501c3 Printable Form: Your Comprehensive Guide to Nonprofit Tax Exemption

Navigating the complexities of nonprofit tax exemption can be a daunting task, but with the right tools, it doesn’t have to be. Enter Form 501c3, a crucial document that can unlock significant benefits for your organization. This comprehensive guide will delve into the intricacies of Form 501c3, providing you with a clear understanding of its purpose, eligibility requirements, and benefits. We’ll also equip you with a downloadable printable form and step-by-step instructions to ensure a smooth and successful application process.

As we explore the world of 501c3, you’ll gain valuable insights into the criteria for tax exemption, the types of organizations that qualify, and the application timeline. We’ll discuss the substantial tax savings, fundraising advantages, and enhanced credibility that come with 501c3 status. Additionally, we’ll provide guidance on maintaining compliance and the potential consequences of losing your tax-exempt status.

Form Overview

Form 501c3 is a tax-exempt form for organizations in the United States that are considered charitable, religious, or educational.

It’s a lengthy form with various sections and fields that require detailed information about your organization. Completing it accurately is crucial to ensure your organization’s tax-exempt status.

Sections and Fields

The form is divided into several sections, including:

- Part I: Basic information about your organization, such as its name, address, and mission statement.

- Part II: Detailed information about your organization’s activities, including its programs, services, and beneficiaries.

- Part III: Financial information, including your organization’s income, expenses, and assets.

- Part IV: Additional information, such as your organization’s governing documents and list of officers and directors.

Completing the Form

To complete Form 501c3, you’ll need to gather all the necessary information about your organization, including its financial records, governing documents, and list of officers and directors.

Once you have all the information, you can start filling out the form. It’s important to be accurate and complete in your answers, as any errors could delay the processing of your application.

Eligibility Requirements

Blag if you’re buzzin’ about baggin’ that 501c3 status for your rad org. Here’s the lowdown on who’s in the club and how to get your mitts on it.

Types of Orgs that Qualify

Not all orgs are cut out for this gig. You need to be a non-profit that’s into one of these peng things:

- Charity

- Education

- Religion

- Science

- Literary

- Testing for public safety

- Fostering national or international amateur sports competition

- Preventing cruelty to children or animals

Application Process and Timeline

To get your hands on that sweet 501c3, you’ll need to fill out a Form 1023 or 1023-EZ. These forms are like your passport to tax-exempt heaven.

The timeline for approval can be a bit of a drag, so don’t expect it to happen overnight. It usually takes about 6 months, but it can be longer depending on how busy the IRS is. So, don’t get your knickers in a twist if you don’t hear back straight away.

Benefits of 501c3 Status

501c3 status brings numerous advantages to organizations dedicated to charitable, educational, or other public benefit purposes. These benefits extend to tax exemptions, enhanced fundraising opportunities, and a boost in credibility and reputation.

Tax Exemptions and Deductions

- Federal Income Tax Exemption: 501c3 organizations are exempt from paying federal income tax on their earnings, allowing them to direct more resources towards their charitable activities.

- State and Local Tax Exemptions: Many states and localities also grant tax exemptions to 501c3 organizations, further reducing their tax burden.

- Donor Deductions: Donations made to 501c3 organizations are tax-deductible for individuals and corporations, encouraging charitable giving and supporting the organization’s mission.

Fundraising and Donation Benefits

- Increased Donations: The tax-deductible status of donations attracts more donors, leading to increased funding for the organization’s programs and services.

