The 1040 Printable Form: A Comprehensive Guide to Filing Your Taxes

Filing taxes can be a daunting task, but it doesn’t have to be. The 1040 Printable Form is the most common tax form used by individuals in the United States, and it’s designed to help you report your income and expenses to the Internal Revenue Service (IRS). This guide will provide you with everything you need to know about the 1040 Printable Form, from understanding its purpose to completing it accurately and submitting it on time.

The 1040 Printable Form is a fillable PDF document that you can download from the IRS website. Once you’ve downloaded the form, you can fill it out by hand or using tax preparation software. If you’re not sure how to fill out the form, there are many resources available to help you, including the IRS website, tax professionals, and online help forums.

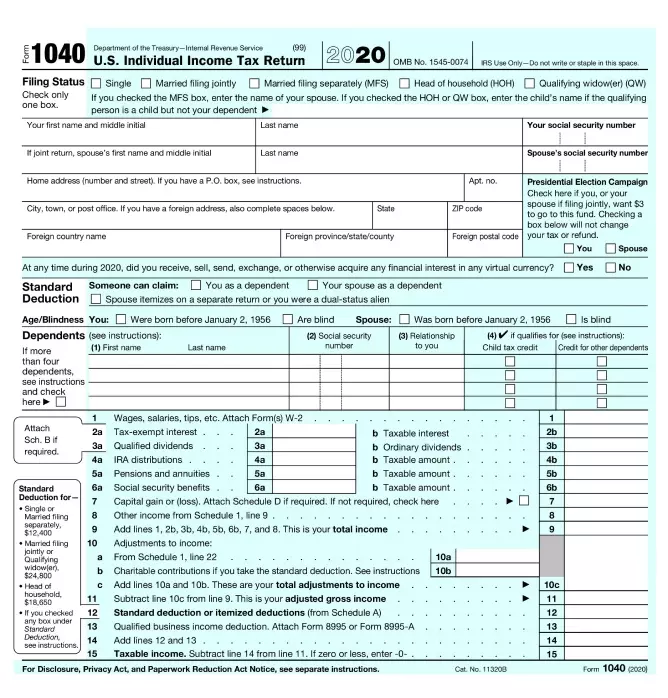

Understanding the 1040 Printable Form

The 1040 Printable Form is a crucial document for individuals in the UK required to submit their annual tax returns to Her Majesty’s Revenue and Customs (HMRC). This form is designed to collect vital information about your income, deductions, and tax liability for the previous tax year.

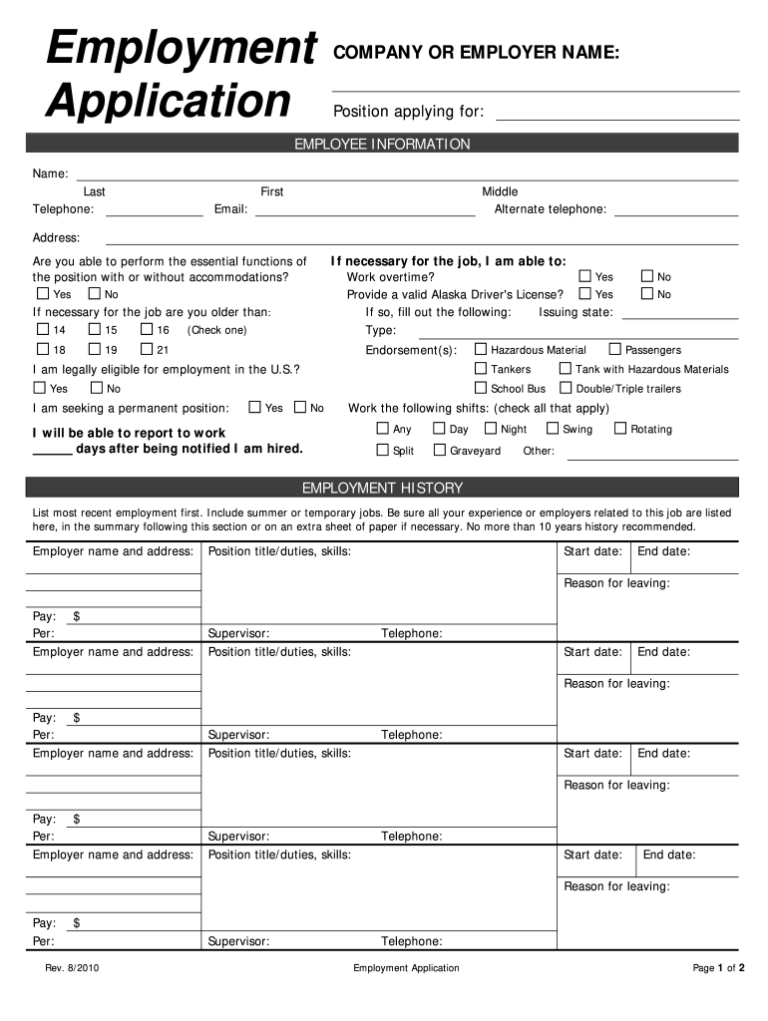

The form comprises several sections, each with a specific purpose:

- Personal Information: This section gathers basic details such as your name, address, and National Insurance number.

- Income: Here, you’ll provide details of all your income sources, including employment, self-employment, investments, and benefits.

- Deductions and Allowances: This section allows you to claim various deductions and allowances that can reduce your taxable income.

- Tax Calculation: Based on your income and deductions, this section calculates your tax liability.

- Payment or Refund: This section determines whether you owe any taxes or are entitled to a refund.

