52 Week Savings Challenge Printable: A Comprehensive Guide to Financial Success

Embark on a transformative journey towards financial freedom with the 52 Week Savings Challenge Printable. This meticulously crafted guide empowers individuals to cultivate a disciplined savings habit, conquer their financial goals, and experience the transformative power of financial empowerment.

Whether you aspire to pay off debt, build an emergency fund, or invest for the future, the 52 Week Savings Challenge Printable provides a structured and accessible roadmap to achieve your aspirations. Dive into the intricacies of this challenge and unlock the gateway to financial well-being.

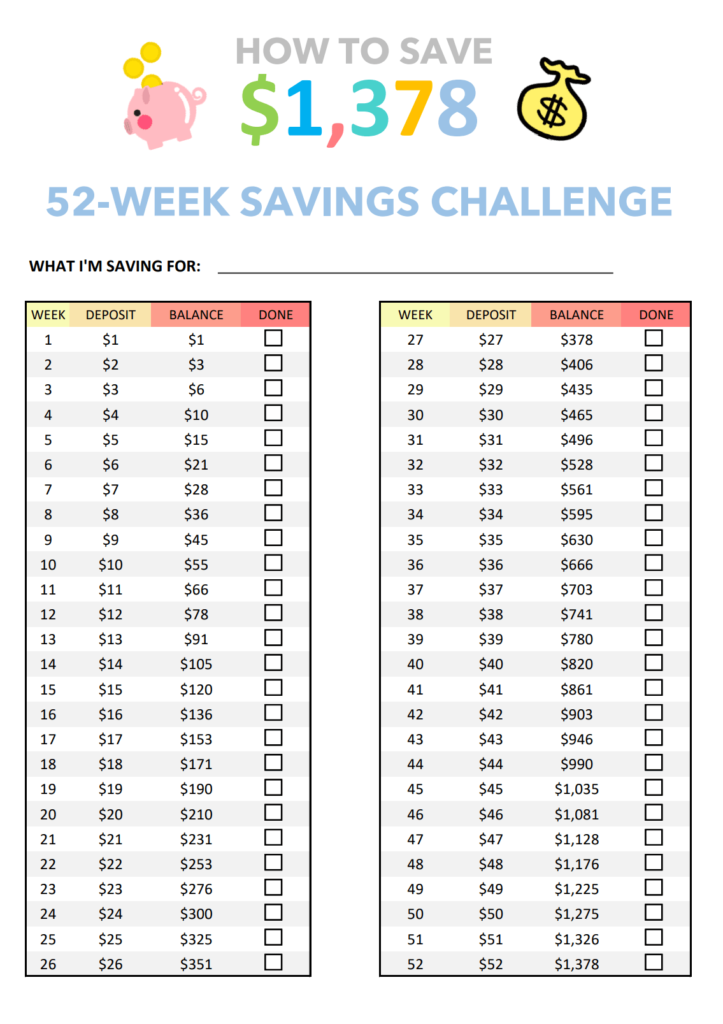

Printable 52-Week Savings Challenge

The 52-week savings challenge is a simple way to save money over the course of a year. The challenge involves setting aside a specific amount of money each week, and then increasing the amount you save each week by a set amount. By the end of the year, you’ll have saved a significant amount of money.

To make the challenge easier, we’ve created a printable 52-week savings challenge tracker. The tracker includes a table with 4 columns, one for each week of the year. There’s also a space for notes and a total savings column.

Table Design

The table design is simple and easy to use. The first column lists the week number, and the second column lists the amount of money you’ll need to save that week. The third column is for notes, and the fourth column is for the total amount you’ve saved so far.

The table is designed to be responsive, so it will adjust to fit any screen size. You can print the tracker out on a standard piece of paper, or you can use it on your computer or phone.

Using the Tracker

To use the tracker, simply fill in the amount of money you want to save each week in the second column. You can also add notes in the third column, such as what you’re saving for or why you’re saving. As you complete each week, fill in the total amount you’ve saved so far in the fourth column.

The 52-week savings challenge is a great way to save money and reach your financial goals. By using the printable tracker, you can make the challenge even easier and more fun.

Savings Goals

The 52-week savings challenge is designed to help individuals accumulate funds over a year. By setting aside a specific amount each week, participants can build their savings gradually and reach their financial objectives.

The challenge promotes financial discipline and encourages individuals to prioritize saving over unnecessary spending. It provides a structured approach to saving, making it easier to track progress and stay motivated.

Setting Realistic Savings Targets

Setting realistic savings targets is crucial for the success of the challenge. Here are some tips:

- Assess your financial situation: Determine your income, expenses, and existing financial commitments to establish a realistic savings goal.

- Start small: If saving a significant amount each week seems daunting, begin with a smaller sum and gradually increase it as you become more comfortable.

