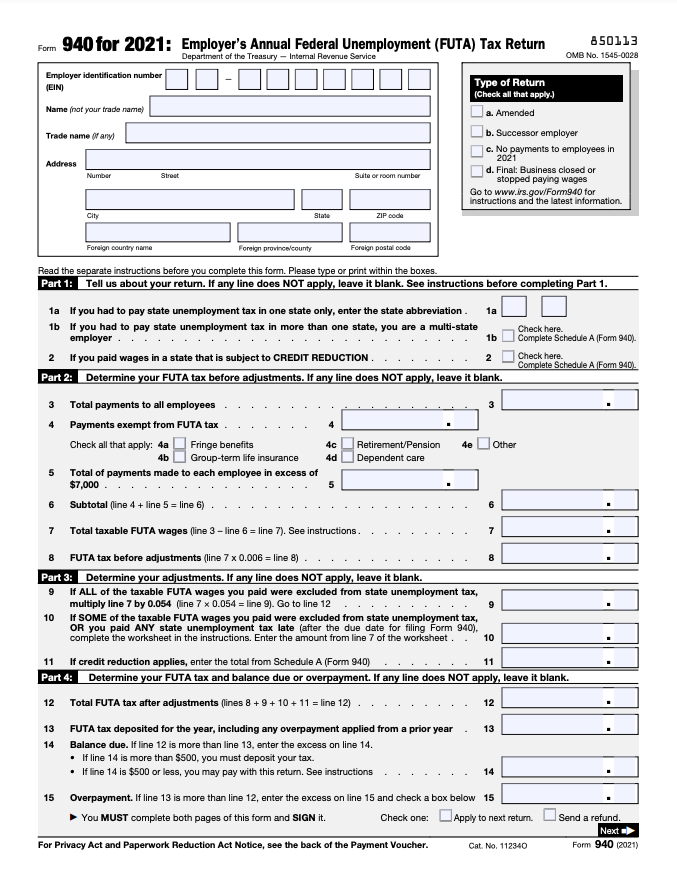

940 Printable Form: A Comprehensive Guide to Navigating Tax Obligations

In the realm of taxation, understanding and completing the appropriate forms is crucial for individuals and businesses alike. Among these essential documents, Form 940 stands out as a vital component for reporting federal unemployment taxes. This guide delves into the intricacies of Form 940, providing a comprehensive overview of its purpose, completion process, and the advantages of using printable forms.

Printable forms offer a convenient and accessible solution for fulfilling tax obligations. Their flexibility allows for easy customization and adaptability to specific requirements, making them a valuable tool for both personal and professional tax management.

Forms and Documents

Yo, listen up! Printable forms are like a cheat code for life. They’re the easy way to sort out all your paperwork and get stuff done without any hassle.

There’s a ton of different printable forms out there, from job applications to tax returns. And the best part is, you can find them all online for free.

