2023 W9 Printable Form: The Essential Guide for Tax Season

Navigating tax season can be daunting, but with the 2023 W9 Printable Form, you can simplify the process. This comprehensive guide will provide you with a clear understanding of the form’s purpose, key features, and benefits. Whether you’re a business owner, contractor, or individual taxpayer, this guide will empower you to complete your W9 accurately and efficiently.

The W9 form is a crucial document that serves as a record of a taxpayer’s identification information. It enables businesses and individuals to report payments made to contractors or self-employed individuals for services rendered. Understanding the nuances of this form is essential for ensuring accurate tax reporting and avoiding potential penalties.

Overview of 2023 W9 Printable Form

The 2023 W9 Printable Form is a crucial document used for tax reporting purposes. It enables individuals and businesses to provide their tax identification information to entities making payments to them for services rendered. By completing and submitting the W9 form, individuals can ensure that they receive accurate tax reporting and avoid potential tax-related issues.

The W9 form is particularly relevant for freelancers, contractors, and small business owners who receive payments from multiple sources. It allows them to provide their tax information to their clients, who are then responsible for withholding and reporting the appropriate taxes. The form helps streamline the tax reporting process and ensures compliance with tax regulations.

Purpose of the W9 Form

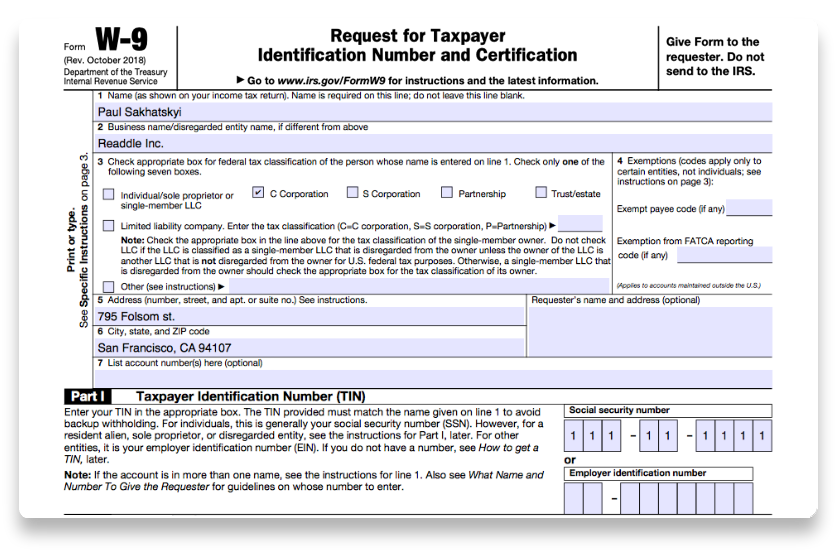

The primary purpose of the W9 form is to collect essential tax information from individuals and businesses receiving payments. This information includes the recipient’s name, address, taxpayer identification number (TIN), and certification status. The TIN is crucial for tax reporting as it identifies the recipient and ensures that they receive proper tax treatment.

Target Audience

The 2023 W9 Printable Form is primarily intended for individuals and businesses who are receiving payments for services rendered. This includes freelancers, contractors, self-employed individuals, and small business owners. By completing and submitting the W9 form, they can provide their tax information to the entities making payments to them.

Key Features and Sections of the Form

The 2023 W9 Printable Form comprises crucial sections that play significant roles in its functionality. Each section serves a specific purpose, ensuring the accurate and efficient collection of taxpayer information.

The form’s layout and sections are designed to streamline the process of providing the Internal Revenue Service (IRS) with the necessary details to determine an individual’s or business’s tax liability. Understanding the significance of each section helps ensure accurate completion and timely filing.

Part I: Taxpayer Identification

This section is paramount as it establishes the identity of the taxpayer. It includes fields for the taxpayer’s name, address, and Taxpayer Identification Number (TIN), which can be either a Social Security Number (SSN) or an Employer Identification Number (EIN).

