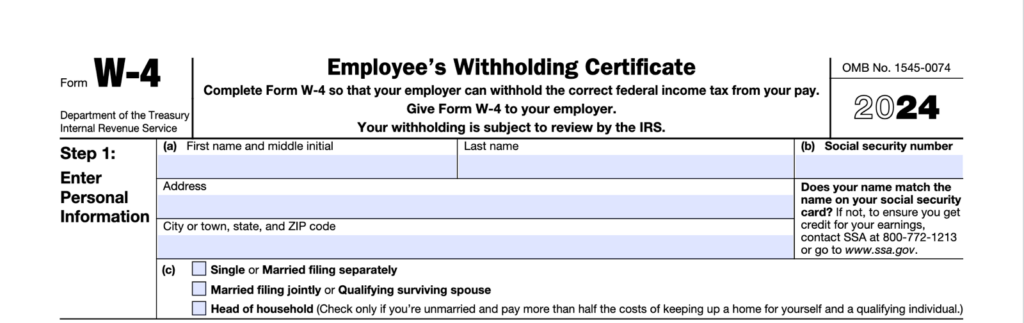

2024 W4 Printable Form: A Comprehensive Guide for Taxpayers

Navigating the intricacies of the U.S. tax system can be a daunting task, especially when it comes to completing the annual W4 form. The 2024 W4 Printable Form, a crucial document in determining your income tax withholding, has undergone significant changes compared to previous versions. This comprehensive guide will delve into the nuances of the 2024 W4 form, providing a clear understanding of its purpose, key changes, and how to complete it accurately to optimize your tax liability.

The 2024 W4 Printable Form serves as a vital tool for taxpayers to communicate their withholding preferences to their employers. By providing accurate information on the form, you can ensure that the appropriate amount of federal income tax is withheld from your paychecks throughout the year, minimizing the risk of overpayment or underpayment come tax time.

Introduction

The 2024 W4 Printable Form is an official tax document that employees in the United Kingdom must complete to inform their employers of their tax status. It is used to calculate the amount of tax that should be deducted from your wages each pay period.

Completing the W4 form accurately is crucial to ensure that you pay the correct amount of tax. If you do not complete the form correctly, you may end up paying too much or too little tax, which can lead to penalties or a tax refund.

Purpose and Significance

The purpose of the W4 form is to collect information about your tax status, including your:

- Name

- Address

- Social Security number

- Number of dependents

- Filing status

This information is used by your employer to calculate the amount of tax that should be withheld from your paycheck. The form also includes a section for you to indicate if you want to have additional taxes withheld from your paycheck.

Completing the W4 form correctly is important for several reasons. First, it ensures that you pay the correct amount of tax. If you do not complete the form correctly, you may end up paying too much or too little tax, which can lead to penalties or a tax refund.

Second, completing the W4 form correctly can help you avoid having to file a tax return. If you have too much tax withheld from your paycheck, you will receive a tax refund when you file your tax return. However, if you do not have enough tax withheld from your paycheck, you may have to pay additional taxes when you file your tax return.

Finally, completing the W4 form correctly can help you avoid penalties. If you do not pay enough tax during the year, you may be subject to penalties when you file your tax return.

Changes from Previous Versions

Fam, the 2024 W4 form has got some fresh updates compared to its old mates. These changes are gonna have an impact on how you do your taxes, so listen up!

One major tweak is the addition of a new line for reporting income from self-employment. This is a biggie for freelancers, contractors, and other self-employed peeps. It makes it easier to track your earnings and avoid any nasty surprises come tax time.

Updated Deductions

The 2024 W4 also has some new options for claiming deductions. These include:

- A higher standard deduction for both single and married taxpayers.

- A new deduction for student loan interest.

- An expanded deduction for charitable contributions.

These changes could save you some serious dough on your taxes, so it’s worth taking a closer look.

