1095-A Printable Form: A Comprehensive Guide for Individuals and Employers

The 1095-A Printable Form is an essential document that provides individuals and employers with crucial information regarding health insurance coverage. This comprehensive guide will delve into the purpose, structure, eligibility criteria, filing requirements, distribution process, and common errors associated with the 1095-A form. By understanding these aspects, individuals and employers can ensure accurate and timely filing, ensuring compliance with healthcare regulations and facilitating seamless tax preparation.

The 1095-A form plays a vital role in the healthcare system, enabling individuals to prove their health insurance coverage and employers to report employee health insurance information to the government. It is important to note that the 1095-A form is distinct from the 1095-B and 1095-C forms, which are used by insurance companies and employers, respectively.

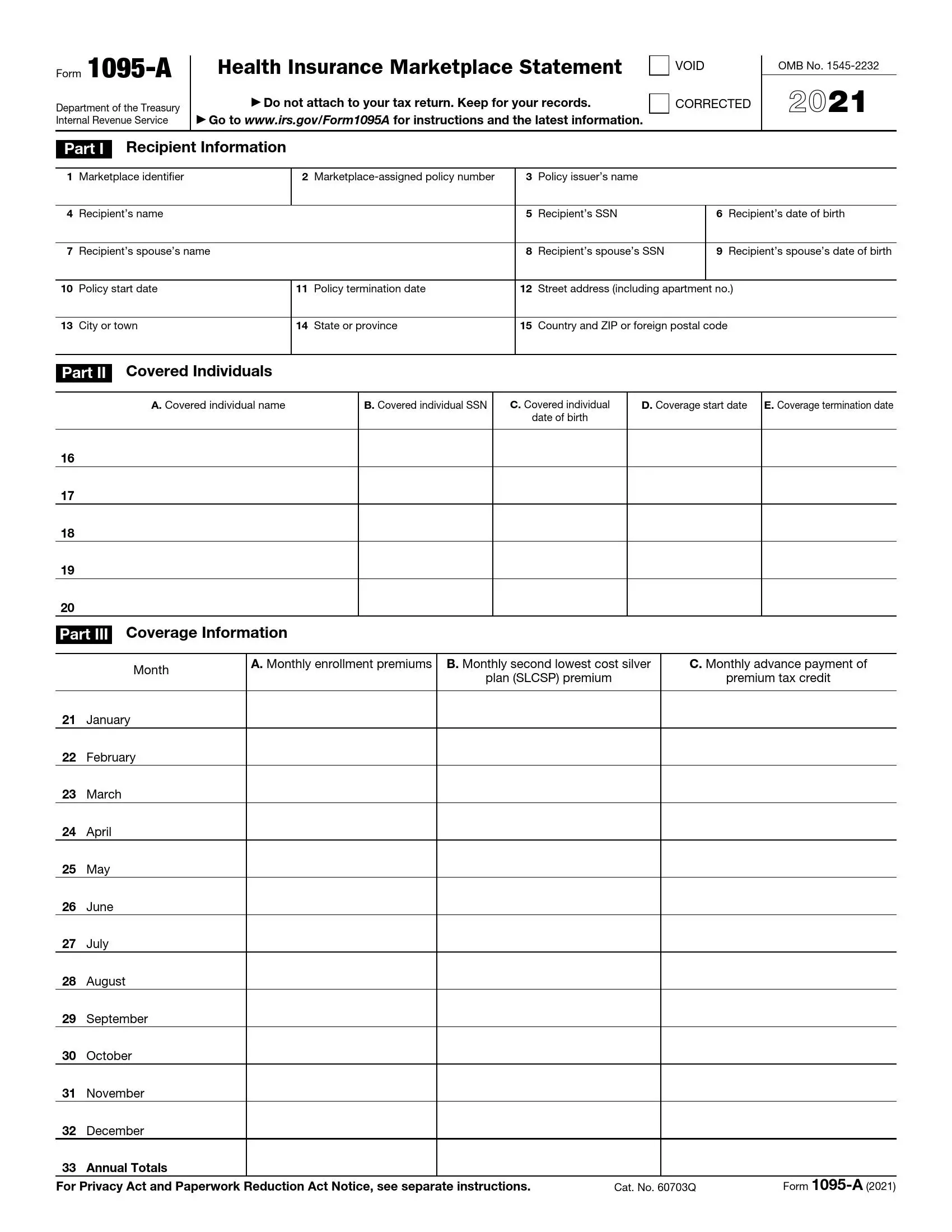

Form Overview

The 1095-A form, also known as the Health Insurance Marketplace Statement, is a document that provides individuals and employers with important information about their health insurance coverage. It is issued by health insurance companies and employers to individuals and employers who have purchased health insurance through the Health Insurance Marketplace or through an employer-sponsored plan.

The 1095-A form includes information such as the individual’s or employer’s name, address, and Social Security number; the health insurance plan’s name and policy number; the coverage period; and the amount of any premium assistance received. This information is used by the individual or employer to file their taxes and to reconcile their health insurance coverage with the government.

Importance of the 1095-A Form

The 1095-A form is an important document for both individuals and employers. For individuals, the 1095-A form provides proof of health insurance coverage, which may be required to avoid paying a penalty under the Affordable Care Act. For employers, the 1095-A form provides information that is necessary to comply with the Affordable Care Act’s employer mandate.

Form Structure

The 1095-A form is a multi-part document that provides information about your health insurance coverage.

The form is divided into three main sections:

- Part 1: Individual Information

- Part 2: Health Insurance Coverage

- Part 3: Marketplace Coverage

Part 1: Individual Information

This section includes basic information about you, such as your name, address, and Social Security number.

Part 2: Health Insurance Coverage

This section includes information about your health insurance coverage, such as the name of your insurance company, the type of coverage you have, and the dates of your coverage.

