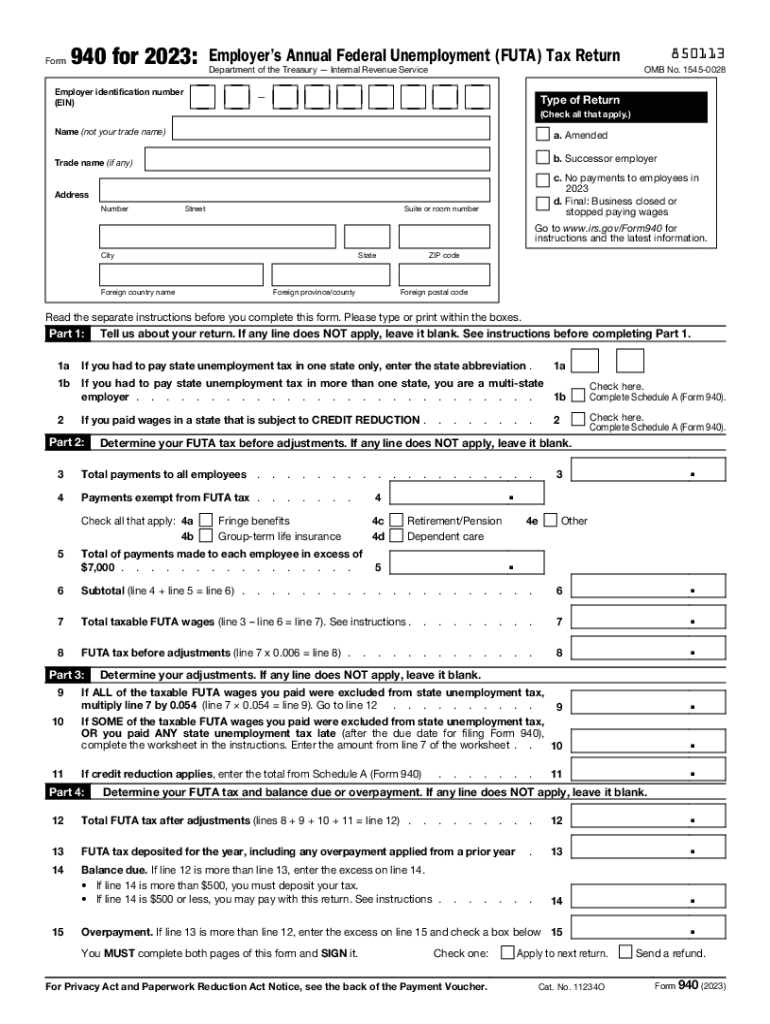

Printable Form 940: A Comprehensive Guide to Filing and Understanding

Navigating the complexities of Form 940 can be daunting, but it’s a crucial task for businesses to fulfill their tax obligations accurately and efficiently. This comprehensive guide will provide you with an in-depth understanding of Printable Form 940, its purpose, and how to complete and file it seamlessly.

We’ll cover everything from the basics of Form 940 to the intricate details of its calculations. By the end of this guide, you’ll have the confidence to tackle Form 940 with ease, ensuring compliance and minimizing the risk of errors.

Form 940 Overview

Form 940 is a document used to report federal unemployment (FUTA) taxes to the Internal Revenue Service (IRS). It is essential for businesses and organizations to understand their responsibilities regarding FUTA and ensure compliance with the law.

FUTA taxes are levied on employers to fund unemployment benefits for eligible workers who have lost their jobs. Filing Form 940 accurately and timely is crucial to avoid penalties and ensure that the unemployment insurance system remains adequately funded.

Who Must File Form 940?

Generally, employers are required to file Form 940 if they meet any of the following criteria:

- Paid wages of $1,500 or more in any calendar quarter during the current or preceding calendar year.

- Employed one or more employees for at least some part of a day in any 20 or more different calendar weeks during the current or preceding calendar year.

