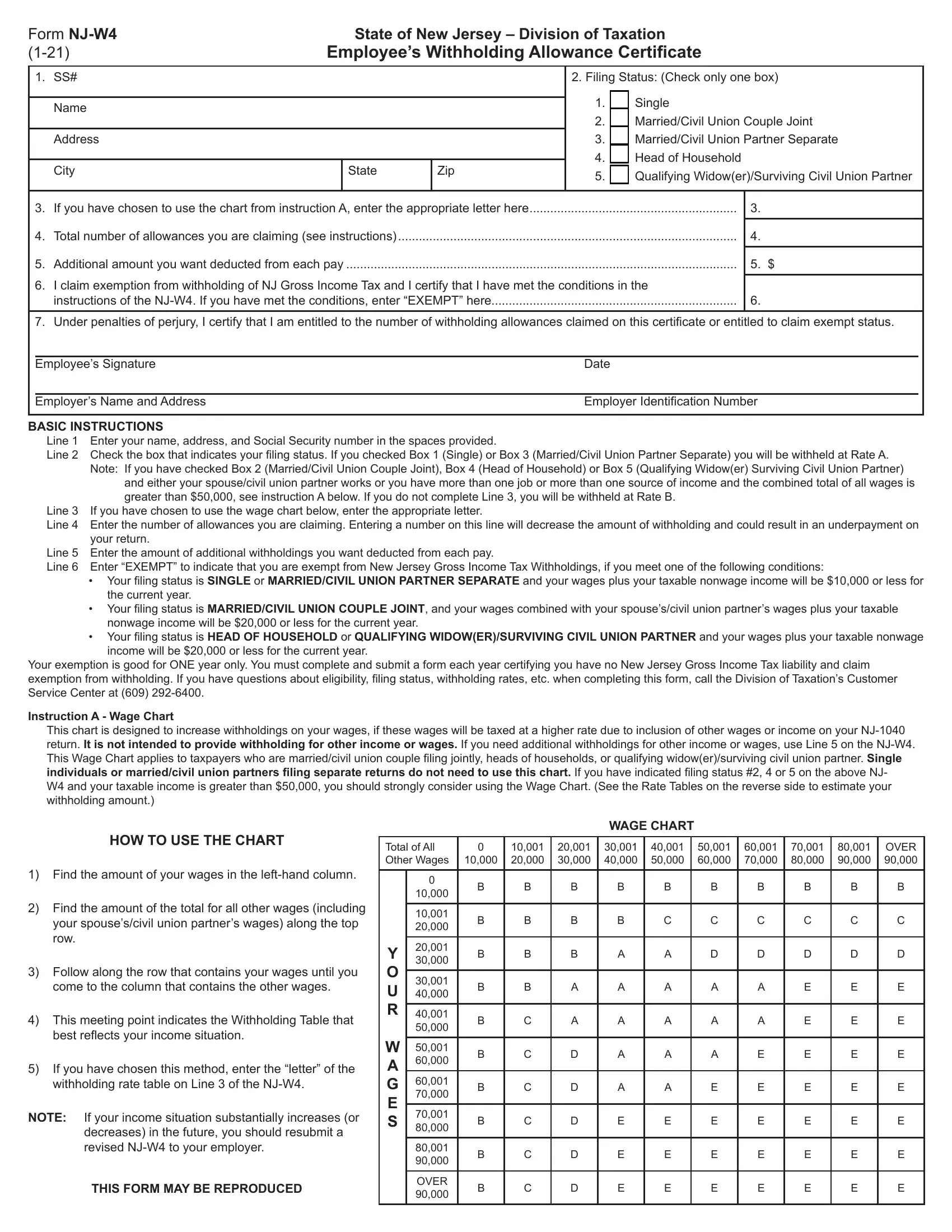

Understanding the New Jersey W-4 Printable Form: A Comprehensive Guide

Navigating the intricacies of tax forms can be daunting, but understanding the New Jersey W-4 Printable Form is essential for ensuring accurate tax withholding and avoiding potential penalties. This comprehensive guide will provide you with a clear overview of the form’s purpose, sections, and filing requirements, empowering you to complete it confidently.

Whether you’re a seasoned taxpayer or a first-time filer, this guide will equip you with the knowledge and insights necessary to effectively manage your tax obligations. By understanding the nuances of the New Jersey W-4 Printable Form, you can streamline the filing process, minimize tax liabilities, and ensure compliance with state regulations.

Form Overview

Blud, the New Jersey W4 Printable Form is like a sick form that tells the taxman how much cheddar you wanna keep each paycheque. It’s like a cheat code for making sure you don’t end up skint when tax time rolls around.

This peng form is split into a bunch of sections, fam. There’s a bit where you can put your personal deets like your name, addy, and SSN. Then there’s a bit where you can choose how many allowances you want. Allowances are like little deductions that reduce the amount of tax you pay each pay period.

Sections

- Personal Information: This is where you drop your name, address, and social security number.

- Allowances: This is where you choose how many allowances you want. The more allowances you choose, the less tax you’ll pay each pay period.

- Additional Information: This is where you can provide any additional information that might affect your tax withholding, like if you have multiple jobs or dependents.

Personal Information

Fam, when you’re filling out your New Jersey W4 Printable Form, make sure you’re on the ball with your personal info. That means your name, addy, and that all-important Social Security number.

Why’s it so crucial to get this right? Well, mate, the taxman needs to know who you are and where to find you. Plus, they use this info to work out how much tax you owe. So, if you don’t want any aggro with the taxman, make sure your personal details are spot on.

Withholding Allowances

Withholding allowances are the number of dependents you claim on your tax return, which affects how much tax is withheld from your paycheck. Claiming more allowances means less tax is withheld, while claiming fewer allowances means more tax is withheld.

