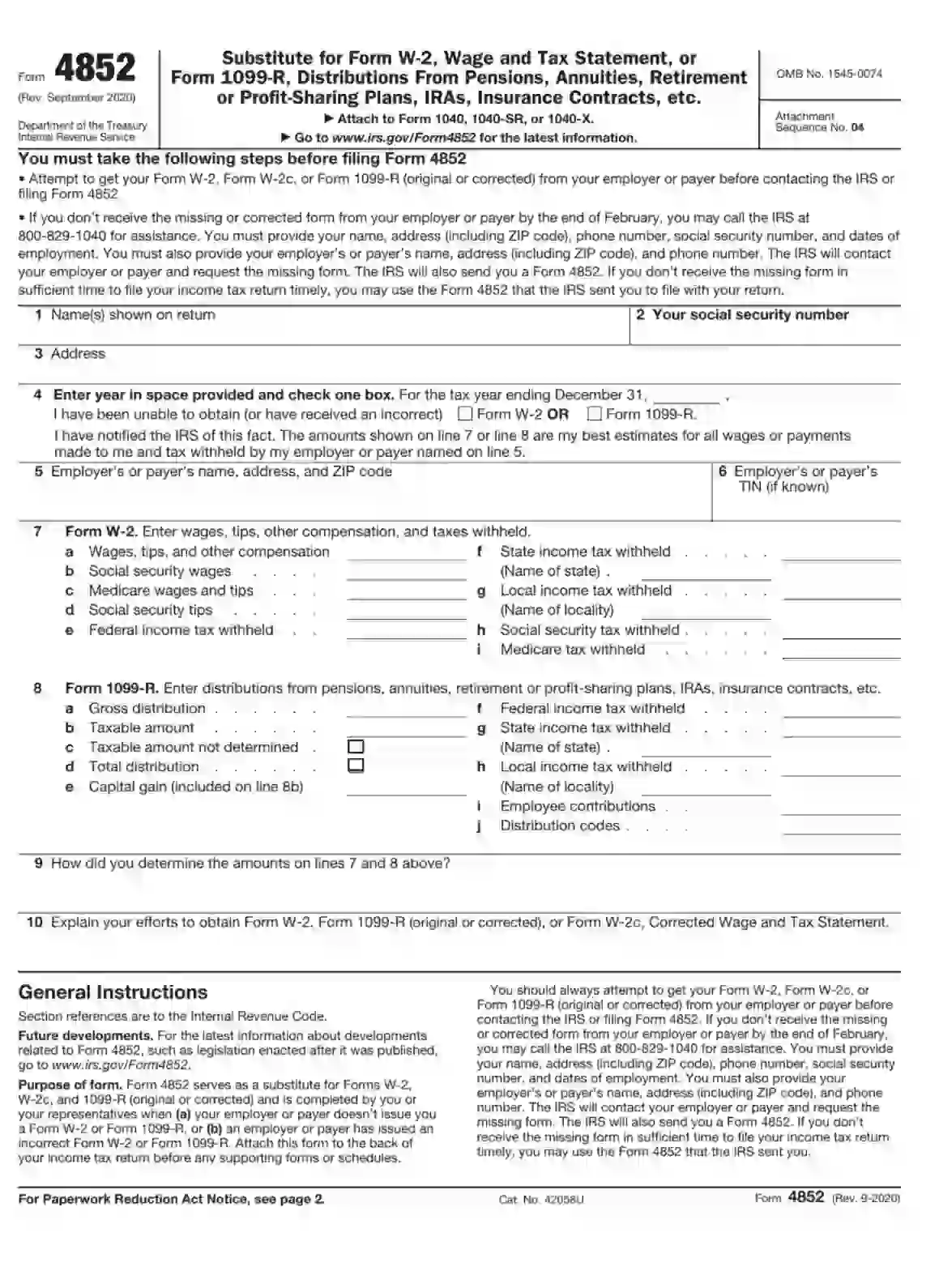

Printable Form 4852: A Comprehensive Guide for Accurate Completion

Navigating the intricacies of tax forms can be a daunting task, especially when dealing with specialized forms like Form 4852. This printable document plays a crucial role in the world of taxation, and understanding its purpose, structure, and completion process is essential for ensuring accuracy and compliance.

In this comprehensive guide, we will delve into the details of Printable Form 4852, providing a step-by-step breakdown of its components, uses, and potential pitfalls. By the end of this discussion, you will be equipped with the knowledge and confidence to tackle Form 4852 with ease, ensuring a seamless tax filing experience.

Definition and Overview

Yo, check it, Form 4852 is like a sick document that helps you get your tax situation sorted. It’s like a guide to navigating the maze of taxes, so you can claim back what’s rightfully yours.

