing or Incomplete Information

Make sure to complete all the required fields on the form. Leaving any fields blank or incomplete can also delay the processing of your form.

Incorrect Filing Deadline

Be aware of the filing deadline for the 1099 Printable Form 2023. Missing the deadline can result in penalties and interest charges.

Incorrect Form Used

There are different types of 1099 forms available, each designed for a specific type of income. Make sure to use the correct form for the income you received. Using the wrong form can lead to incorrect tax calculations and penalties.

Incorrect Recipient Information

Provide the correct name, address, and Taxpayer Identification Number (TIN) of the recipient. Mistakes in any of these fields can delay the processing of your form or result in the recipient not receiving the correct tax information.

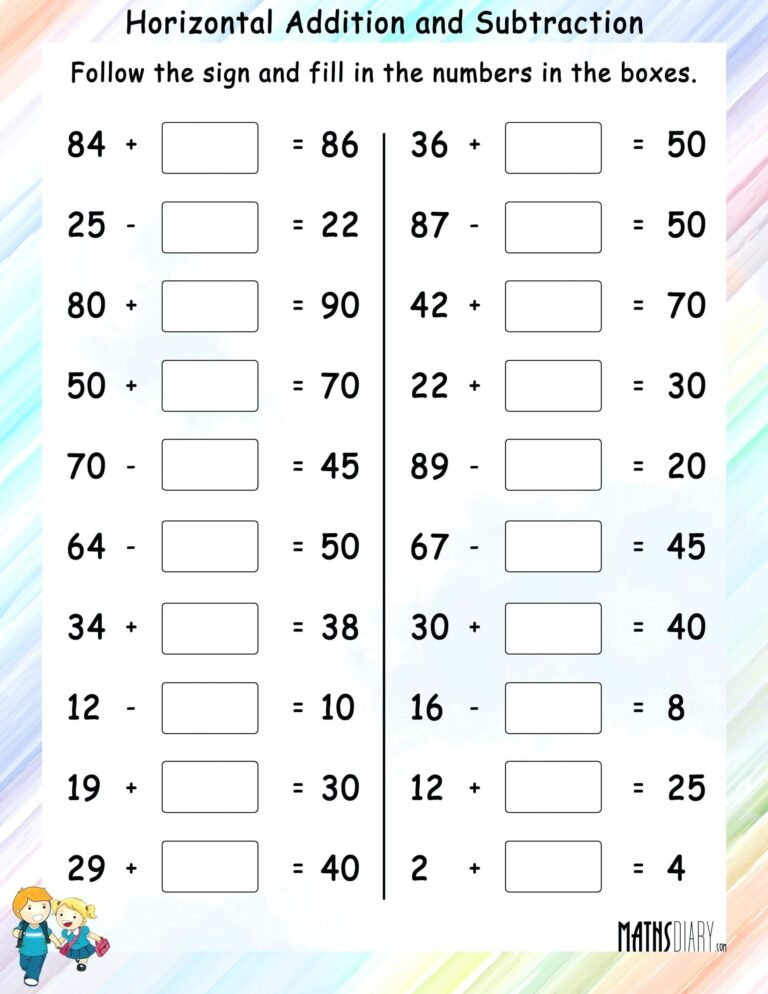

Mathematical Errors

Double-check all your calculations on the form. Any mathematical errors can affect your tax liability and result in penalties.

Not Keeping a Copy

Make sure to keep a copy of the completed 1099 Printable Form 2023 for your records. This can be helpful if there are any questions or disputes about the information provided on the form.

Helpful Answers

Who is required to file Form 1099-NEC?

Businesses and individuals who pay nonemployees $600 or more for services performed in the course of their trade or business.

What is the difference between Form 1099-MISC and Form 1099-K?

Form 1099-MISC is used to report miscellaneous income, such as rent or prizes, while Form 1099-K is specifically for reporting payments made to independent contractors for the sale of goods or services through a third-party payment network.

Where can I obtain a 1099 Printable Form 2023?

You can download the form from the IRS website or obtain it from your local IRS office or a tax software provider.

What are the penalties for late filing of Form 1099-MISC?

Late filing penalties can range from $50 to $270 per form, depending on the length of the delay.

What are some common mistakes to avoid when completing Form 1099-NEC?

Common mistakes include misclassifying employees as independent contractors, failing to report all income, and providing incorrect taxpayer information.