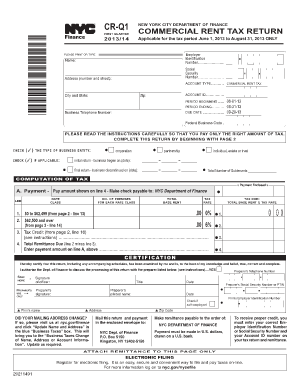

Navigating Tax Season with Ease: Printable Q1 Form

As the first quarter of the year draws to a close, businesses and individuals alike turn their attention to the inevitable task of tax filing. Amidst the myriad of forms and deadlines, the Printable Q1 Form emerges as a crucial document, offering a simplified approach to tax reporting. In this comprehensive guide, we will delve into the intricacies of this form, empowering you with the knowledge and tools to navigate tax season with confidence.

Whether you’re a seasoned tax filer or a first-timer, understanding the Printable Q1 Form is essential for ensuring accuracy and timely submission. Its user-friendly design and clear instructions make it accessible to all, providing a straightforward path to fulfilling your tax obligations.

Form Overview

The Printable Q1 Form is an essential document that allows businesses and individuals to accurately report their financial performance during the first quarter of the year. It provides a snapshot of the company’s financial health and can be used for various purposes, such as tax filing, budgeting, and forecasting.

This form is particularly important for businesses as it helps them track their progress towards financial goals and identify areas where they need to make adjustments. For individuals, it can provide a clear understanding of their income and expenses, enabling them to make informed financial decisions.

Data Entry

Entering data into the Printable Q1 Form is easy. Here’s how:

- Download the form from the official website.

- Open the form in a PDF reader.

- Fill in the required fields with your information.

- Save the completed form.

Missing or Incomplete Information

If you’re missing or unsure about some information, it’s best to leave it blank for now. You can always come back later and fill it in once you have the details.

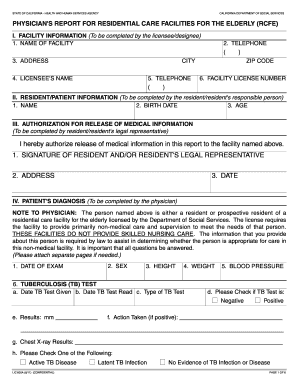

Data Accuracy and Completeness

Make sure you enter the data accurately and completely. Incorrect or missing information can delay the processing of your form.

Filing and Submission

Submitting your Printable Q1 Form is a crucial step in fulfilling your tax obligations. Understanding the available filing methods and their deadlines will help ensure timely and accurate submission, avoiding potential penalties.

Filing Methods

There are three primary methods for filing your Printable Q1 Form:

- Online: File directly through HMRC’s online portal, accessible via your Government Gateway account.

- Mail: Print and post your completed form to the specified address provided by HMRC.

- In-Person: Visit a designated HMRC office to submit your form in person.

Deadlines and Penalties

Meeting the filing deadline is essential to avoid late filing penalties. The deadline for filing your Printable Q1 Form is 31st July following the end of the relevant tax year.

Late filing can result in penalties, including daily fines and interest charges on any unpaid tax. Penalties may vary depending on the severity of the delay.

Consequences of Incorrect or Incomplete Forms

Submitting an incorrect or incomplete form can lead to delays in processing, potential tax errors, and additional penalties.

To ensure accuracy, it is crucial to carefully complete all sections of the form, providing all required information. If you encounter any difficulties, seeking professional advice is recommended.

Common Errors

Filling out the Printable Q1 Form can be a straightforward process, but errors can occur. These errors can delay the processing of your return and lead to penalties. To avoid these errors, it’s important to be aware of the most common ones and take steps to prevent them.

One of the most common errors is entering incorrect information. This can include entering the wrong taxpayer identification number, Social Security number, or address. It’s important to double-check all of your information before submitting your return to ensure it’s accurate.

Another common error is failing to sign the return. This is a simple but important step that can delay the processing of your return. Make sure to sign the return in the designated area before submitting it.

Finally, failing to file your return on time is another common error. The due date for the Printable Q1 Form is April 15th. If you file your return late, you may be subject to penalties and interest charges.