Determining the Appropriate Number of Allowances

The number of allowances you can claim depends on several factors, including your filing status, number of dependents, and income. The IRS provides a worksheet to help you determine the correct number of allowances to claim.

Scenarios Affecting the Number of Allowances Claimed

– Marriage: Getting married or divorced can affect the number of allowances you can claim.

– Birth or Adoption of a Child: Adding a new dependent to your family increases the number of allowances you can claim.

– Job Change: Starting a new job or leaving a job can impact your withholding allowances.

– Change in Income: A significant increase or decrease in your income may require you to adjust your withholding allowances.

Additional Income and Adjustments

Additional income and adjustments are sections of the NJ W-4 form that provide information about earnings beyond your primary job and any adjustments that affect your tax withholding. Reporting this information helps ensure your withholding is accurate and minimizes the risk of over- or underpayment.

Additional Income

In the Additional Income section, you can report income from sources other than your main job, such as bonuses, commissions, self-employment earnings, or income from investments. This information helps the employer calculate your withholding more accurately, ensuring that you pay the correct amount of taxes on all of your income.

Adjustments

The Adjustments section allows you to make changes to your withholding based on specific factors that affect your tax liability. These factors include:

- Deductions: You can claim deductions for certain expenses, such as mortgage interest, charitable contributions, and retirement savings, which reduce your taxable income and may result in a lower withholding amount.

- Credits: Tax credits are amounts that directly reduce your tax liability, such as the child tax credit or the earned income tax credit. Claiming credits can lower your withholding even further.

- Estimated tax payments: If you expect to owe more than $1,000 in taxes, you may make estimated tax payments throughout the year. Reporting these payments on the W-4 form can help adjust your withholding to avoid underpayment penalties.

Signature and Date

Signing and dating the form are of utmost importance. Your signature signifies your approval and verification of the information provided on the form. The date serves as proof of when the form was completed and submitted.

Submitting an unsigned or undated form can result in delays in processing your return. The IRS may also request that you provide a signed and dated copy before they can process your return.

Filing s

After you have completed the form, you need to file it with the relevant authorities to ensure your tax obligations are met. There are different methods of filing, each with its own deadlines. Understanding these methods and the associated deadlines is crucial to avoid any penalties or late filing fees.

You can file your completed form through the following methods:

Postal mail

- Print the completed form and mail it to the address provided by the tax authorities. Ensure you use the correct postage to avoid delays in processing.

- Allow ample time for the form to reach the authorities before the filing deadline. Postal delays can occur, so it’s advisable to mail the form well in advance.

Online filing

- Many tax authorities offer online filing portals where you can submit your completed form electronically. This method is convenient and allows for faster processing.

- To file online, you will need to create an account on the tax authority’s website and follow the instructions provided.

In-person filing

- You can visit the tax authority’s office and submit your completed form in person. This method is less common but may be necessary if you have any complex tax issues that require face-to-face assistance.

- Make sure to check the office’s operating hours and bring all necessary documentation with you.

It’s important to note that the filing deadlines may vary depending on the tax authority and the method of filing. Check with the relevant authorities to confirm the specific deadlines applicable to your situation. Failing to meet the filing deadlines can result in penalties and interest charges.

Common Errors and Troubleshooting

To avoid delays in processing your form, it’s crucial to steer clear of common pitfalls. Here’s a heads-up on what to watch out for and how to rectify any slip-ups.

Don’t let these blunders hold you back; use this guide to breeze through the form with ease.

Missing or Incorrect Personal Information

- Ensure you’ve filled in all the essential personal details, like your name, address, and National Insurance number.

- Double-check that the information you’ve provided matches your official records to prevent any mix-ups.

Inaccurate Withholding Allowances

- Make sure you’ve claimed the correct number of withholding allowances based on your personal circumstances.

- If you’re unsure, use the online calculator provided by HMRC to determine the appropriate number of allowances.

Omissions in Additional Income and Adjustments

- Remember to declare all sources of income, including any benefits, pensions, or savings interest.

- Don’t forget to account for any allowable deductions or adjustments, such as charitable donations or pension contributions.

Incomplete or Illegible Signature

- Sign the form clearly and legibly, ensuring your signature matches the one on your official documents.

- Avoid using initials or nicknames; your full legal signature is required.

Alternative Options

There are several alternative options available for filing the W4 form besides the printable PDF version. Each option has its own advantages and disadvantages, so it’s important to choose the one that best suits your needs.

Online Tools

Online tools, such as the IRS Withholding Estimator, can help you calculate your withholding allowances and generate a completed W4 form. These tools are quick and easy to use, and they can be accessed from any computer or mobile device. However, they may not be as accurate as using the printable PDF version, and they may not be able to handle complex tax situations.

Professional Assistance

If you have a complex tax situation, you may want to consider getting professional assistance from a tax preparer. A tax preparer can help you calculate your withholding allowances and complete your W4 form accurately. However, professional assistance can be expensive, and it may not be necessary for everyone.

Helpful Answers

What is the purpose of the New Jersey W-4 Printable Form?

The New Jersey W-4 Printable Form is used to provide your employer with information necessary to calculate the correct amount of New Jersey income tax to withhold from your paycheck.

Where can I find the New Jersey W-4 Printable Form?

You can download the New Jersey W-4 Printable Form from the New Jersey Division of Taxation website.

When is the New Jersey W-4 Printable Form due?

The New Jersey W-4 Printable Form is due to your employer when you start a new job or when your withholding allowances change.

What are the penalties for not filing a New Jersey W-4 Printable Form?

If you do not file a New Jersey W-4 Printable Form, your employer may withhold more taxes from your paycheck than necessary. You may also be subject to penalties if you underpay your taxes.