Filing Form 940

Filing Form 940 is a breeze. You can do it electronically or by mail. The choice is yours, bruv.

Filing Electronically

Filing electronically is the slickest way to go. You can use the IRS’s e-file system or go through a tax software provider. Either way, you’ll need to have your info handy, like your EIN, tax year, and total wages paid.

Filing by Mail

If you’re more of an old-school type, you can file by mail. Just download the form from the IRS website, fill it out, and pop it in the post. Make sure you use the right address, or your form might get lost in the shuffle.

Filing Deadlines and Penalties

Don’t be a slacker when it comes to filing your Form 940. The deadlines are firm, and there are penalties for late filing. The due date depends on your tax year, so check the IRS website for the exact dates.

If you miss the deadline, you’ll have to pay a late filing penalty. The penalty is a percentage of the tax you owe, so it can add up fast. Don’t risk it, file on time.

Understanding Form 940 Calculations

Form 940 involves various calculations to determine your FUTA tax liability. These calculations include:

Taxable Wages

- Taxable wages are the total amount of wages paid to your employees, up to the taxable wage base, which is $7,000 for 2023.

- For example, if you paid an employee $10,000 in wages during the year, the taxable wages would be $7,000.

FUTA Tax Rate

- The FUTA tax rate is 6.0%, of which 0.6% is allocated to the Federal Unemployment Tax Act (FUTA) and 5.4% to the State Unemployment Tax Act (SUTA).

- The FUTA tax is calculated by multiplying the taxable wages by the FUTA tax rate.

FUTA Tax Liability

- Your FUTA tax liability is the amount of FUTA tax you owe. It is calculated by multiplying the taxable wages by the FUTA tax rate.

- For example, if your taxable wages are $7,000 and the FUTA tax rate is 6.0%, your FUTA tax liability would be $420 ($7,000 x 0.06).

Tax Tables and Other Resources

The IRS provides tax tables and other resources to help you calculate the amounts on Form 940. These resources include:

- Publication 15 (Circular E), Employer’s Tax Guide

- IRS website: https://www.irs.gov/businesses/small-businesses-self-employed/form-940-employer-s-annual-federal-unemployment-tax-return

Common Questions and Issues

Filing Form 940 can raise questions and concerns. This section addresses common queries and provides guidance on resolving issues that may arise.

Understanding the intricacies of Form 940 is crucial to avoid potential pitfalls. This section aims to clarify common misconceptions and provide practical solutions to ensure a smooth filing process.

Frequently Asked Questions

- What is the due date for filing Form 940?

Form 940 is due on or before the 31st of January following the end of the tax year (December 31). - Can I file Form 940 electronically?

Yes, you can file Form 940 electronically through the HMRC website or via approved software. - What are the penalties for late filing or incorrect reporting?

Late filing can result in penalties and interest charges. Incorrect reporting may lead to additional taxes and penalties.

Common Issues

- Incorrect Employer Identification Number (EIN)

Ensure that the EIN provided on Form 940 matches the one registered with HMRC. - Errors in Calculating Tax Liability

Carefully review your calculations and ensure you have applied the correct tax rates and deductions. - Missing or Incomplete Information

Provide all the necessary information on Form 940, including employee details, wages, and tax withheld.

Additional Resources

Need more help with Form 940? Here are some helpful resources:

IRS Website

IRS Publications

Contact Information

If you need further assistance with Form 940, you can contact the IRS at 1-800-829-4933.

Helpful Answers

What is the purpose of Form 940?

Form 940 is used to report federal unemployment taxes (FUTA) for businesses with employees.

Who is required to file Form 940?

Businesses with employees who earn more than $1,500 in a calendar year must file Form 940.

When is Form 940 due?

Form 940 is due by January 31st of the year following the calendar year in which the wages were paid.

Can I file Form 940 electronically?

Yes, you can file Form 940 electronically through the IRS website or using tax software.