Completing the 2024 W4 Form

Filling in the 2024 W4 Form can be a breeze, bruv. Here’s a step-by-step guide to get it done right:

Step 1: Personal Info

- Scribble down your name, addy, and tax details, mate.

Step 2: Allowances

- Calculate your allowances based on your tax situation. It’s like a cheat code to reduce the amount of tax taken out of your pay.

Step 3: Other Income

- If you’re raking in extra dough from other sources, like investments or side hustles, let the taxman know.

Step 4: Deductions

- If you’re splashing out on work-related expenses, like travel or uniforms, you can claim deductions to lower your taxable income.

Step 5: Credits

- Certain life events, like having kids or going to college, can bag you some tax credits. Don’t miss out, fam.

Step 6: Sign and Date

- Once you’ve filled in all the blanks, put your John Hancock on the line and slap on the date.

Common Pitfalls

- Overestimating Allowances: Don’t go overboard with the allowances, or you might end up owing taxes later.

- Forgetting Other Income: Don’t be a div and forget to declare all your income sources.

- Messing Up Deductions: Make sure your deductions are legit and backed up with receipts.

Personal Allowances

Personal allowances are a deduction from your income that reduces the amount of tax you pay. The more allowances you claim, the less tax you will withhold from your paycheck. You can claim up to four personal allowances on your W-4 form.

The number of allowances you can claim depends on your circumstances, such as your filing status, your spouse’s income, and the number of dependents you have. If you claim too few allowances, you may end up owing taxes when you file your return. If you claim too many allowances, you may have to pay a penalty when you file your return.

Strategies for Claiming the Appropriate Number of Allowances

There are a few strategies you can use to claim the appropriate number of allowances on your W-4 form:

* Use the IRS withholding calculator. The IRS withholding calculator can help you determine how many allowances you should claim based on your circumstances.

* Use the W-4 worksheet. The W-4 worksheet is a step-by-step guide that can help you determine how many allowances you should claim.

* Talk to a tax professional. A tax professional can help you determine how many allowances you should claim and can help you avoid owing taxes or paying a penalty when you file your return.

Deductions and Credits

The 2024 W4 form allows you to claim certain deductions and credits that can reduce your tax liability. Deductions reduce your taxable income, while credits directly reduce the amount of tax you owe.

Common deductions include:

- Standard deduction: A fixed amount that reduces your taxable income.

- Itemized deductions: Specific expenses, such as mortgage interest or charitable contributions, that you can choose to deduct instead of the standard deduction.

- Student loan interest deduction: Up to $2,500 of interest paid on qualified student loans.

Common credits include:

- Earned income tax credit (EITC): A refundable credit for low- and moderate-income working individuals and families.

- Child tax credit (CTC): A credit for each qualifying child under the age of 17.

- American opportunity tax credit (AOTC): A credit for qualified education expenses.

Claiming the correct deductions and credits can significantly reduce your tax liability. Be sure to consult with a tax professional to determine which deductions and credits you are eligible for.

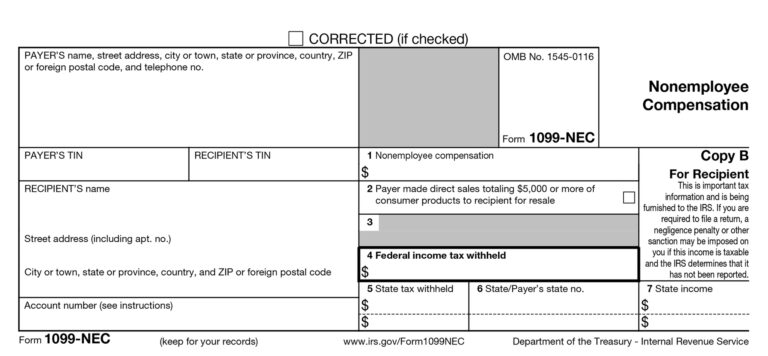

Additional Income and Jobs

Taxpayers with multiple jobs or income sources must account for all earnings on the 2024 W4 form to ensure accurate withholding.

