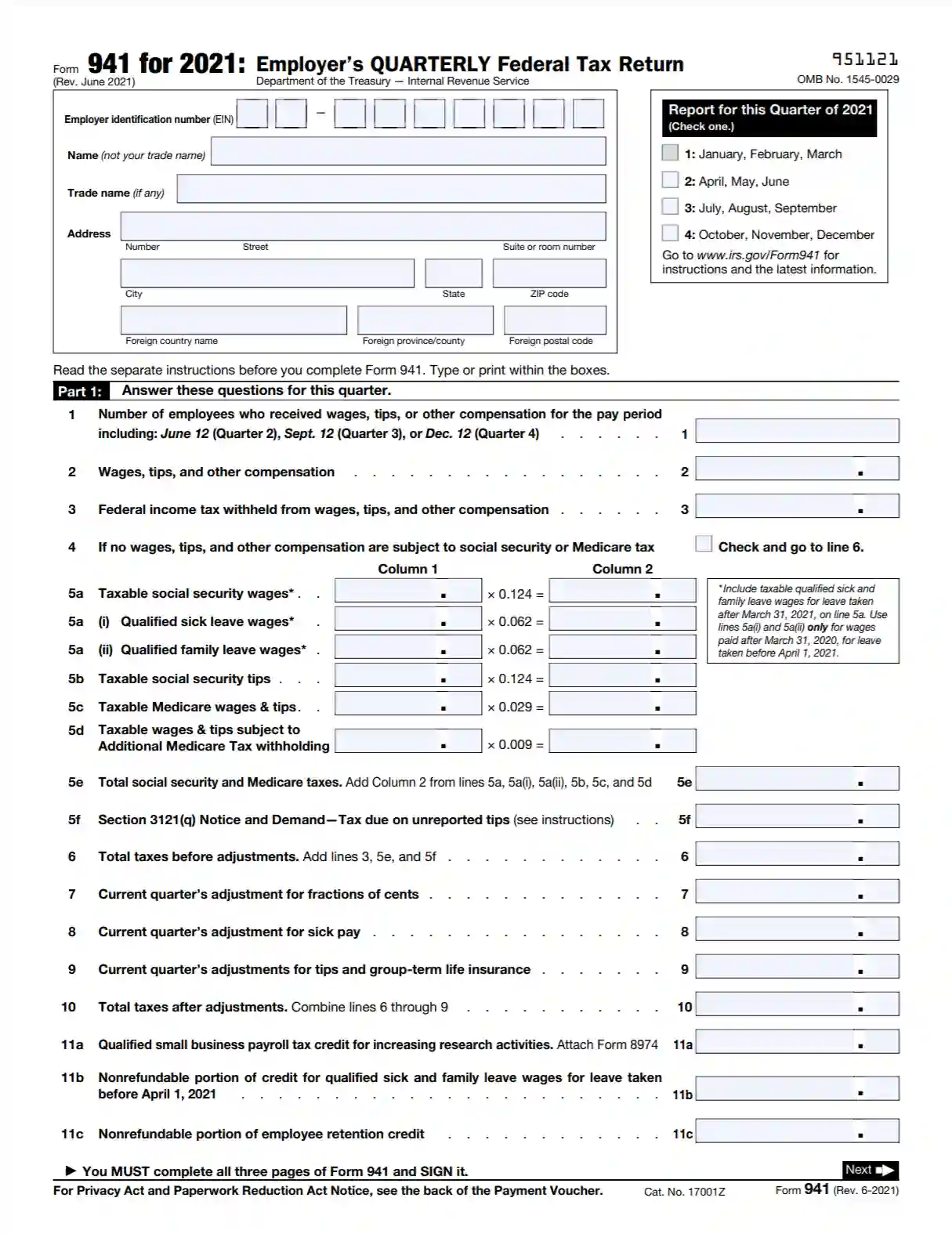

941 Printable Form: A Comprehensive Guide to Filing and Submission

Navigating the complexities of tax reporting can be a daunting task, especially when dealing with forms like the 941 Printable Form. This comprehensive guide will provide a clear understanding of the 941 Printable Form, its significance, structure, and the essential steps involved in filing and submitting it accurately.

The 941 Printable Form plays a crucial role in the quarterly reporting of federal income tax, Social Security tax, and Medicare tax. It is a legal document that employers must file with the Internal Revenue Service (IRS) to report the taxes withheld from employees’ wages. Understanding the form’s structure and requirements is essential for ensuring timely and accurate tax payments.

Introduction

The 941 Printable Form is a crucial document for employers in the UK. It’s used to report details about employees’ Pay As You Earn (PAYE) and National Insurance (NI) deductions to Her Majesty’s Revenue and Customs (HMRC).

This form is vital for ensuring that the correct amount of tax and NI is paid by employees, and it plays a key role in the UK’s tax system.

Who needs to use the 941 Printable Form?

- All employers in the UK who pay employees are required to use the 941 Printable Form.

Structure and Components

Blud, this 941 Printable Form is like a proper organised geezer. It’s got a clear structure with some key sections that make it easy to fill in.

Sections and Functions

- Personal Information: This is where you spill the beans about yourself, like your name, addy, and all that jazz.

