2024 W-9 Printable Form: Your Guide to Accurate Completion and Filing

The 2024 W-9 Printable Form is a crucial document that plays a significant role in tax reporting and compliance. Whether you’re an individual, a freelancer, or a business owner, understanding how to complete and file this form accurately is essential to avoid potential tax issues and penalties.

This comprehensive guide will provide you with a step-by-step walkthrough of the 2024 W-9 Printable Form, ensuring that you can navigate its sections, gather the necessary information, and submit it seamlessly. By the end of this guide, you’ll be fully equipped to handle this important tax-related task with confidence.

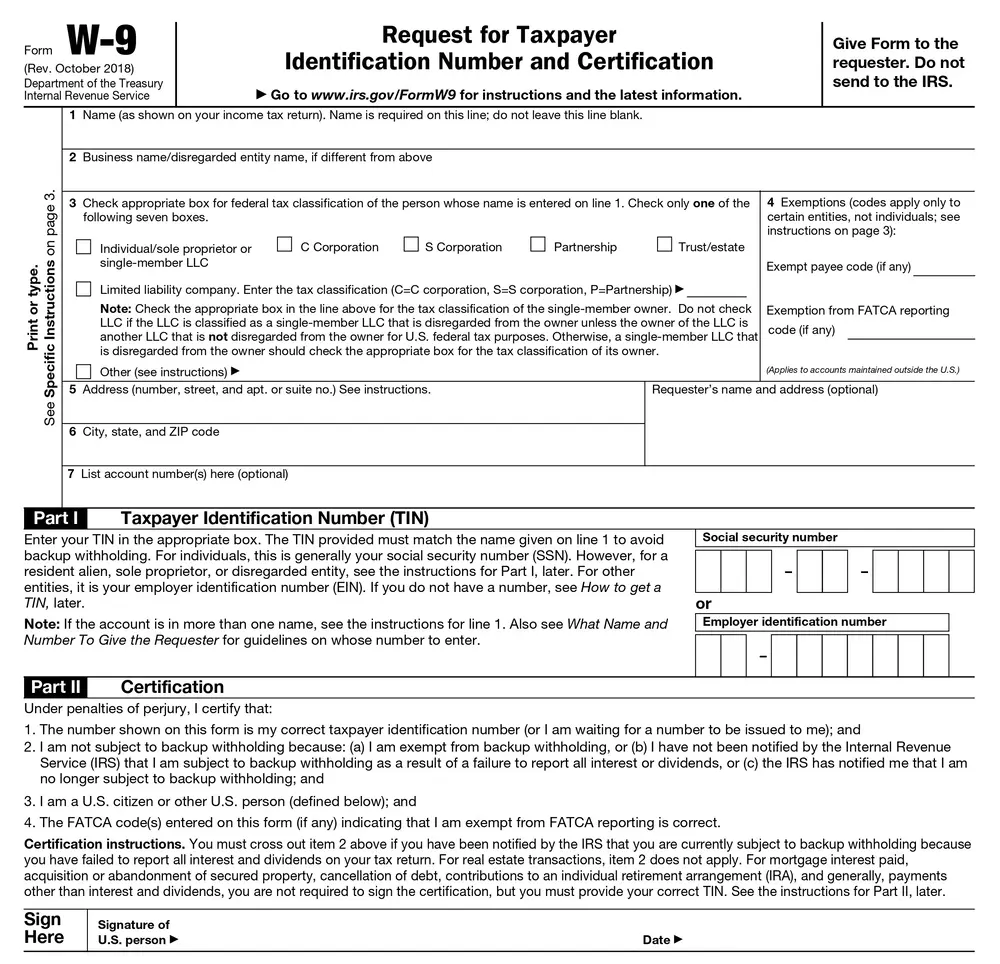

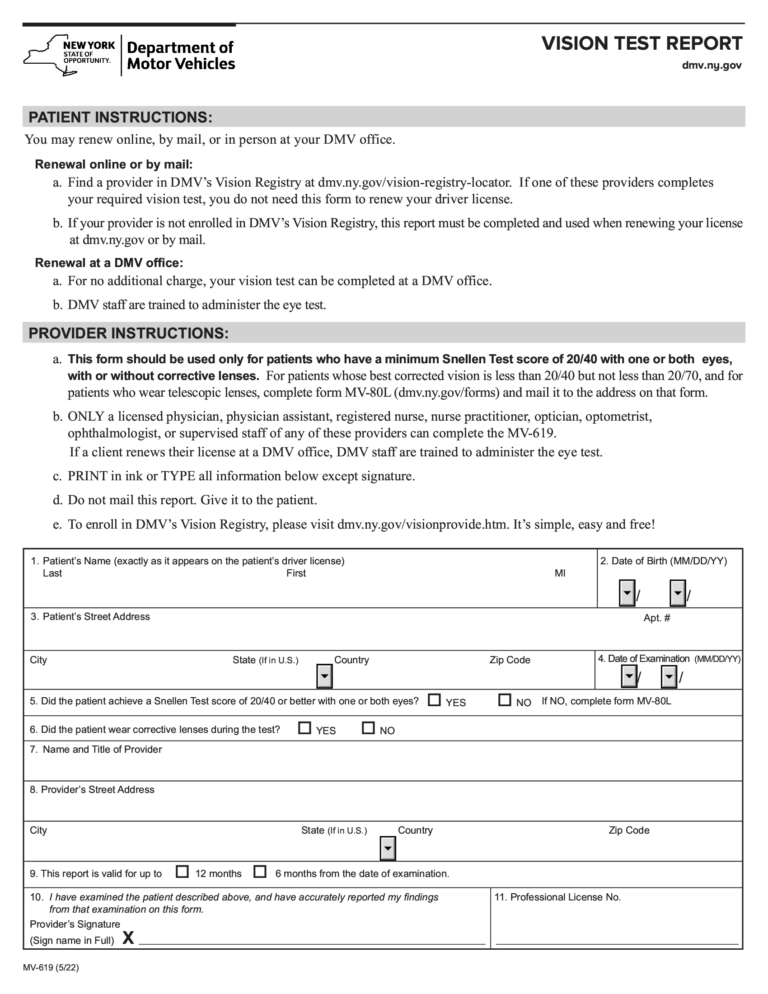

Form Overview

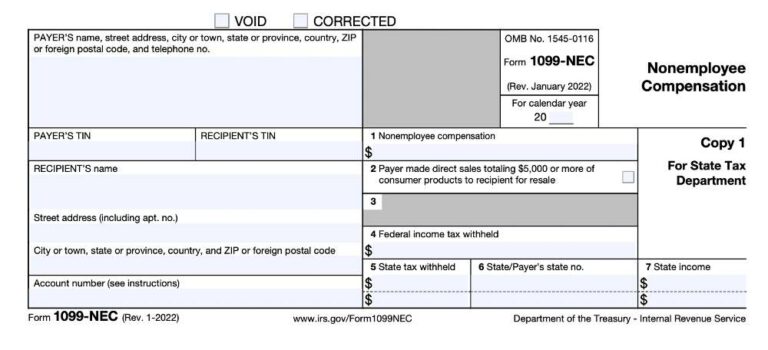

The 2024 W-9 Printable Form is a crucial document for self-employed individuals and businesses to provide their tax information to the payer. It is used to request a Taxpayer Identification Number (TIN) and certify that the information provided is accurate.

The form consists of several sections, including the taxpayer’s name, address, and contact information, as well as their certification and signature.

Purpose and Significance

- Provides the payer with the taxpayer’s TIN, which is essential for tax reporting purposes.

- Certifies that the taxpayer is a U.S. citizen or resident and that the information provided is accurate.

- Helps prevent fraud and ensures that the taxpayer receives the correct tax treatment.

Completion s

Filling out the 2024 W 9 Printable Form accurately is a breeze, mate. Here’s a step-by-step guide to get it done right.

Before you start, make sure you’ve got all the info and docs you need. This includes your name, address, business name, taxpayer identification number, and any other details the form asks for.

Line-by-Line Instructions

- Line 1: Name – Write your full name or the name of your business.

- Line 2: Business Name – If you’re a sole proprietor, write “N/A” here.

- Line 3: Address – Fill in your complete address.

- Line 4: City, State, ZIP – Enter your city, state, and ZIP code.

- Line 5: Taxpayer Identification Number – Write your Social Security number (SSN) or Employer Identification Number (EIN).

- Line 6: Certification – Sign and date the form to certify the information you’ve provided is true and correct.

Form Structure

The 2024 W 9 Printable Form is structured using an HTML table, ensuring a clear and organized layout for easy navigation and data entry.

The table structure employs responsive columns, allowing the form to adapt seamlessly to different screen sizes and devices, providing an optimal user experience regardless of the platform used.