Part 3: Marketplace Coverage

This section includes information about your Marketplace coverage, such as the type of plan you have, the amount of your premium, and the amount of your subsidy.

Tips for Completing the Form Accurately

- Make sure you have all of the necessary information before you start filling out the form.

- Read the instructions carefully before you start filling out the form.

- Fill out the form completely and accurately.

- Sign and date the form before you mail it.

Eligibility and Exceptions

The 1095-A form is required for certain individuals, known as “applicable individuals”, who have obtained health insurance coverage through the Health Insurance Marketplace. These individuals must meet specific eligibility criteria to determine whether they need to file the form.

Generally, applicable individuals include those who:

- Enrolled in a health plan through the Health Insurance Marketplace

- Received advance payments of the premium tax credit (APTC)

- Were enrolled in a Marketplace plan for at least one month during the year

Exceptions

There are certain exceptions to the eligibility requirements for filing the 1095-A form. These exceptions include:

- Individuals who were not enrolled in a Marketplace plan for any part of the year

- Individuals who did not receive any APTC payments

- Individuals who were enrolled in a Marketplace plan for less than three months during the year

- Individuals who were eligible for Medicaid or CHIP for the entire year

- Individuals who were incarcerated for the entire year

Filing Requirements

Yo, listen up, filing that 1095-A form is no joke. You gotta get it in by the tax deadline, or you’re gonna face some serious consequences. The due date varies depending on how you file, so check with the IRS for the exact dates.

If you’re late with your form, you could get hit with a penalty of up to £500 per month, up to a maximum of £2,500. And if you file it wrong, you could get slapped with a £500 penalty. So, make sure you do it right and on time.

Filing electronically is the easiest way to go. You can do it through the IRS website or through a tax software program. It’s quick, easy, and you don’t have to worry about postage or losing your form in the mail.

Electronic Filing Options

There are a few different ways you can file your 1095-A form electronically:

- Through the IRS website: You can create an account on the IRS website and file your form online.

- Through a tax software program: There are many different tax software programs that allow you to file your 1095-A form electronically.

- Through a third-party provider: There are a number of third-party providers that offer electronic filing services for 1095-A forms.