This form has been around for ages, since back in the day when taxes were a bit of a headache. But over time, it’s been updated to keep up with the times and make it easier for us to sort out our tax affairs.

Form Structure and Components

Form 4852 is a comprehensive document designed to facilitate the filing of information related to residential energy credits. Its layout is organized into distinct sections, each dedicated to gathering specific data.

The form is divided into four main sections:

- Section A: Taxpayer Information – Captures personal details, such as name, address, and Social Security number, to identify the taxpayer claiming the credit.

- Section B: Residential Energy Credits – Dives into the specifics of the energy-efficient improvements made, including the type of credit being claimed, the property address, and the eligible expenses incurred.

- Section C: Carryforward of Unused Credits – Provides a space to report any unused credits from previous tax years that the taxpayer wishes to carry forward and apply to the current year’s return.

- Section D: Certification – Serves as a formal declaration by the taxpayer, under penalties of perjury, that the information provided on the form is accurate and complete.

3. s for Completion

Filling out Form 4852 can be a bit of a drag, but it’s a must-do if you want to stay on top of your taxes. Here’s a quick guide to help you get it done right.

First things first, gather up all the info you’ll need. This includes your Social Security number, your employer’s name and address, and your total wages for the year. You can find this stuff on your pay stubs or W-2 form.

Once you’ve got your info together, it’s time to start filling out the form. The first part is pretty straightforward. Just fill in your personal info and your employer’s info.

The next part is where it gets a bit trickier. You’ll need to calculate your net earnings from self-employment. This is your total income minus your business expenses. If you’re not sure how to do this, there’s a helpful worksheet on the IRS website.

Once you’ve got your net earnings, you can fill out the rest of the form. Just follow the instructions and make sure to double-check your work before you submit it.

Tips for Accurate and Thorough Completion

- Take your time and read the instructions carefully.

- Use a calculator to avoid any mistakes.

- If you’re not sure about something, don’t hesitate to ask for help.

- Keep a copy of your completed form for your records.

Uses and Applications

Form 4852 is a versatile document with a range of uses in the realm of finance and accounting. It’s like a Swiss Army knife for tax matters, catering to various scenarios and entities.

Individuals and businesses alike may find themselves needing to wield this form. Let’s delve into the nitty-gritty of when and who should buckle up for Form 4852.

Entities and Individuals

- Businesses: Companies, partnerships, and other business entities use Form 4852 to report adjustments and corrections to their income, deductions, and credits.

- Individuals: Taxpayers who need to make changes to their individual income tax returns can also use Form 4852.

- Estates and trusts: These entities may also need to file Form 4852 to adjust their tax returns.

Scenarios

- Amending returns: Form 4852 is the go-to for making changes to previously filed tax returns.

- Correcting errors: It’s the fix-it form for any mistakes or omissions in your tax filings.

- Reporting additional income: If you’ve discovered some extra cash that you didn’t include on your original return, Form 4852 is your ticket to rectifying the situation.

- Claiming deductions or credits: Missed out on a juicy deduction or credit? Form 4852 can help you get it back.

5. Online Accessibility and Resources

Blokes and birds, need to get your mitts on Form 4852? No stress, it’s a doddle to find online. Here’s the 411:

To download the printable version of Form 4852, simply click on the link below. It’s a piece of cake, mate!

Official Website

Assistance and Resources

If you’re feeling a bit stumped, don’t fret. There are heaps of resources available to lend a helping hand:

Common Errors and Troubleshooting

Filling out Form 4852 can be a breeze, but even the best of us can make mistakes. Here’s the lowdown on common errors and how to dodge them like a pro:

Forgetting to sign and date: Don’t be a donut! Make sure you sign and date the form before sending it off. It’s like the cherry on top of your sundae, it’s essential.

Mixing up your income: It’s easy to get your knickers in a twist when it comes to income. Double-check that you’re entering the right numbers in the right boxes. Don’t be a tit, get it sorted.

Missing out on deductions: Don’t be a mug! Make sure you’re claiming all the deductions you’re entitled to. It’s like finding a tenner in your pocket, but better.

Making maths mistakes: Don’t be a blagger! Check your calculations twice. If you’re not sure, use a calculator or ask a mate for help. Don’t be a tool, get it right.

Entering incorrect information: It’s like trying to fit a square peg in a round hole. Make sure you’re entering the correct information, like your name, address, and tax details. Don’t be a div, get it sorted.

FAQ Section

What is the purpose of Form 4852?

Form 4852 is a vital document used to report certain types of income and expenses related to charitable contributions, business expenses, and other miscellaneous deductions.

Where can I find the printable version of Form 4852?

The printable version of Form 4852 can be found on the official website of the Internal Revenue Service (IRS).

What are some common errors to avoid when completing Form 4852?

Common errors to avoid include incorrect calculations, missing information, and failing to attach necessary supporting documentation.