Sections and Fields

The table structure divides the form into distinct sections, each containing specific fields related to the information being collected.

Each section is clearly labeled, and the fields within it are arranged in a logical order, guiding users through the form completion process smoothly.

Examples and Illustrations

This section presents clear examples and visual aids to demonstrate proper formatting of the 2024 W 9 Printable Form.

Examples of completed form sections will showcase correct formatting, including required fields, field labels, and acceptable input formats.

Infographic or Visual Aid

An infographic or visual aid will be created to illustrate the form’s layout, providing a clear and concise overview of its structure.

This visual representation will assist users in quickly understanding the form’s organization and the placement of specific sections and fields.

Filing and Submission

Yeet your completed W 9 straight to the taxman. There are a couple of slick ways to do it:

Online Submission

Hop on the interweb and file that W 9 like a boss. It’s quick, easy, and you don’t have to leave the comfort of your sofa.

Mail Delivery

If you’re feeling old-school, you can always chuck your W 9 in the post. Just make sure it gets there before the deadline or the taxman will be on your case.

Faxing

Not many peeps use fax machines these days, but if you’re one of the cool kids who still does, you can fax your W 9 to the taxman. Just make sure you get a confirmation that it went through.

Timely Submission

Don’t be a slacker and file your W 9 on time. The taxman has a deadline, and if you miss it, you could face some penalties. So, get that W 9 in before the buzzer beater.

FAQs

What is the purpose of the 2024 W-9 Printable Form?

The 2024 W-9 Printable Form is used to collect essential information from individuals or businesses who are receiving payments for services rendered. It serves as a way for the payer to verify the payee’s taxpayer identification number (TIN) and to report payments made to the payee to the Internal Revenue Service (IRS).

Who is required to complete a W-9 form?

Any individual or business that receives payments for services that are not subject to backup withholding is required to complete a W-9 form. This includes independent contractors, freelancers, sole proprietors, and corporations.

What information is required on the W-9 form?

The W-9 form requires the following information: name, address, taxpayer identification number (TIN), and certification.

Where can I find the 2024 W-9 Printable Form?

The 2024 W-9 Printable Form can be downloaded from the IRS website.