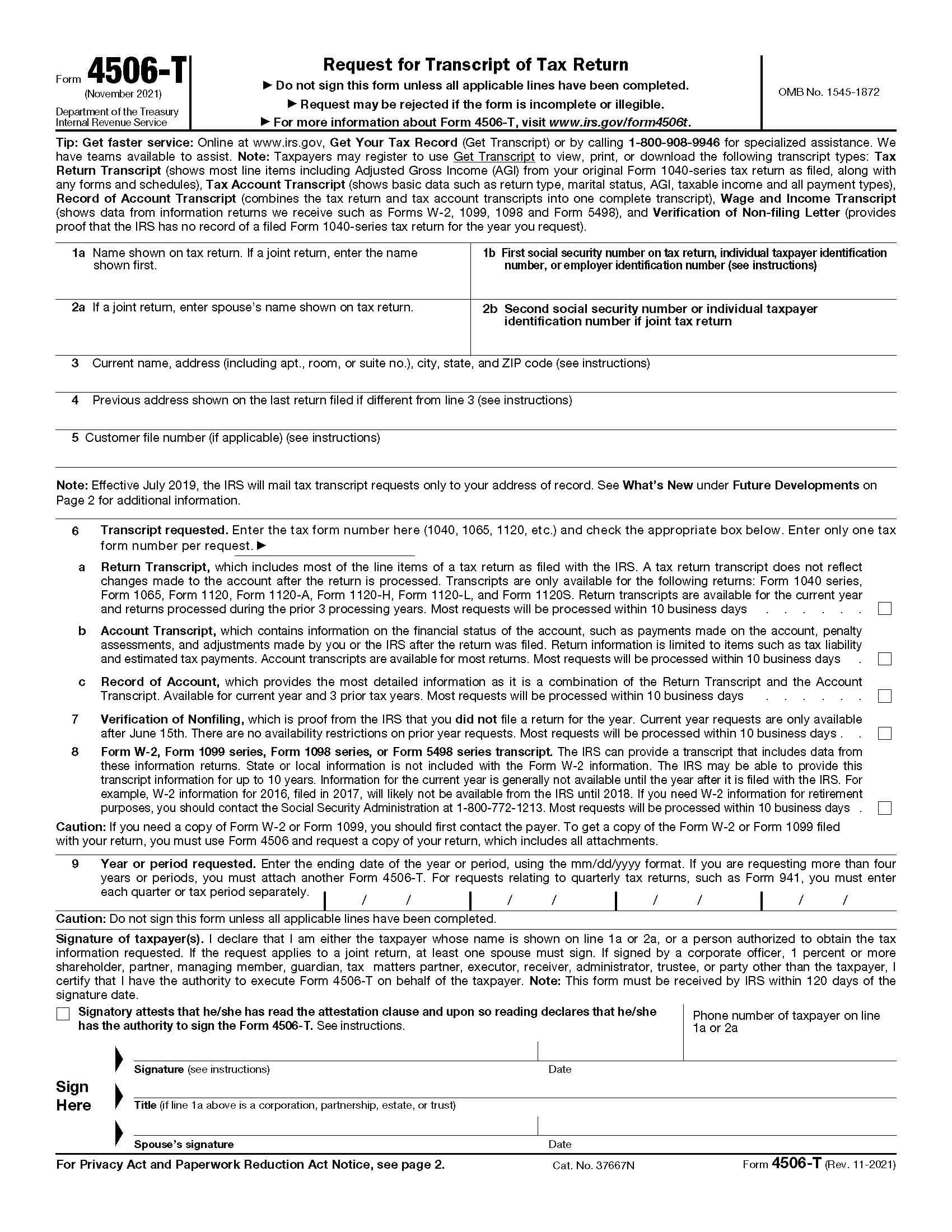

Understanding Form 4506-T Printable Form: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but Form 4506-T Printable Form aims to simplify the process for individuals seeking to request a tax transcript. This comprehensive guide will delve into the intricacies of this form, providing you with a clear understanding of its purpose, structure, and eligibility requirements. By equipping you with the necessary knowledge, we empower you to complete Form 4506-T accurately and efficiently.

Whether you’re a seasoned tax filer or embarking on your first tax-related endeavor, this guide will serve as an invaluable resource. We’ll cover everything from the form’s layout and organization to common errors and troubleshooting tips. By the end of this guide, you’ll possess the confidence to tackle Form 4506-T with ease, ensuring that your tax transcript request is processed smoothly and efficiently.