It’s imperative to fill out the 1040 Printable Form accurately and completely to ensure that you pay the correct amount of tax and avoid potential penalties. If you’re unsure about any aspect of the form, don’t hesitate to seek professional advice from a tax advisor or HMRC.

Preparing to Fill Out the Form

Bruv, getting ready to fill out the 1040 Printable Form is like getting ready for a cheeky Nando’s – you need to be prepped and have your bits together. So, here’s the lowdown on what you need to do to get started.

First up, gather your bits. This means getting your hands on all the important documents, like your P60, payslips, bank statements, and any other bits and bobs that might be relevant. It’s like getting your squad together for a night out – you need everyone there to make it a banger.

Next, you need to figure out your filing status. This is basically who you are in the eyes of the taxman. Are you a single pringle, a loved-up couple, or a parent with a crew of little ‘uns? Knowing your status will help you fill out the form correctly and avoid any awkward tax mishaps.

Finally, it’s time to suss out what deductions and credits you can claim. These are like little perks that can reduce your tax bill. Think of it like finding a tenner in your jeans – it’s a nice little bonus that makes life a bit easier.

So, there you have it, the basics of getting ready to fill out the 1040 Printable Form. Remember, it’s not rocket science, but it’s worth taking the time to get it right. That way, you can avoid any tax-related dramas and keep more of your hard-earned dough.

Completing the 1040 Printable Form

Completing the 1040 Printable Form can be a daunting task, but with a step-by-step guide and some helpful tips, you can get it done right. Here’s a guide to help you fill out each section of the form accurately and avoid common errors.

Personal Information

Start by filling out your personal information in the top right corner of the form. This includes your name, address, Social Security number, and filing status. If you’re married filing jointly, you’ll need to provide your spouse’s information as well.

Income

Next, report your income on lines 1-9 of the form. This includes wages, salaries, tips, interest, dividends, and other types of income. If you have any self-employment income, you’ll need to fill out Schedule SE (Form 1040) and attach it to your return.

Adjustments to Income

Certain deductions can reduce your taxable income. These adjustments are reported on lines 10-16 of the form. Common adjustments include contributions to traditional IRAs, student loan interest, and alimony paid.

Taxable Income

Your taxable income is your total income minus any adjustments. Calculate this by subtracting line 16 from line 9.

Taxes

Use the tax table or tax software to calculate the amount of tax you owe. Enter this amount on line 18.

Credits

Tax credits directly reduce your tax liability. Common credits include the child tax credit, earned income credit, and education credits. List any applicable credits on lines 19-26.

Payments

Report any tax payments you’ve made during the year, such as withholding from your paycheck or estimated tax payments. Enter these amounts on lines 27-33.

Refund or Amount You Owe

Subtract your payments from your taxes to determine if you’re due a refund or owe more tax. If you’re due a refund, enter the amount on line 37. If you owe more tax, enter the amount on line 39.

Common Errors

To avoid errors, make sure you:

* Use the correct tax table or software for your filing status.

* Enter all income and deductions accurately.

* Double-check your math before submitting your return.

* Sign and date your return before mailing it.

Submitting the 1040 Printable Form

Blimey, you’ve slogged through filling out your 1040 Printable Form, so now it’s time to get that bad boy submitted. There are a few different ways to do it, so let’s have a chinwag about each one.

Mailing

If you’re feeling a bit old-school, you can always mail your form to the IRS. Just make sure you’ve got the right address and postage. You can find the address on the IRS website or in the instructions that came with your form.

E-filing

E-filing is a right doddle. You can do it through the IRS website or through a tax preparation software program. E-filing is faster and more accurate than mailing, and you’ll get your refund quicker too.

Tax Preparation Software

If you’re not feeling confident about filling out your form on your own, you can use tax preparation software. These programs will guide you through the process and make sure you don’t miss anything. Some programs even offer free e-filing.

Deadlines and Consequences of Late Filing

Don’t be a berk and miss the deadline for filing your taxes. The deadline is April 15th, and if you file late, you could face penalties and interest charges. If you can’t file by the deadline, you can file for an extension, but you’ll still need to pay any taxes you owe by April 15th.

Resources for Assistance

The 1040 Printable Form can be a daunting task, but there are plenty of resources available to help you get it done right.

If you need help understanding the form or filling it out, you can contact the IRS for assistance. The IRS website also has a number of helpful resources, including publications, videos, and online tools.

Tax Professionals

If you’re not comfortable filling out the form yourself, you can hire a tax professional to help you. Tax professionals can help you understand the form, gather the necessary documents, and file your return on time.

Online Help Forums

There are also a number of online help forums where you can ask questions about the 1040 Printable Form. These forums can be a great way to get help from other taxpayers who have already completed the form.

Links to Relevant Websites and Publications

Questions and Answers

What is the purpose of the 1040 Printable Form?

The 1040 Printable Form is used to report your income and expenses to the IRS. It’s the most common tax form used by individuals in the United States.

How do I fill out the 1040 Printable Form?

You can fill out the 1040 Printable Form by hand or using tax preparation software. If you’re not sure how to fill out the form, there are many resources available to help you, including the IRS website, tax professionals, and online help forums.

What are the deadlines for filing the 1040 Printable Form?

The deadline for filing the 1040 Printable Form is April 15th. However, if you file for an extension, you have until October 15th to file your taxes.

What are the penalties for filing the 1040 Printable Form late?

If you file your 1040 Printable Form late, you may be subject to penalties and interest charges. The amount of the penalty will depend on how late you file your taxes and how much you owe.