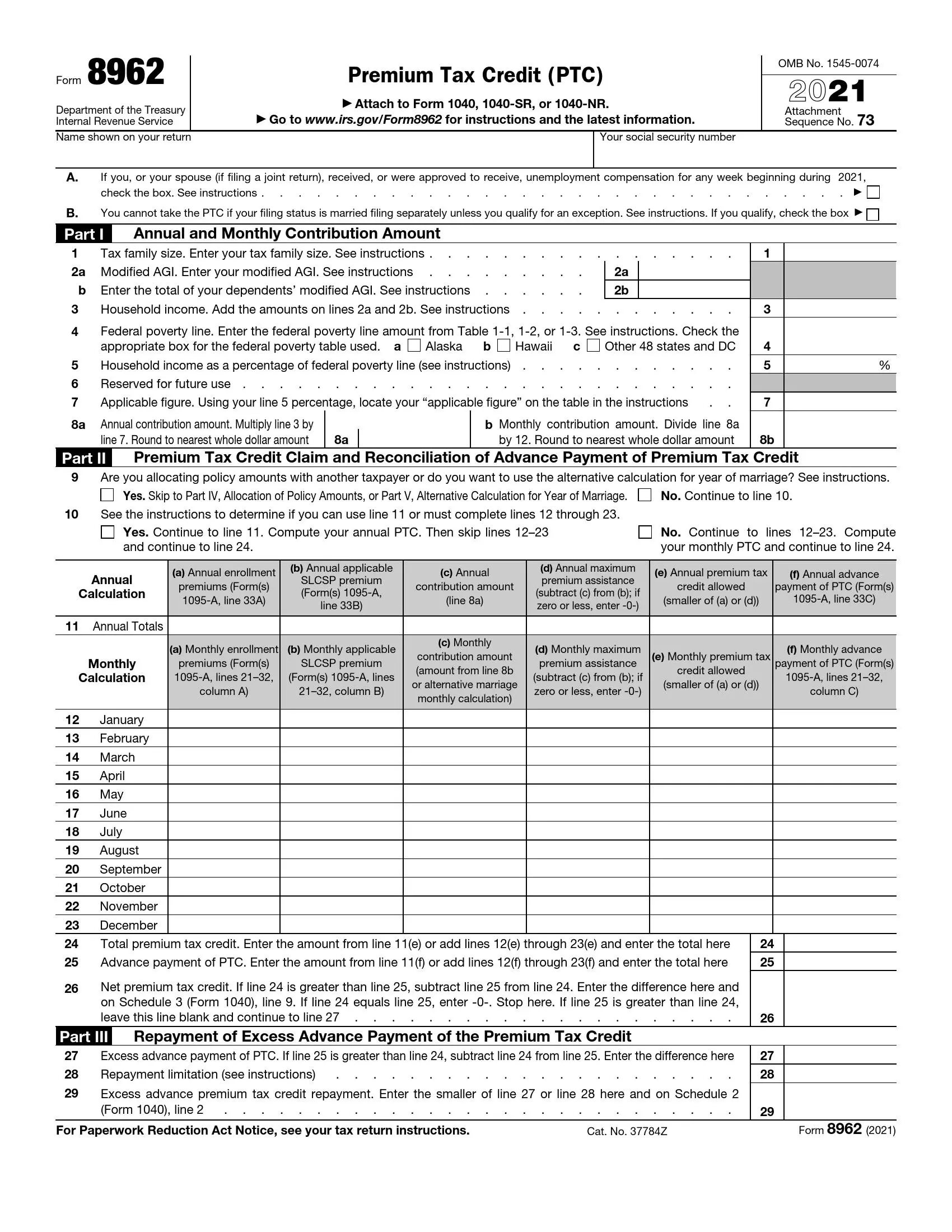

8962 Form 2021 Printable: A Comprehensive Guide

Navigating the complexities of tax reporting can be daunting, but understanding Form 8962 is crucial for individuals and businesses alike. This guide will provide a comprehensive overview of Form 8962, including its purpose, who needs to file it, and step-by-step instructions for completing it accurately.

Form 8962, also known as the “Premium Tax Credit (PTC) Reconciliation Form,” plays a vital role in reconciling advance payments of the PTC received during the year with the actual amount of PTC you are eligible to claim. This form ensures that you receive the correct amount of PTC and helps avoid potential tax liabilities.

Form 8962: Overview

Form 8962 is a tax form used to report the sale or exchange of certain types of property. These include stocks, bonds, mutual funds, and real estate. The form is used to calculate the gain or loss on the sale or exchange of the property and to determine the amount of tax that is owed.

Form 8962 is required to be filed by any individual or business that has sold or exchanged property during the tax year. The form is due on the same date as the individual’s or business’s income tax return.

Who Needs to File Form 8962?

Form 8962 is required to be filed by any individual or business that has sold or exchanged property during the tax year. This includes the following types of property:

- Stocks

- Bonds

- Mutual funds

- Real estate

Form 8962 is not required to be filed if the property was sold or exchanged for a loss. However, if the property was sold or exchanged for a gain, Form 8962 must be filed to report the gain and to calculate the amount of tax that is owed.