Part II: Certification

The certification section serves as a legal declaration by the taxpayer. By signing and dating the form, the taxpayer affirms that the information provided is true and accurate under the penalties of perjury. This section emphasizes the importance of providing correct information and holds the taxpayer accountable for any discrepancies.

Part III: Request for Taxpayer Identification Number (TIN)

This section is optional and is used when the taxpayer does not have a TIN. It provides instructions on how to obtain a TIN from the IRS and highlights the importance of providing the TIN to avoid backup withholding.

Part IV: Backup Withholding

Backup withholding is a mechanism used by the IRS to collect taxes from certain types of payments, such as dividends and prizes. This section allows the taxpayer to indicate if they are subject to backup withholding and provides space for the withholding agent to record the appropriate information.

Additional Information

The W9 form also includes additional sections for providing optional information, such as the taxpayer’s business name and contact details. These sections help ensure that the IRS has complete and up-to-date information for efficient communication and processing.

Benefits of Using the Printable Form

Using the 2023 W9 Printable Form offers several advantages over other methods.

It provides convenience, accuracy, and time-saving benefits that make it a practical choice for both individuals and businesses.

Convenience

The printable form allows for easy access and completion without the need for special software or online platforms.

It can be downloaded and printed from anywhere with internet access, making it convenient for individuals who may not have access to computers or prefer to fill out forms manually.

s for Completing the Form

Completing the 2023 W9 Printable Form is straightforward. Follow these step-by-step s to ensure accuracy and completeness:

Start by reading the form thoroughly to understand its purpose and the information required.

Part 1: Business Information

- Enter your business’s legal name as it appears on your tax documents.

- Provide your business’s address, including street address, city, state, and ZIP code.

- State your business’s taxpayer identification number (TIN), which is either your Social Security number (SSN) or Employer Identification Number (EIN).

Part 2: Contact Information

- Enter your name and title as the person completing the form.

- Provide your business’s phone number, fax number (if applicable), and email address.

Part 3: Certification

- Sign and date the form in the designated space.

- Enter your printed name and title below your signature.

Part 4: Payer Information

- Leave this section blank as it will be filled out by the payer who needs your W9 information.

Part 5: Exemptions

- If applicable, check the box that corresponds to any backup withholding exemptions you are claiming.

Part 6: Foreign Accounts

- Answer the questions in this section if you have foreign accounts or receive foreign income.

Part 7: FATCA

- Complete this section if you are a non-US citizen or resident alien.

Where to Obtain the Printable Form

Obtaining the 2023 W9 Printable Form is a breeze, bruv. You can snag it from a variety of legit sources, innit.

Hit up the official websites of the Internal Revenue Service (IRS) or reputable tax software providers. They’re like the go-to spots for all things tax-related.

Official IRS Website

The IRS website is the ultimate hub for all your tax needs. Head over to https://www.irs.gov/forms-pubs/about-form-w-9 to download the latest version of the W9 form.

Tax Software Providers

If you’re using tax software to file your taxes, chances are they’ll provide you with a fillable W9 form within the software. No need to go hunting for it elsewhere.

Additional Resources and Considerations

To stay up-to-date on the latest regulations and guidance regarding the 2023 W9 Printable Form, it’s recommended to refer to official sources such as the Internal Revenue Service (IRS) website and publications.

Additionally, there are several reputable online resources and articles that provide in-depth information about the form’s usage, including tips for completing it accurately and avoiding common mistakes.

IRS Guidelines and Publications

- IRS Publication 1220: General Instructions for Certain Information Returns

- IRS Form W-9: Request for Taxpayer Identification Number (TIN) and Certification

FAQ Corner

What is the purpose of the 2023 W9 Printable Form?

The 2023 W9 Printable Form is used to collect essential taxpayer identification information from individuals or businesses who are not employees but provide services for a company.

Who should use the 2023 W9 Printable Form?

Businesses and individuals who engage contractors or self-employed individuals for services must use the 2023 W9 Printable Form to collect their taxpayer information.

Where can I obtain the 2023 W9 Printable Form?

You can download the 2023 W9 Printable Form from the official IRS website or reputable tax preparation websites.