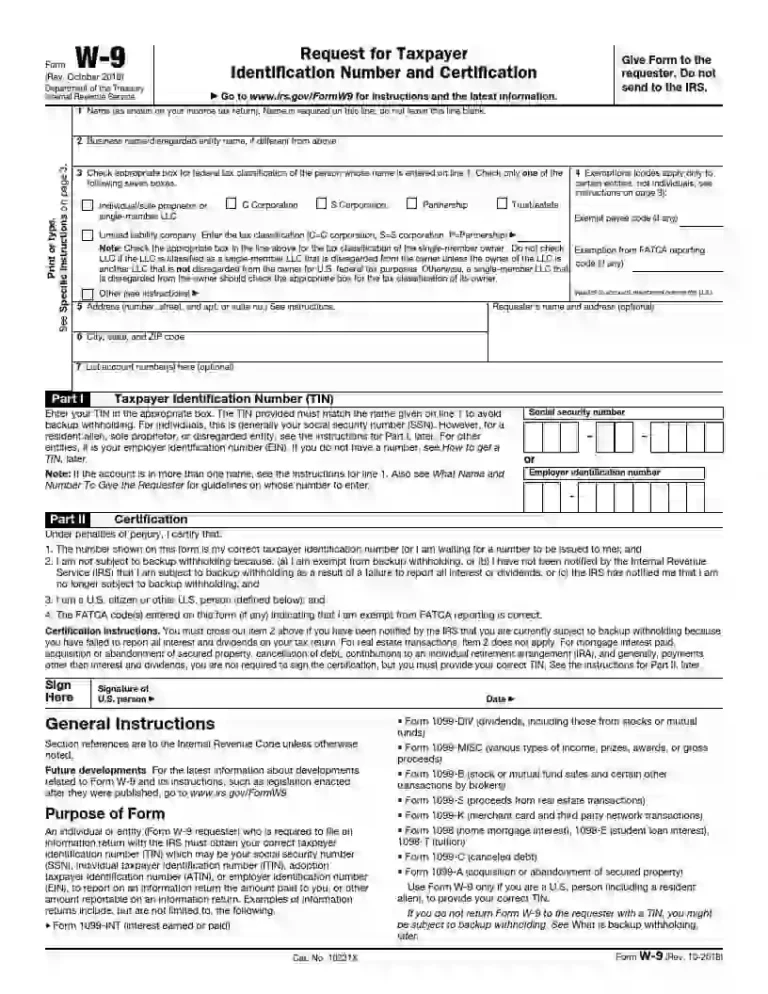

Document Overview

Form 4506-T is a tax document that you need to complete if you received a distribution from a qualified retirement plan, such as a 401(k) or IRA. The form is used to report the amount of the distribution and to calculate any taxes that you owe on it.

The form is divided into several sections. The first section includes information about you and your spouse, if you are married. The second section includes information about the distribution, such as the amount of the distribution and the date it was received. The third section includes information about any taxes that you owe on the distribution.

Key Sections and Information

- Section 1: Personal Information

- Section 2: Distribution Information

- Section 3: Tax Information

Form Structure and Completion

Yo, let’s smash down the lowdown on Form 4506-T, bruv. This form is your ticket to claiming tax deductions for your tuition and other education expenses. It’s like a cheat code for saving cash, innit?

The form is split into two main parts: Part I and Part II. Part I is all about your personal info and education expenses. Part II is where you calculate your deduction and figure out how much cheddar you’re gonna save. Let’s dive into the nitty-gritty, shall we?

Part I: Personal Information and Education Expenses

- Line 1: Pop in your full name and social security number. It’s like the password to your tax refund, fam.

- Line 2: Drop down your address, so the taxman knows where to send your hard-earned dough.

- Line 3: State your filing status. Are you single and ready to mingle? Or hitched up with your boo?

- Line 4: Chuck in your age as of the end of the tax year. Don’t try to fib, the taxman knows all.

- Line 5: If you’re a student, you’re in luck! Enter the number of months you were enrolled at least half-time during the tax year.

- Line 6: Time to get specific. List all your qualified education expenses, like tuition, fees, books, and supplies. Don’t forget to include scholarships and grants, too.