- Tax Information: Here’s where you get down to the nitty-gritty, giving the taxman the lowdown on your income and expenses.

- Payments: This section’s for sorting out how much you owe and how you’re gonna pay it. Could be a lump sum, instalments, or whatever.

- Declaration: Time to put your John Hancock on it and swear on your mum’s life that everything you’ve said is true.

Data Collection and Reporting

The 941 Printable Form is designed to collect specific data about employees and their earnings. This data is used to calculate tax and National Insurance contributions, as well as to provide information to various government agencies.

Types of Data Collected

The following types of data are collected on the 941 Printable Form:

- Employee’s name and address

- Employee’s National Insurance number

- Employee’s date of birth

- Employee’s gender

- Employee’s occupation

- Employee’s earnings

- Employee’s deductions

- Employer’s name and address

- Employer’s National Insurance number

- Employer’s PAYE reference number

- Employer’s tax year

Reporting Requirements

The 941 Printable Form must be submitted to HMRC on a quarterly basis. The deadline for submitting the form is the 19th of the month following the end of the quarter.

Employers are required to keep a copy of the 941 Printable Form for at least three years.

Filing and Submission

Deadlines and Methods for Submission

The 941 form must be filed quarterly, by the last day of the month following the end of the quarter. The deadlines are as follows:

- First quarter (January 1 – March 31): April 30

- Second quarter (April 1 – June 30): July 31

- Third quarter (July 1 – September 30): October 31

- Fourth quarter (October 1 – December 31): January 31

The form can be filed electronically or by mail. Electronic filing is the preferred method, as it is more efficient and secure. To file electronically, you will need to use the IRS’s EFTPS (Electronic Federal Tax Payment System) website. You can also file by mail by sending the completed form to the address provided on the form.

Common Errors and Troubleshooting

Filling out the 941 form can be a bit tricky, so it’s easy to make mistakes. But don’t worry, we’re here to help. Here are some of the most common errors people make when filling out the form, along with some tips on how to avoid them.

One of the most common errors is forgetting to sign and date the form. This is a required field, so make sure you don’t forget to do it. Another common error is making mistakes in the calculations. The form is full of numbers, so it’s easy to make a mistake. Be sure to double-check your work before you submit the form.

Incorrectly completing the form

- Entering incorrect information in the form fields.

- Omitting required information or leaving fields blank.

- Using incorrect formatting or units of measurement.

- Making mathematical errors in calculations.

- Failing to sign and date the form.

To avoid these errors, carefully read and follow the instructions on the form. Ensure you have all the necessary information before you start filling it out. Double-check your entries for accuracy, including calculations and formatting. Finally, don’t forget to sign and date the form before submitting it.

Filing the form late

- Missing the filing deadline.

- Submitting the form after the due date.

To avoid late filing, mark the filing deadline on your calendar and start working on the form well in advance. Allow ample time for gathering information, completing the form, and submitting it before the deadline. Consider using electronic filing options, such as the IRS e-file system, to ensure timely submission.

Incorrectly submitting the form

- Using an outdated form.

- Submitting the form to the wrong address.

- Failing to include all required attachments.

To ensure correct submission, use the most recent version of the 941 form. Verify the correct mailing address for your location. Gather all necessary supporting documents and attach them to the form. Double-check the completeness of your submission before sending it.

Alternatives and Similar Forms

There are alternative methods to report the same information required on the 941 Printable Form. One option is to use the 941 Online Filing System, which allows you to file your return electronically. This option is more convenient and can save you time.

Another alternative is to use a tax preparation software program. These programs can help you to calculate your taxes and file your return. They can also save you time and help you to avoid errors.

Comparison with Similar Forms

The 941 Printable Form is similar to other forms used to report employment taxes. These forms include:

- Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return

- Form 944, Employer’s Quarterly Federal Tax Return

- Form W-2, Wage and Tax Statement

These forms all require you to report information about your employees’ wages and taxes. However, there are some key differences between these forms.

The 941 Printable Form is used to report quarterly employment taxes. This includes federal income tax, Social Security tax, and Medicare tax. Form 940 is used to report annual FUTA tax. Form 944 is used to report quarterly federal income tax and Social Security tax. Form W-2 is used to report an employee’s wages and taxes for the year.

Resources and Support

Get the support you need to fill out the 941 form effortlessly. Check out the resources and contacts below for expert guidance and assistance.

For any queries or assistance, don’t hesitate to reach out to the friendly team at the following channels:

Contact Information

- Phone: 0300 200 3500

- Email: [email protected]

- Webchat: Available on the HMRC website

Frequently Asked Questions

What is the purpose of the 941 Printable Form?

The 941 Printable Form is used to report federal income tax, Social Security tax, and Medicare tax withheld from employees’ wages.

When is the 941 Printable Form due?

The 941 Printable Form is due on the last day of the month following the end of each calendar quarter (April 30, July 31, October 31, and January 31).

Where can I find the 941 Printable Form?

The 941 Printable Form can be downloaded from the IRS website.

What are some common errors to avoid when filling out the 941 Printable Form?

Common errors to avoid include incorrect calculations, missing or incomplete information, and filing the form late.