Adjusting the W4 Form

To adjust the W4 form for multiple jobs, follow these steps:

- Combine the annual income from all jobs.

- Determine the total number of allowances claimed on all W4 forms.

- Subtract the number of allowances claimed from the total number of allowances allowed based on the combined income.

- Enter the resulting number of additional allowances on each W4 form.

Common Errors and Troubleshooting

Completing the W4 form can be daunting, and errors are common. Here’s a guide to help you avoid and resolve these issues:

Mistakes to watch out for include:

Incorrect Personal Allowances

- Claiming too many or too few allowances based on your income and deductions.

- Not adjusting allowances for multiple jobs or income sources.

Missing or Inaccurate Information

- Leaving fields blank or filling them in incorrectly, such as your name, address, or Social Security number.

- Failing to indicate your filing status or provide your spouse’s information if applicable.

Deductions and Credits

- Overestimating or underestimating your deductions and credits.

- Not including all eligible deductions and credits.

Additional Income and Jobs

- Failing to report all your income sources, including wages, tips, and self-employment income.

- Not adjusting allowances for multiple jobs or income sources.

Resolving Errors

- Review your form carefully before submitting it.

- Use the IRS withholding calculator to estimate your allowances and deductions.

- If you make a mistake, file a corrected W4 form with your employer as soon as possible.

- Consult with a tax professional if you have complex tax situations or need guidance.

Filing the 2024 W4 Form

Filing the 2024 W4 form is a crucial step in ensuring accurate withholding of federal income taxes from your paychecks. It helps determine the appropriate amount of tax that should be deducted from your earnings, minimizing the risk of overpaying or underpaying taxes.

The W4 form should be completed and submitted to your employer by the end of January 2024. This provides sufficient time for your employer to process the information and adjust your withholding accordingly. Filing an incorrect or incomplete W4 form can result in incorrect tax deductions, leading to potential penalties or refunds during tax filing season.

Consequences of Incorrect or Incomplete Filing

Submitting an incorrect or incomplete W4 form can have several consequences:

- Overpayment of Taxes: An incorrect W4 form may result in excessive withholding, leading to a larger tax refund during tax filing season. While this may seem beneficial, it means you have effectively provided an interest-free loan to the government throughout the year.

- Underpayment of Taxes: An incomplete or inaccurate W4 form may result in insufficient withholding, leading to an unexpected tax bill during tax filing season. This can result in penalties and interest charges.

- Delayed Refunds: If your W4 form is incorrect, it may take longer to process your tax return and issue any refunds due.

Therefore, it is essential to complete the W4 form carefully and accurately to avoid these potential issues.

Helpful Answers

What is the purpose of the 2024 W4 Printable Form?

The 2024 W4 Printable Form is used to indicate your withholding preferences to your employer, determining how much federal income tax is withheld from your paychecks throughout the year.

What are the key changes in the 2024 W4 Printable Form compared to previous versions?

The 2024 W4 form has been redesigned to simplify the process and align with the Tax Cuts and Jobs Act. It now includes a new section for claiming the Child Tax Credit and Earned Income Tax Credit.

How can I complete the 2024 W4 Printable Form accurately?

Follow the step-by-step instructions on the form and consult the accompanying IRS Publication 15-T for detailed guidance. Be sure to provide accurate personal information, withholding allowances, and any applicable deductions or credits.

What are personal allowances and how do they affect withholding?

Personal allowances represent the number of dependents and other factors that reduce your taxable income. Claiming the appropriate number of allowances can help ensure that the correct amount of tax is withheld from your paychecks.

What deductions and credits can I claim on the 2024 W4 Printable Form?

The 2024 W4 form allows you to claim certain deductions, such as mortgage interest and charitable contributions, and credits, such as the Child Tax Credit, to further reduce your tax liability.