Form Distribution

The responsibility of distributing Form 1095-A lies with the health insurance provider. They are obligated to send the form to the policyholder, ensuring that every individual covered under the plan receives their copy.

The distribution timeline is crucial. Health insurance providers are required to mail Form 1095-A to policyholders by the end of January following the tax year. This means that for the 2023 tax year, forms should be sent out by January 31, 2024.

Consequences of Not Receiving the Form

In case you don’t receive Form 1095-A by the specified deadline, it’s essential to reach out to your health insurance provider promptly. They can provide a duplicate copy or assist you in obtaining the necessary information.

Not having Form 1095-A can have implications when filing your taxes. It’s a key document for claiming the Premium Tax Credit or reconciling your health insurance coverage with the IRS. Therefore, it’s vital to make every effort to obtain your form on time.

Use of the Form

The 1095-A form is a crucial document for both individuals and employers in the UK. It plays a vital role in tax preparation and reporting, as well as healthcare enrollment.

For individuals, the 1095-A form provides proof of health insurance coverage throughout the year. This information is essential when filing taxes, as it allows individuals to claim the Premium Tax Credit or avoid paying the individual mandate penalty.

Tax Preparation and Reporting

- Individuals use the 1095-A form to report their health insurance coverage on their tax returns.

- The form provides information about the type of health insurance plan, the coverage period, and the amount of premiums paid.

- This information is used to determine eligibility for the Premium Tax Credit and to calculate any individual mandate penalty.

Healthcare Enrollment

- Individuals can also use the 1095-A form to enroll in health insurance through the Health Insurance Marketplace.

- The form provides information about the individual’s income and household size, which is used to determine eligibility for premium subsidies.

- Individuals can submit the 1095-A form online or by mail to the Health Insurance Marketplace.

Common Errors

Filling out the 1095-A form can be a bit of a chore, but it’s important to make sure you’re doing it right. Here are some of the most common errors people make when completing the form, along with some tips on how to avoid them.

Incorrect Information

- Make sure you’re entering all of the information correctly, including your name, address, and Social Security number.

- Double-check the information provided by your health insurance provider to ensure it matches what you’re entering on the form.

- If you’re not sure about something, refer to the instructions on the form or contact the IRS for help.

Missing Information

- Make sure you’re filling out all of the required fields on the form.

- If you’re not sure if a field is required, refer to the instructions on the form.

- If you’re missing information, you may need to contact your health insurance provider or the IRS for help.

Inconsistent Information

- Make sure the information you’re entering on the form is consistent with the information you’ve provided on other tax forms, such as your W-2.

- If there are any inconsistencies, you may need to correct the information on one or more of the forms.

- If you’re not sure how to correct the information, you may need to contact the IRS for help.

Resources and Assistance

Need help with your 1095-A form? Here’s where you can find some blud:

Organizations and Agencies

– Your health insurance provider

– The Health Insurance Marketplace

– The IRS

Online Resources

– [HealthCare.gov](https://www.healthcare.gov/coverage-costs/1095-a/)

– [IRS website](https://www.irs.gov/forms-pubs/about-form-1095-a)

FAQ Corner

Who is required to file the 1095-A form?

Individuals who receive health insurance coverage through an employer-sponsored group health plan and employers with 50 or more full-time employees are required to file the 1095-A form.

What information is collected on the 1095-A form?

The 1095-A form collects information such as the individual’s name, Social Security number, health insurance coverage dates, and the employer’s name and employer identification number.

What are the penalties for late or incorrect filing of the 1095-A form?

Penalties for late or incorrect filing of the 1095-A form can range from $250 to $250,000 per form, depending on the size of the employer and the number of forms filed late or incorrectly.

Can I file the 1095-A form electronically?

Yes, the 1095-A form can be filed electronically through the IRS website or through a third-party vendor.

What should I do if I do not receive a 1095-A form?

If you do not receive a 1095-A form, you should contact your employer or health insurance provider as soon as possible to request a copy.