- Set achievable goals: Avoid setting targets that are too ambitious, as this can lead to discouragement and failure. Choose an amount that you can consistently contribute without putting undue financial strain on yourself.

- Automate savings: Set up automatic transfers from your checking account to a dedicated savings account to minimize the temptation to spend the money.

Tracking Progress

To ensure success, tracking progress is crucial throughout the 52-Week Savings Challenge. Regular monitoring helps stay motivated and accountable, making it easier to achieve savings goals.

There are various ways to track progress:

Digital Tools

- Spreadsheet: Create a spreadsheet to record weekly savings, set reminders, and calculate progress.

- Budgeting Apps: Use budgeting apps that allow tracking specific savings goals, such as Mint or YNAB.

Physical Methods

- Savings Tracker Printable: Use a printable tracker to physically mark off each week’s savings.

- Jar System: Designate a jar for the challenge and physically add coins or bills each week.

Visualizing Progress

- Savings Thermometer: Create a visual thermometer to track progress, with each week’s savings representing a portion of the thermometer.

- Savings Graph: Plot a graph to visualize savings over time, highlighting milestones and setbacks.

Benefits of Completing the Challenge

Completing the 52-week savings challenge can be a life-changing experience. It can help you to save a significant amount of money, gain financial literacy, and boost your confidence.

One of the biggest benefits of completing the challenge is the financial reward. By setting aside a small amount of money each week, you can save over £1,300 by the end of the year. This money can be used to pay off debt, build an emergency fund, or invest in your future.

In addition to the financial benefits, the 52-week savings challenge can also help you to gain financial literacy. By tracking your progress and seeing how your savings grow, you will learn more about how to manage your money. This knowledge can help you to make better financial decisions in the future.

Finally, completing the 52-week savings challenge can boost your confidence. Saving money can be challenging, but by completing the challenge, you will prove to yourself that you can achieve your financial goals. This sense of accomplishment can motivate you to continue saving and achieving your other financial goals.

Success Stories

There are many success stories from people who have completed the 52-week savings challenge. One person saved over £1,500 by completing the challenge. They used the money to pay off their credit card debt and build an emergency fund. Another person saved over £2,000 by completing the challenge. They used the money to invest in their future.

These are just a few examples of the many success stories from people who have completed the 52-week savings challenge. If you are looking for a way to save money, gain financial literacy, and boost your confidence, then the 52-week savings challenge is a great option.

Printable Design Variations

There’s a smorgasbord of printable designs out there for the 52-week savings challenge, each with its own unique style and flair. Whether you’re a fan of bright and bold colours or prefer something more understated, there’s a design to suit your taste.

When choosing a design, it’s important to pick one that’s both visually appealing and easy to use. The design should be clear and concise, with a layout that makes it easy to track your progress. You should also consider the size of the printable and whether it will fit in your wallet or on your fridge.

Customizable Templates

If you can’t find a printable design that you like, you can always create your own using a customizable template. There are many free and paid templates available online, so you can find one that fits your needs and style.

Tips for Success

Smashing the 52-week savings challenge is a total win, but it’s not always a doddle. Here are some top tips to help you max out your savings and keep your motivation on point.

Penny-pinching pros:

- Ditch the daily caffeine fix: Swap pricey lattes for home-brewed bevvies.

- Cook up a storm: Dining out is a budget-buster. Whip up meals at home instead.

- Haggle like a boss: Don’t be afraid to negotiate bills or ask for discounts.

- Shop around for bargains: Compare prices before splashing out.

- Ditch the non-essentials: Take a hard look at your spending and cut out anything you don’t really need.

Boosting Your Income

Hustle hard:

- Side hustle: Get a part-time job or start a side gig to earn extra cash.

- Sell your unwanted gear: Declutter and make some dough by selling stuff you don’t use.

- Rent out a room: If you’ve got space to spare, rent it out for extra income.

- Invest wisely: Put your savings to work by investing in stocks, bonds, or property.

Overcoming Challenges

Staying motivated:

- Set realistic goals: Don’t try to save too much too soon. Start small and gradually increase your savings.

- Track your progress: Seeing your savings grow will keep you motivated.

- Find an accountability partner: Share your goals with a friend or family member for support.

- Reward yourself: Celebrate your milestones with small treats to stay on track.

Common Queries

Is the 52 Week Savings Challenge suitable for all income levels?

Absolutely! The challenge is designed to be adaptable to any income level. By tailoring the weekly savings amounts to your financial situation, you can participate and reap the benefits regardless of your income.

How can I stay motivated throughout the challenge?

Maintaining motivation is crucial. Consider setting up a visual tracker to witness your progress, connect with others participating in the challenge for support, and celebrate your milestones along the way.

What happens if I miss a week or two?

Don’t be discouraged if you encounter setbacks. The key is to recommit and catch up as soon as possible. Consistency is essential, but flexibility is also important. Adjust the subsequent weeks’ savings amounts slightly to make up for the missed weeks.