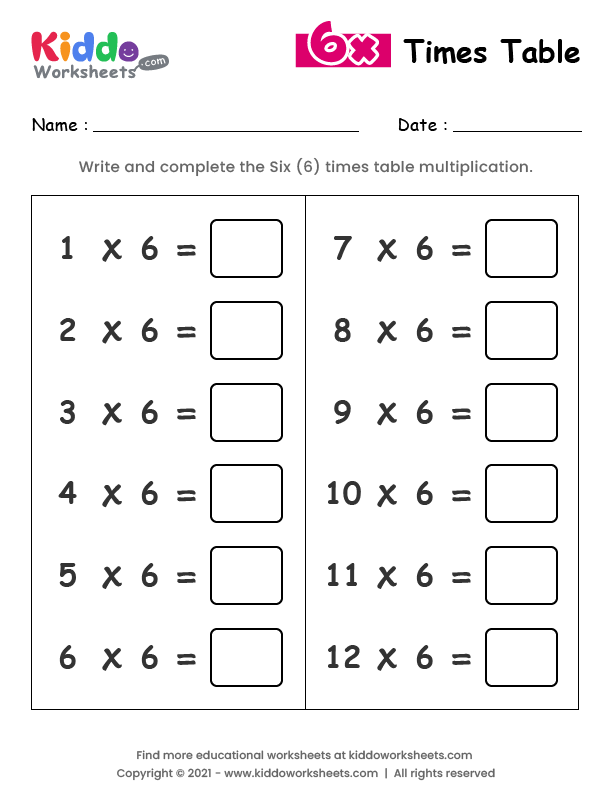

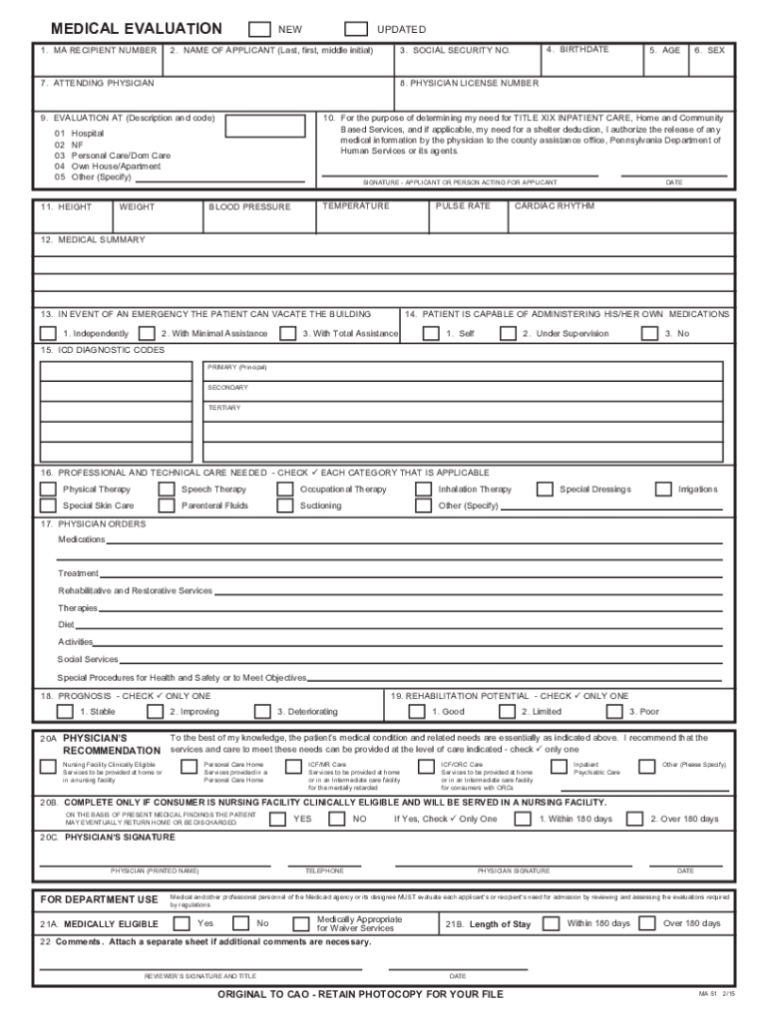

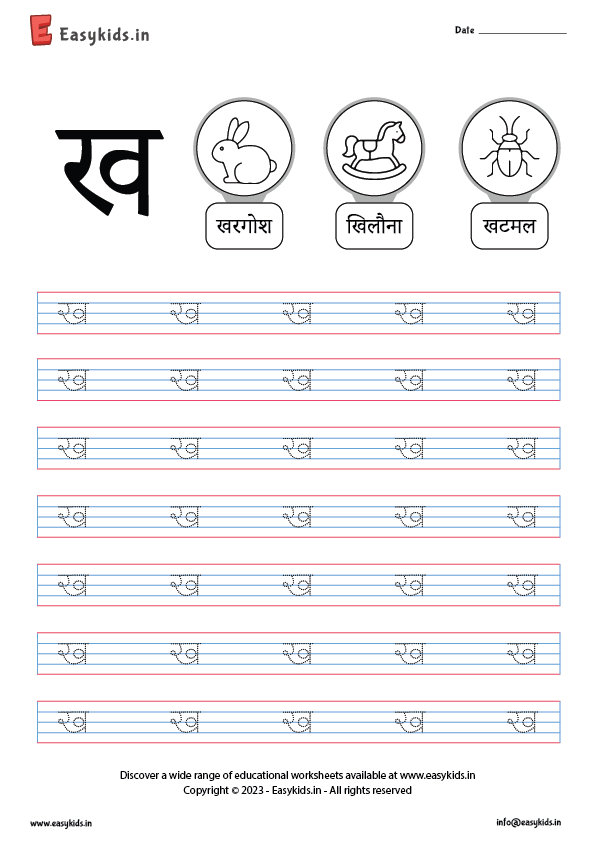

Types of Printable Forms

- Job applications

- Tax returns

- Medical forms

- Legal documents

- School forms

It’s important to choose the right form for your needs. If you’re not sure which one to use, just do a quick search online or ask a grown-up for help.