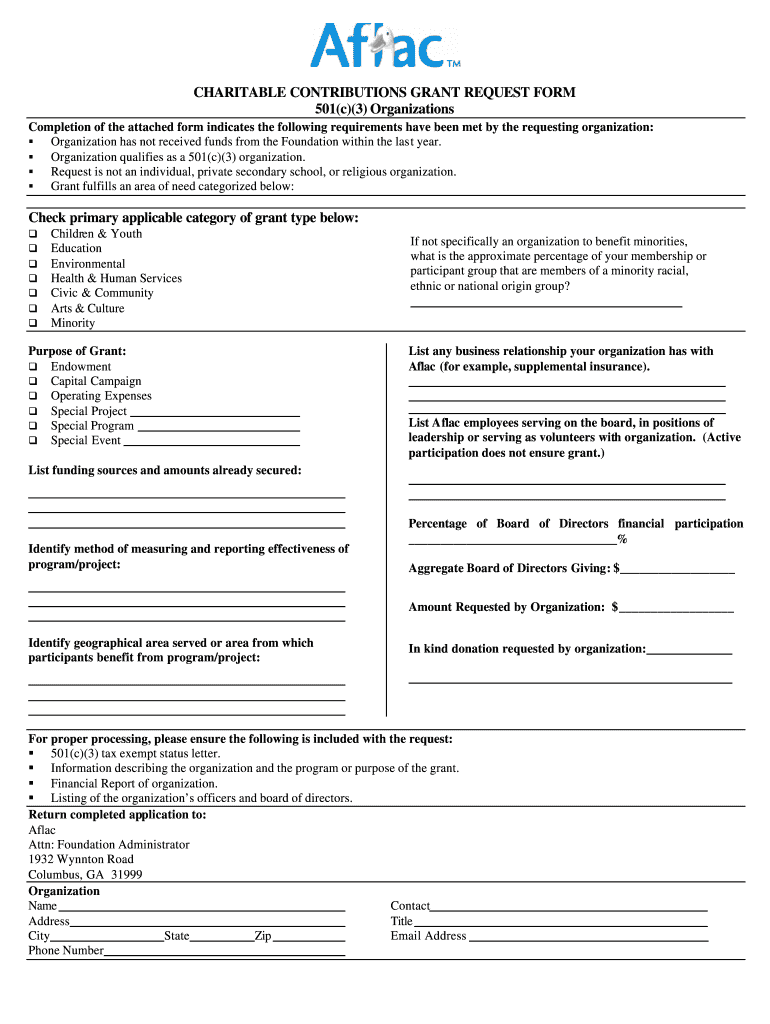

- Access to Grants: Many government agencies and private foundations prioritize funding organizations with 501c3 status, providing access to additional financial resources.

- Corporate Partnerships: Businesses often seek to partner with 501c3 organizations for charitable initiatives, offering financial support, in-kind donations, or volunteer opportunities.

Credibility and Reputation Benefits

- Public Trust: The 501c3 designation signifies that an organization has met specific requirements and is recognized as a legitimate charitable entity, fostering public trust and confidence.

- Enhanced Reputation: 501c3 status can enhance an organization’s reputation as a responsible and trustworthy steward of public funds, attracting donors and volunteers.

- Access to Government Programs: Certain government programs and initiatives are only available to organizations with 501c3 status, providing access to additional resources and opportunities.

Maintaining 501c3 Status

Staying in compliance with 501c3 regulations is essential for maintaining your tax-exempt status. Let’s look at the key steps you need to take.

Filing Annual Reports

File Form 990, 990-EZ, or 990-N annually to report your organization’s financial and operational information to the IRS. Timely filing is crucial, as late submissions can result in penalties.

Staying in Compliance

Complying with the following requirements is vital for maintaining your 501c3 status:

- Operate exclusively for charitable, educational, religious, or other exempt purposes

- Prohibit private inurement or benefiting from organization activities

- Comply with federal and state lobbying regulations

- Avoid political campaign involvement

- Maintain accurate financial records

Consequences of Losing 501c3 Status

Losing your 501c3 status can have serious consequences, including:

- Tax liability on past and future income

- Fines and penalties

- Loss of public trust and support

Sample Form and s

Filing Form 501c3 can be a daunting task, but with the right s, it can be a breeze. Here’s a step-by-step guide to help you through the process, along with a downloadable version of the form for your convenience.

To start, you can download the Form 501c3 from the IRS website. Once you have the form, follow these s to fill it out:

Part I: Application Information

- Name of organization: Enter the legal name of your organization.

- Employer Identification Number (EIN): If you have an EIN, enter it here. If you don’t have one, you can apply for one online.

- Address: Enter the address of your organization.

- Contact information: Enter the name, title, email address, and phone number of the person who will be responsible for completing the form.

Common Questions and Answers

Many people have questions about Form 501c3. Here are some of the most frequently asked questions and their answers:

For more information, you can refer to the IRS website or seek guidance from a tax professional.

Can I file Form 501c3 online?

Yes, you can file Form 501c3 online through the IRS website. However, it is important to note that the online filing process is only available for certain types of organizations.

What is the difference between a 501c3 and a 501c4?

501c3 organizations are non-profit organizations that are exempt from federal income tax. 501c4 organizations are non-profit organizations that are exempt from federal income tax and are also allowed to engage in political activities.

How long does it take to get a 501c3 determination letter?

The IRS typically takes 6 to 9 months to process Form 501c3 applications. However, the processing time can vary depending on the complexity of the application.

What are the benefits of having a 501c3 status?

There are many benefits to having a 501c3 status, including:

- Exemption from federal income tax

- Eligibility for grants and donations

- Increased credibility and trust from donors

How do I maintain my 501c3 status?

To maintain your 501c3 status, you must:

- File an annual Form 990

- Comply with all applicable laws and regulations

- Use your funds for charitable purposes

Questions and Answers

What are the key sections of Form 501c3?

Form 501c3 consists of several sections, including: Part I – Organization Information; Part II – Activities; Part III – Financials; Part IV – Governance; and Part V – Members and Supporters.

How long does it typically take to process a Form 501c3 application?

The IRS typically takes 6-12 months to process Form 501c3 applications, although the timeline may vary depending on the completeness and accuracy of your submission.

What are the consequences of losing 501c3 status?

Losing 501c3 status can result in significant tax liabilities, including retroactive taxes and penalties. It can also damage your organization’s reputation and make it more difficult to attract donations.

Can I use the same Form 501c3 for multiple organizations?

No, each organization must file its own separate Form 501c3. The information provided on the form is specific to the applying organization.