Printable Form W-3: A Comprehensive Guide to Completing and Filing

Navigating the intricacies of tax reporting can be a daunting task, but understanding and accurately completing Form W-3 is a crucial step in ensuring a smooth and compliant process. This guide will provide a comprehensive overview of Printable Form W-3, empowering you with the knowledge and resources to complete and file it confidently.

Form W-3 serves as a vital communication channel between employees and employers, facilitating the accurate reporting of wages and other compensation for tax purposes. By understanding its purpose, structure, and completion guidelines, you can effectively fulfill your tax obligations and avoid potential penalties.

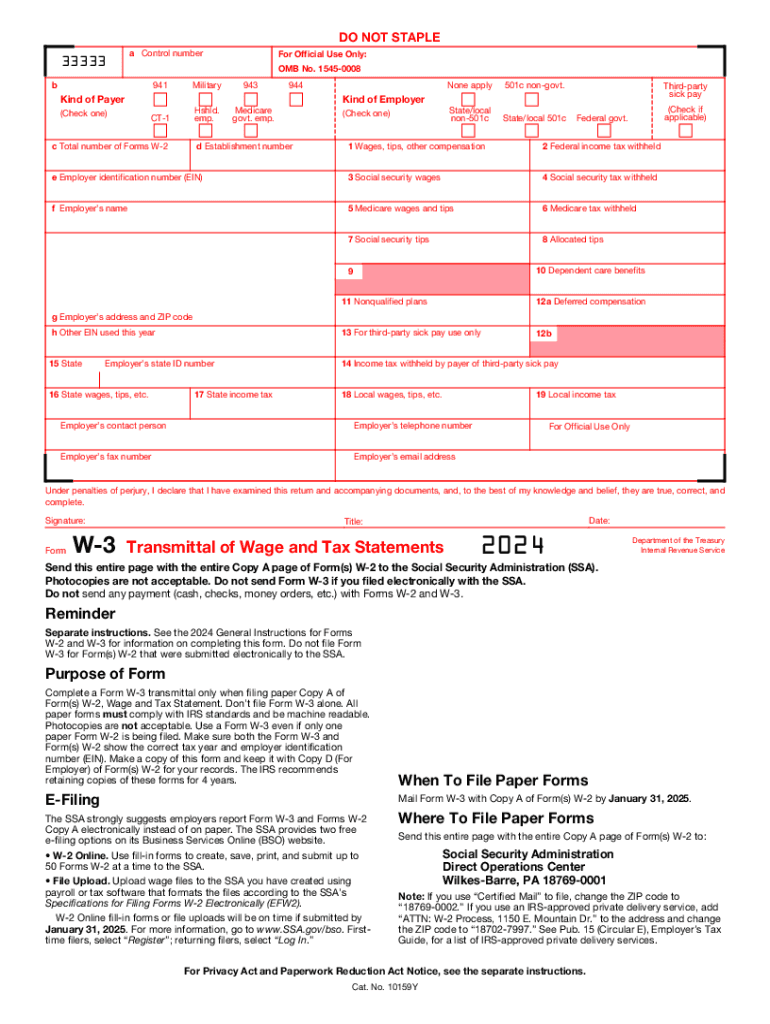

Printable Form W-3

Form W-3 is a tax document used by employees to provide information to their employers for tax reporting purposes. It contains details about the employee’s income, deductions, and tax credits. The employer uses this information to complete Form W-2, which is then provided to the employee and the Internal Revenue Service (IRS).

Who Uses Form W-3 and When It’s Required

Form W-3 is used by employees who have been asked by their employers to provide additional information for tax reporting. This may be necessary if the employee has multiple jobs, has complex income or deductions, or has claimed certain tax credits.

Form W-3 is not required to be filed with the IRS. However, it is important to complete the form accurately and submit it to your employer by the deadline provided.

Structure and Sections of Form W-3

Form W-3, Employee’s Withholding Certificate, is designed to gather personal and financial information from employees to assist employers in accurately calculating federal income tax withholding. The form consists of several key sections and fields, each serving a specific purpose in the withholding process.

The layout of Form W-3 is straightforward, with clear instructions and ample space for employees to provide the necessary information. The form is divided into sections that are clearly labeled and organized, making it easy for employees to complete and submit.

Personal Information

The personal information section of Form W-3 includes fields for the employee’s name, address, and Social Security number. This information is essential for identifying the employee and ensuring that the correct tax withholding is applied to their income.

Income Details

The income details section of Form W-3 includes fields for the employee’s wages, tips, and other compensation. This information is used to calculate the employee’s federal income tax liability.

Tax Credits

The tax credits section of Form W-3 includes fields for the employee to claim any applicable tax credits. Tax credits are deductions from the employee’s tax liability that can reduce the amount of taxes they owe. Common tax credits include the child tax credit, the earned income tax credit, and the education tax credit.

Purpose and Importance of Each Section

Each section of Form W-3 plays a vital role in the withholding process. The personal information section ensures that the correct employee is identified and that the appropriate tax withholding is applied. The income details section provides the information needed to calculate the employee’s tax liability. The tax credits section allows employees to claim deductions that can reduce their tax liability.