By avoiding these common errors, you can ensure a successful filing and avoid any unnecessary delays or penalties.

Benefits of Using a Printable Q1 Form

Filling out your Q1 form can be a bit of a chore, but it’s definitely worth it to get it done right. Using a printable Q1 form can save you a lot of time and hassle, and it can also help you avoid making mistakes.

Time Savings

One of the biggest benefits of using a printable Q1 form is that it can save you a lot of time. Instead of having to fill out the form by hand, you can simply print it out and fill it in at your leisure. This can save you hours of time, especially if you have a lot of information to enter.

Cost Savings

Another benefit of using a printable Q1 form is that it can save you money. If you file your Q1 form electronically, you will have to pay a filing fee. However, if you file your form by mail, you will not have to pay any fees.

Convenience

Finally, using a printable Q1 form is simply more convenient than other methods of filing. You can fill out the form at your own pace, and you don’t have to worry about finding a time to file it in person.

Alternatives to Printable Q1 Forms

Online portals and tax preparation software offer convenient alternatives to Printable Q1 Forms.

Online Portals

Online portals provided by tax authorities allow taxpayers to file Q1 returns electronically. These portals often feature user-friendly interfaces, guided navigation, and error checks to ensure accuracy.

Advantages:

* Convenience: File returns anytime, anywhere with an internet connection.

* Accuracy: Automated calculations and error checks minimize mistakes.

* Security: Data is encrypted and stored securely by tax authorities.

Disadvantages:

* Technical issues: Occasional technical glitches may interrupt filing.

* Limited support: Assistance may be limited compared to tax professionals.

* Not suitable for complex returns: May not be suitable for returns involving complex calculations or schedules.

Tax Preparation Software

Tax preparation software is another alternative to Printable Q1 Forms. These programs provide comprehensive guidance, automate calculations, and generate ready-to-file returns.

Advantages:

* Comprehensive support: Offers detailed instructions, tutorials, and access to tax professionals.

* Customization: Allows taxpayers to tailor returns to their specific circumstances.

* Multiple filing options: Supports electronic filing, paper filing, and preparation for professional submission.

Disadvantages:

* Cost: Software can be expensive, especially for advanced features.

* Learning curve: May require a learning curve for first-time users.

* Potential errors: Incorrect data entry or software glitches can lead to errors.

When to Use an Alternative Method

Consider using an alternative method when:

* Convenience is a priority: File returns quickly and easily from any location.

* Accuracy is essential: Minimize errors with automated calculations and error checks.

* Complex returns require expert assistance: Seek professional support from tax preparation software or a tax professional.

Printable Q1 Forms remain a viable option for taxpayers who prefer a traditional approach or for simple returns. However, online portals and tax preparation software offer advantages that may make them a better choice for many taxpayers.

Additional Resources

Get extra help with your Printable Q1 Form using these resources:

Official websites and guides provide detailed information and instructions.

Official Resources

- Tax Authority Website: [Insert website URL]

- Printable Q1 Form Guide: [Insert guide URL]

Contact Information

Need assistance? Contact the tax authorities or support services for guidance:

- Tax Authority Helpline: [Insert phone number]

- Email Support: [Insert email address]

Professional Advice

For complex tax matters, consider seeking professional advice from:

- Tax Accountants

- Tax Solicitors

Frequently Asked Questions

What is the purpose of the Printable Q1 Form?

The Printable Q1 Form is designed to simplify the process of reporting quarterly income and expenses for businesses and individuals.

Who should use the Printable Q1 Form?

The Printable Q1 Form is suitable for businesses and individuals who prefer a paper-based method of tax filing.

What are the benefits of using the Printable Q1 Form?

The Printable Q1 Form offers convenience, cost-effectiveness, and accessibility, allowing users to complete their tax returns at their own pace and without the need for additional software or online platforms.

What are some common errors to avoid when completing the Printable Q1 Form?

Common errors include missing or incomplete information, incorrect calculations, and failure to meet filing deadlines. Careful review and attention to detail can help prevent these errors.

Where can I find additional resources and support for completing the Printable Q1 Form?

Official websites, guides, tutorials, and tax authorities provide valuable resources and support for completing the Printable Q1 Form. Professional tax advice may also be sought if needed.