Printable Form 940

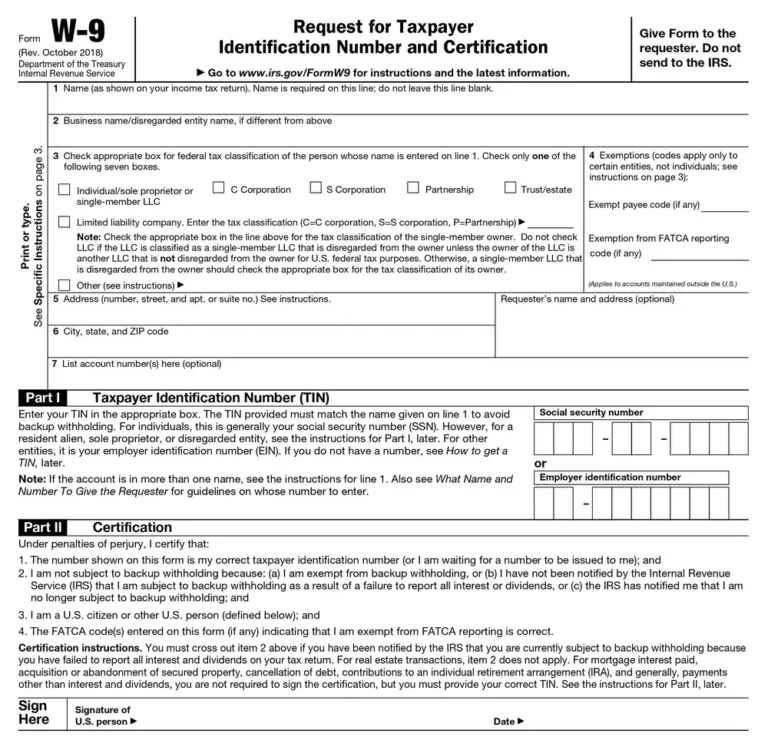

Form 940 is a printable document used by employers to report federal unemployment taxes (FUTA) to the Internal Revenue Service (IRS). It is required for employers who pay wages to employees or have a certain amount of employee income.

Information Required to Complete Form 940

To complete Form 940 accurately, you will need the following information:

– Employer Identification Number (EIN)

– Name and address of the business

– Total wages paid to employees

– Federal unemployment tax liability

– Taxable wages

Obtaining Form 940

You can obtain Form 940 from the IRS website or by calling the IRS at 1-800-829-1040. You can also find the form at your local IRS office.

Benefits of Printable Forms

Bruv, printable forms are the bomb when it comes to paperwork. They’re like the OG of forms, but with some serious advantages that make ’em way better than their digital counterparts.

Convenience and Accessibility

First off, printable forms are mad convenient. You can print ’em out anytime, anywhere, without having to worry about an internet connection or software updates. Just grab a printer and you’re good to go. Plus, you can keep ’em on hand for easy reference or to fill out later.

Organization and Tracking

Secondly, printable forms are sick for organizing and tracking information. You can physically file ’em away or use a binder to keep ’em all in one place. This makes it easy to find what you need when you need it, unlike digital forms that can get lost in the depths of your computer.

Using Printable Forms

Getting your hands on Printable Form 940 is a breeze. Just follow these steps:

- Visit the official website of the IRS.

- Navigate to the “Forms and Publications” section.

- Search for Form 940.

- Click on the “Download” button.

- Save the PDF file to your computer.

Once you’ve got the form downloaded, it’s time to fill it out. Here’s a step-by-step guide:

- Gather all the necessary information, such as your employer identification number (EIN), unemployment insurance (UI) account number, and payroll details.

- Start by filling out the header section with your business information.

- Move on to the “Taxable Wages, Tips, etc.” section and report the total wages and tips paid to your employees.

- Calculate the federal unemployment tax (FUTA) liability and enter it in the appropriate field.

- If you qualify for any credits or deductions, make sure to include them.

- Review your form carefully before submitting it.

To ensure accuracy and efficiency when completing Form 940, keep these tips in mind:

- Use the latest version of the form.

- Write clearly and legibly.

- Double-check your calculations.

- File your form on time.

Considerations for Printable Forms

Innit, printable forms can be a right laugh, but they ain’t all sunshine and rainbows. Let’s have a butcher’s at some of the bits you need to watch out for, like security and keeping ’em organized.

Security

These forms might be printable, but they can still get nicked or fall into the wrong hands. So, make sure you keep ’em safe like a lockbox. Use strong passwords and don’t share ’em with anyone. It’s like protecting your precious jewels, but with forms.

Storage and Management

Don’t be a tit and leave your forms lying around like a right mess. Get yourself a filing cabinet or something to keep ’em organized. That way, you can find ’em when you need ’em, and they won’t end up getting lost or nicked.

FAQs

What are the benefits of using printable forms over electronic forms?

Printable forms offer advantages such as convenience, accessibility, and the ability to physically organize and track information. They provide a tangible record that can be easily reviewed, stored, and retrieved as needed.

How can I download and print Form 940?

Form 940 can be downloaded from the Internal Revenue Service (IRS) website. Once downloaded, the form can be printed using a standard printer.

What information is required to complete Form 940 accurately?

To complete Form 940 accurately, you will need information such as your employer identification number (EIN), the number of employees, wages paid, and unemployment taxes owed.

Where can I obtain Form 940 for printing?

Form 940 can be obtained from the IRS website or by contacting the IRS directly.