The Ultimate Guide to Printable Income and Expense Worksheets

Are you ready to take control of your finances and make informed decisions about your spending? Printable income and expense worksheets are the key to unlocking financial freedom and achieving your financial goals. Whether you’re an individual looking to manage your personal finances or a business owner seeking to optimize your operations, these worksheets provide a comprehensive solution for tracking your financial transactions and making sense of your financial data.

In this guide, we’ll dive into the world of printable income and expense worksheets, exploring their components, how to create and use them effectively, and advanced features that can help you maximize their benefits. Get ready to transform your financial management and empower yourself with the knowledge to make informed decisions about your money.

Overview of Printable Income and Expense Worksheets

Printable income and expense worksheets are tools that help individuals and businesses track their financial transactions. These worksheets provide a structured format for recording income and expenses, making it easier to identify spending patterns, manage cash flow, and plan for the future.

There are many benefits to using printable income and expense worksheets. For personal finance management, these worksheets can help individuals:

- Create a budget and stick to it

- Identify areas where they can save money

- Plan for large purchases or unexpected expenses

For business finance management, these worksheets can help businesses:

- Track expenses and identify areas where costs can be reduced

- Forecast cash flow and plan for future investments

- Prepare financial statements and reports

Printable income and expense worksheets are available in a variety of formats, so you can choose one that best suits your needs. Some worksheets are simple and straightforward, while others are more complex and include additional features such as graphs and charts.

No matter what your financial management needs are, a printable income and expense worksheet can be a valuable tool for helping you track your finances and make informed financial decisions.

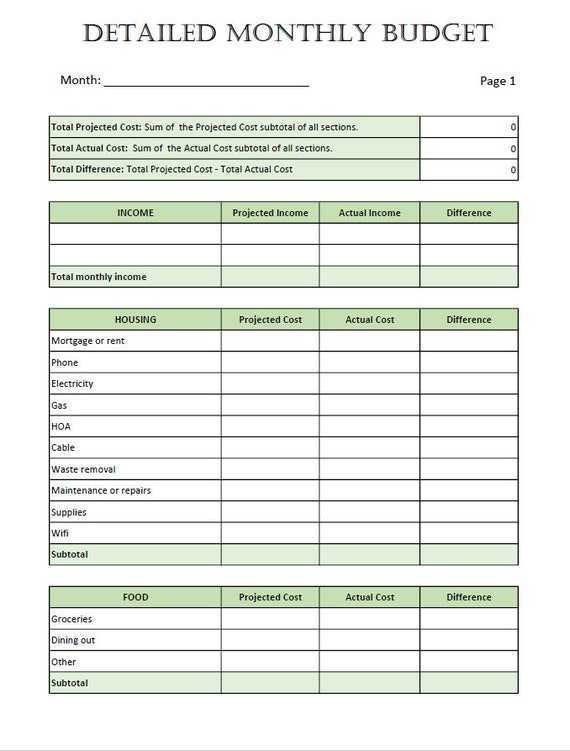

Components of a Comprehensive Printable Income and Expense Worksheet

Yo, check it! A banging printable income and expense worksheet is your money game’s best mate. It’s like having a sick personal accountant in your pocket. But what makes a proper worksheet? Let’s break it down.

Key Sections

A lit worksheet has these key bits:

- Income: Your cheddar, the dough you’re raking in. This includes your salary, side hustles, and any other loot.

- Expenses: Your bills, the cash you’re shelling out. This covers everything from rent to Netflix.

- Categories: These are like folders for your income and expenses. It helps you organize your money into stuff like “Food” or “Entertainment.”

- Totals: The grand finale! This shows you how much bread you’re making and spending. It’s like a money snapshot.

Each section is like a piece of a puzzle, giving you a clear picture of your financial situation. Plus, you can customize these worksheets to fit your own needs. Just add or remove categories to make it work for you.

Creating and Using a Printable Income and Expense Worksheet

Creating a printable income and expense worksheet can be a great way to track your financial situation and make informed decisions about your spending. Here are some step-by-step instructions on how to create and use a printable income and expense worksheet:

Gathering and Entering Financial Data

The first step is to gather all of your financial data. This includes your income, expenses, and any other relevant financial information. Once you have gathered your data, you can enter it into the worksheet.

Calculating Totals, Subtotals, and Balances

Once you have entered your financial data, you can calculate your totals, subtotals, and balances. This will help you see how much money you have coming in, how much you are spending, and how much you have left over.

Using the Worksheet to Track Your Financial Situation

Once you have created your worksheet, you can use it to track your financial situation over time. This can help you identify areas where you can save money or make other financial improvements.

Analyzing and Interpreting Printable Income and Expense Worksheets

![]()

Analyzing and interpreting printable income and expense worksheets is crucial for understanding your financial situation and making informed decisions. These worksheets provide a snapshot of your cash flow, allowing you to identify patterns, trends, and areas for improvement.