Completing Form W-3

Filling out Form W-3 accurately is crucial to ensure you receive the correct tax withholding from your paycheck. Here are some step-by-step s, common errors to avoid, and tips for a smooth completion process.

Step-by-Step s

- Gather your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Enter your full name, address, and contact information.

- Check the box indicating your marital status as single, married, or head of household.

- Enter the number of allowances you are claiming.

- Sign and date the form.

Common Errors to Avoid

- Using an incorrect SSN or ITIN.

- Claiming more allowances than you are entitled to.

- Entering incomplete or incorrect address information.

- Signing the form before completing all the fields.

Tips for Accuracy

- Keep a copy of your W-3 for your records.

- Review your W-3 each year to ensure the information is still accurate.

- Use the IRS Withholding Calculator to determine the correct number of allowances to claim.

- Contact your employer if you have any questions or need assistance completing the form.

Organizing Supporting Documents

It’s helpful to organize your supporting documents, such as pay stubs, tax returns, and W-2s, before completing Form W-3. This will make the process easier and reduce the risk of errors.

Electronic Filing Options for Form W-3

Electronic filing is an efficient and convenient way to submit Form W-3 to the IRS. It offers several advantages over traditional paper filing, including faster processing, reduced errors, and enhanced security.

There are two primary electronic filing options for Form W-3:

Filing Through an Authorized E-File Provider

- Partner with an IRS-authorized e-file provider to transmit Form W-3 electronically.

- These providers offer software and services to simplify the e-filing process, ensuring compliance with IRS regulations.

- Choose a reputable provider with a proven track record and excellent customer support.

Filing Directly Through the IRS Website

- Access the IRS website and use the “File Form W-3 Electronically” tool.

- This option is suitable for small businesses or individuals with a limited number of W-3 forms to file.

- Ensure you have a valid Employer Identification Number (EIN) and meet the IRS’s eligibility requirements.

Choosing the Appropriate Method

The best electronic filing method depends on your specific needs and circumstances. Consider the following factors:

- Volume of W-3 Forms: If you have a large number of W-3 forms to file, an authorized e-file provider may be more efficient.

- Technical Expertise: If you are comfortable with technology and have the necessary resources, filing directly through the IRS website may be a suitable option.

- Cost: Authorized e-file providers typically charge a fee for their services, while filing directly through the IRS website is free.

Importance of Accuracy and Compliance

Filling out Form W-3 accurately and in accordance with the guidelines is of utmost importance. Providing incorrect or incomplete information can have serious consequences.

Penalties and Liabilities

Non-compliance with the requirements of Form W-3 can result in penalties and liabilities for employers. These may include:

- Fines and penalties for providing inaccurate or incomplete information.

- Legal liability for any damages or losses incurred due to incorrect withholding.

- Revocation of the employer’s authorization to self-certify.

Troubleshooting Common Issues with Form W-3

Filling out Form W-3 can sometimes lead to difficulties. Here’s a guide to common problems and how to fix them.

Incorrect or Missing Information

Ensure all fields are completed accurately and thoroughly. Check for typos, missing data, or incorrect formats (e.g., SSN, address).

SSN Verification

The IRS may need to verify your SSN. Provide the necessary documentation (e.g., passport, birth certificate) if requested.

Employer Identification Number (EIN) Issues

If you’re unsure of your employer’s EIN, contact them or use the IRS’s online EIN verification tool.

Multiple W-3 Forms

If you receive multiple W-3 forms from different employers, file each one separately. Use the same SSN on all forms.

Late Filing

Filing Form W-3 late may result in penalties. File it as soon as possible to avoid complications.

Lost or Misplaced Form W-3

Contact your employer or the IRS to request a duplicate copy.

Electronic Filing Errors

When filing electronically, ensure you’re using the correct software and following the IRS’s instructions.

FAQs

- Q: I made a mistake on my Form W-3. What should I do?

A: Contact your employer or the IRS to correct the error. - Q: I’m not sure how to fill out a certain section.

A: Refer to the IRS’s instructions or seek professional assistance. - Q: Can I file Form W-3 online?

A: Yes, you can file electronically through the IRS’s website or authorized e-file providers.

FAQ Corner

What is the purpose of Form W-3?

Form W-3 is used to transmit wage and tax information from an employee to an employer, facilitating accurate tax withholding and reporting.

Who is required to complete Form W-3?

Employees are responsible for completing Form W-3 and providing it to their employers to ensure correct tax withholding.

What information is included on Form W-3?

Form W-3 includes personal information, income details, and tax credits, enabling employers to calculate accurate tax withholdings.

What are the consequences of inaccurate or incomplete Form W-3 information?

Incorrect or incomplete information on Form W-3 can lead to incorrect tax withholding, potential penalties, and delayed refunds.

Where can I find support if I encounter issues completing Form W-3?

The Internal Revenue Service (IRS) website provides comprehensive resources and guidance for completing Form W-3.