Part II: Calculation of Deduction

- Line 7: This is where the magic happens. Add up all your expenses from Line 6. It’s like counting your loot after a heist.

- Line 8: Now, let’s trim the fat. Enter any nondeductible expenses, like room and board. These are like the pesky fees that eat into your budget.

- Line 9: Subtract Line 8 from Line 7. This gives you your adjusted qualified expenses. It’s like filtering out the good stuff.

- Line 10: If your filing status is single, enter the amount from Line 9. If you’re married filing jointly, you might need to do some extra calculations. Don’t worry, the form will guide you through it.

- Line 11: Now, let’s calculate your deduction. Multiply Line 10 by 20%. This is the amount you can deduct from your taxable income. It’s like finding buried treasure!

Eligibility and Filing Requirements

Yo, check it, fam. If you’re a student or guardian, and you’re tryna get a refund on your student loan interest, then you’re in the right place. Form 4506-T is the form you need to file to claim this refund.

Now, let’s break down who can file this form and when you need to get it done.

Eligibility

- You can file Form 4506-T if you paid interest on a qualified student loan.

- You must have filed a tax return for the year you’re claiming the refund.

- You can’t claim the refund if you’re claimed as a dependent on someone else’s tax return.

Filing Deadlines

- The deadline to file Form 4506-T is April 15th of the year after the year you paid the interest.

- For example, if you paid interest in 2023, you need to file Form 4506-T by April 15th, 2024.

Common Errors and Troubleshooting

Filling out Form 4506-T correctly is essential to avoid delays in processing your tax return. Here are some common errors to watch out for and tips on how to avoid or correct them.

One common error is forgetting to sign and date the form. This is a required step, so make sure to complete it before submitting your return.

Incorrect or Incomplete Information

- Ensure that all personal information, such as your name, address, and Social Security number, is accurate and matches the information on your tax return.

- Double-check that you have entered the correct amounts for your tuition and fees, scholarships and grants, and other relevant expenses.

- If you are claiming the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), make sure you meet the eligibility requirements and have provided all necessary documentation.

Filing Options and Resources

You have a few options for filing Form 4506-T, mate. You can file it electronically or by post.

If you’re filing electronically, you can use the IRS e-file system. This is the quickest and easiest way to file, and you’ll get your refund faster.

If you’re filing by post, you can download the form from the IRS website or order it by phone. Once you have the form, fill it out and mail it to the IRS address listed on the form.

Helpful Resources

- IRS website: https://www.irs.gov/

- IRS e-file system: https://www.irs.gov/e-file-providers/choose-an-authorized-e-file-provider

- Form 4506-T: https://www.irs.gov/forms-pubs/about-form-4506-t

Additional Considerations

Special Circumstances

In certain circumstances, you may need to file Form 4506-T. These include:

- If you are a student who has received a distribution from a 529 plan or Coverdell ESA.

- If you are a parent or guardian who has claimed the American Opportunity Tax Credit or Lifetime Learning Credit for your child’s education expenses.

- If you are a taxpayer who has made a contribution to a qualified tuition program.

Impact on Tax Liability

Filing Form 4506-T may affect your tax liability. The form is used to report distributions from 529 plans and Coverdell ESAs, which are tax-advantaged savings plans for education expenses. The amount of the distribution that is taxable depends on your income and other factors.

In addition, filing Form 4506-T may also affect your eligibility for certain tax credits and deductions. For example, if you claim the American Opportunity Tax Credit or Lifetime Learning Credit, the amount of the credit you can claim may be reduced if you receive a distribution from a 529 plan or Coverdell ESA.

FAQ Section

What is Form 4506-T Printable Form used for?

Form 4506-T is used to request a tax transcript from the Internal Revenue Service (IRS). A tax transcript is a summary of your tax return information, including your income, deductions, and tax liability.

Who is eligible to file Form 4506-T?

Any individual can file Form 4506-T to request a tax transcript. However, you must have filed a tax return for the year(s) for which you are requesting a transcript.

Where can I get Form 4506-T?

You can download Form 4506-T from the IRS website or order it by calling the IRS at 1-800-829-3676.

How do I complete Form 4506-T?

Follow the instructions on the form carefully. You will need to provide your personal information, tax year(s), and the type of transcript you are requesting.

Where do I mail Form 4506-T?

The mailing address for Form 4506-T is:

Internal Revenue Service

Austin, TX 73340