By carefully reviewing your income and expenses, you can gain valuable insights into your financial habits. This information can help you make adjustments to your budget, reduce unnecessary spending, and prioritize saving and investment goals.

Techniques for Analyzing Printable Income and Expense Worksheets

* Categorize expenses: Group expenses into categories such as housing, transportation, food, and entertainment. This helps you identify areas where you’re spending the most money.

* Track spending over time: Use multiple worksheets to compare your expenses over several months. This allows you to spot trends and see if your spending habits are improving.

* Identify areas for improvement: Look for expenses that are higher than expected or that you could potentially reduce. Consider cutting back on non-essential spending or finding ways to negotiate lower bills.

* Use a budgeting app: Some budgeting apps allow you to import your income and expense data, making it easier to track your spending and identify areas for improvement.

Making Informed Decisions with Printable Income and Expense Worksheets

* Set realistic financial goals: Use your worksheets to determine how much money you can save or invest each month. This helps you create a plan to reach your financial objectives.

* Adjust your budget: Based on your analysis, make adjustments to your budget to reduce unnecessary expenses and increase savings.

* Prioritize saving: Identify areas where you can cut back on spending to free up more money for saving and investment.

* Seek professional advice: If you’re struggling to manage your finances or make informed decisions, consider seeking advice from a financial advisor or credit counselor.

Examples of Identifying Areas for Financial Improvement

* High housing costs: Consider downsizing to a smaller home or negotiating a lower rent.

* Excessive entertainment expenses: Limit dining out or find cheaper entertainment options.

* Unnecessary subscriptions: Cancel subscriptions to services you don’t use regularly.

* High transportation costs: Consider carpooling, using public transportation, or finding a more fuel-efficient vehicle.

By regularly analyzing and interpreting printable income and expense worksheets, you can gain a deeper understanding of your financial situation and make informed decisions to improve your financial well-being.

Advanced Features and Customization Options

Printable income and expense worksheets can be enhanced with advanced features to streamline financial management and cater to specific needs.

Conditional Formatting

Conditional formatting applies rules to highlight data based on predefined criteria. For instance, cells exceeding a certain expense threshold can be highlighted in red, drawing attention to areas requiring review.

Formulae

Incorporate formulae to automate calculations and analysis. Summing up expense categories, calculating averages, or applying financial ratios can be automated, saving time and reducing errors.

Charts and Graphs

Visualize financial data with charts and graphs. Pie charts, bar graphs, and line graphs can illustrate income and expense trends, making it easier to identify patterns and areas for improvement.

Customization

Tailor worksheets to suit specific requirements by:

– Adjusting the categories and subcategories to reflect individual income and expense streams.

– Modifying the layout and design to enhance readability and clarity.

– Incorporating additional features, such as notes sections or space for financial goals.

By leveraging these advanced features and customization options, printable income and expense worksheets become powerful tools for effective financial management.

Best Practices and Tips for Effective Use

To make the most of printable income and expense worksheets, it’s crucial to stay on top of them. Regularly update your records and make sure you’re tracking your progress towards your financial goals. If you’re struggling, don’t hesitate to seek professional guidance.

Troubleshooting Common Issues

Sometimes, things don’t go as planned. Here are some common issues and how to fix them:

– Can’t find a worksheet that fits your needs? Create your own using a spreadsheet program or download a template online.

– Worksheet is too complicated? Simplify it by removing unnecessary categories or creating a separate worksheet for each category.

– Not sure how to categorize a transaction? Consult an accountant or financial advisor for guidance.

Maximizing Benefits

To get the most out of your worksheets:

– Set realistic financial goals. Don’t set yourself up for failure by setting goals that are too ambitious.

– Track your progress regularly. This will help you stay motivated and make adjustments as needed.

– Use the worksheets to make informed financial decisions. By seeing where your money is going, you can make better choices about how to spend and save.

Q&A

What are the benefits of using printable income and expense worksheets?

Printable income and expense worksheets offer numerous benefits, including the ability to track your financial transactions, identify spending patterns, set budgets, and make informed decisions about your finances. They provide a clear and organized view of your financial situation, helping you stay on top of your expenses and income.

How can I customize printable income and expense worksheets to meet my specific needs?

Printable income and expense worksheets are highly customizable, allowing you to tailor them to your unique requirements. You can add or remove sections, adjust the layout, and include specific categories that are relevant to your financial situation. This flexibility makes them a versatile tool for both personal and business finance management.

What are some common mistakes to avoid when using printable income and expense worksheets?

One common mistake is neglecting to update your worksheets regularly. It’s crucial to record your financial transactions as they occur to maintain accurate records. Additionally, setting unrealistic financial goals can lead to discouragement. Instead, start with small, achievable goals and gradually increase them as you make progress.