When is Form 8962 Due?

Form 8962 is due on the same date as the individual’s or business’s income tax return. For most individuals, this is April 15th. However, if the individual or business has filed for an extension, the due date for Form 8962 is the same as the extended due date for the income tax return.

s for Completing Form 8962

Filling out Form 8962 can be a bit of a drag, but it’s important to get it right. Here are some tips to help you out:

Before you start, make sure you have all the information you need. This includes your Social Security number, your spouse’s Social Security number (if filing jointly), your income, and any deductions or credits you’re claiming.

Once you have all your information, you can start filling out the form. Here are the step-by-step s:

- Enter your personal information. This includes your name, address, and Social Security number.

- Enter your spouse’s information. If you’re filing jointly, you’ll need to enter your spouse’s name, address, and Social Security number.

- Enter your income. This includes your wages, salaries, tips, and other taxable income.

- Enter your deductions. This includes your standard deduction or itemized deductions.

- Enter your credits. This includes any tax credits you’re claiming.

- Calculate your tax. This is the amount of tax you owe based on your income, deductions, and credits.

- Enter your payments. This includes any federal income tax you’ve already paid.

- Refund or balance due. This is the amount of refund you’re getting or the amount of tax you owe.

Once you’ve completed the form, review it carefully for any errors. Then, sign and date the form and mail it to the IRS.

Here are some tips for avoiding common errors:

- Make sure you’re using the correct form for your filing status.

- Enter your Social Security number correctly.

- Enter your income and deductions accurately.

- Make sure you’re claiming the correct tax credits.

- Calculate your tax correctly.

- Enter your payments correctly.

If you’re not sure how to fill out Form 8962, you can always get help from a tax professional.

Line-by-Line Breakdown of Form 8962

Form 8962 is a tax form used to report certain types of income and expenses. It’s a handy tool to have, especially if you’re a student or self-employed. This guide will break down each line of the form so you can fill it out like a pro.

Here’s a table to help you understand each line:

| Line Number | Description | s | Examples |

|---|---|---|---|

| 1 | Gross income | Enter your total income from all sources. | Wages, salaries, tips, self-employment income, etc. |

| 2 | Adjusted gross income | Subtract any deductions you’re allowed to take from your gross income. | Standard deduction, itemized deductions, etc. |

| 3 | Taxable income | Subtract any other deductions or exemptions from your adjusted gross income. | Personal exemptions, student loan interest deduction, etc. |

| 4 | Tax | Calculate the amount of tax you owe based on your taxable income. | Use the tax table or tax software to determine your tax liability. |

| 5 | Credits | Subtract any tax credits you’re eligible for from your tax. | Child tax credit, earned income credit, etc. |

| 6 | Tax due | Subtract your credits from your tax. This is the amount of tax you owe. | If the result is negative, you’re due a refund. |

| 7 | Estimated tax payments | Enter any estimated tax payments you’ve made. | Payments made throughout the year to cover your tax liability. |

| 8 | Overpayment | If your estimated tax payments are more than your tax due, you’ll receive a refund. | The amount of the overpayment will be refunded to you. |

Special Considerations and Exceptions

Form 8962 generally applies to all taxpayers who meet the eligibility criteria. However, certain special considerations and exceptions may apply in specific situations.

Deceased Taxpayers

If a taxpayer dies before filing their tax return, their executor or administrator may file Form 8962 on their behalf. The due date for filing Form 8962 in such cases is the same as the due date for filing the deceased taxpayer’s final income tax return.

Married Filing Separately

Married couples who file their tax returns separately may be eligible to claim the premium tax credit on Form 8962. However, they must meet certain additional requirements, such as living apart for the entire tax year and maintaining separate households.

Tax-Exempt Individuals

Individuals who are exempt from paying federal income tax, such as those with very low incomes, may not be eligible to claim the premium tax credit on Form 8962.

Filing and Submission of Form 8962

Blud, filing Form 8962 is a doddle. You can do it electronically (e-filing) or by post, innit? If you’re a whizz at tech, e-filing is your jam. Just head over to the IRS website and follow the steps, bruv. It’s as easy as pie.

Now, if you’re more of an old-school type, you can always print out the form and send it in the post. Just make sure you’ve filled it in properly and got all the right bits and bobs attached. Send it to the address on the form, and you’re sorted.

Encountering Issues

Yo, if you’re having a mare with filing your Form 8962, don’t stress. You can always give the IRS a bell on their helpline. They’re usually pretty helpful, so they’ll sort you out.

Q&A

What is the purpose of Form 8962?

Form 8962 is used to reconcile the advance payments of the Premium Tax Credit (PTC) received during the year with the actual amount of PTC you are eligible to claim.

Who needs to file Form 8962?

Individuals and families who received advance payments of the PTC during the year are required to file Form 8962.

When is Form 8962 due?

Form 8962 is due on the same date as your federal income tax return, typically April 15th.

Can I file Form 8962 electronically?

Yes, you can file Form 8962 electronically using tax software or through the IRS website.

What happens if I make a mistake on Form 8962?

If you make a mistake on Form 8962, you can file an amended return using Form 1040-X.