2023 W2 Printable Form: A Comprehensive Guide for Employees and Non-Employees

As the 2023 tax season approaches, it’s essential to understand the significance of the W2 form. This document serves as a crucial record of your earnings and tax withholdings for the previous year. In this comprehensive guide, we’ll provide a printable version of the 2023 W2 form, explain its purpose and importance, and walk you through the process of completing and filing it accurately.

Whether you’re an employee or a non-employee, such as a contractor or freelancer, this guide will equip you with the knowledge and resources you need to navigate the W2 form process seamlessly. We’ll address common errors and provide troubleshooting tips to ensure that your W2 form is filed correctly and on time.

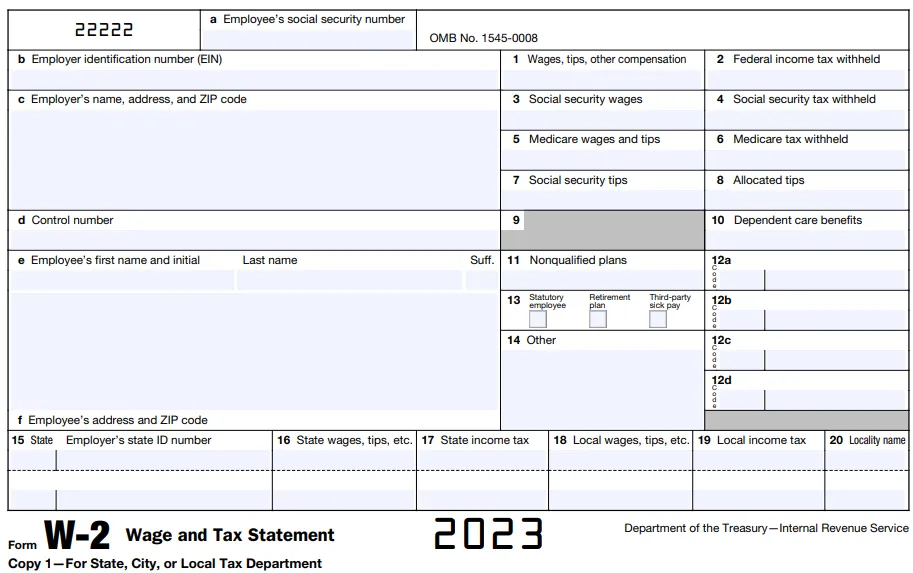

Printable W2 Form for 2023

The 2023 W2 form is a crucial document used to report an employee’s wages and other compensation to the Internal Revenue Service (IRS) and the employee. It is a legal requirement for employers to provide this form to their employees by January 31st of the following year.

The W2 form contains essential information, including the employee’s name, address, Social Security number, wages, and taxes withheld. This information is used to determine the employee’s tax liability and to ensure that the correct amount of taxes is withheld from their paychecks.

Importance of the W2 Form

- It serves as proof of income for employees when filing their tax returns.

- It helps employers comply with their legal obligation to report employee earnings to the IRS.

- It ensures that employees receive the correct tax refunds or owe the appropriate amount of taxes.

Completing the 2023 W2 Form

Filling out your W2 form can be a bit of a faff, but it’s important to get it right. Here’s a quick guide to help you out.

Tips for Completing the Form

- Make sure you have all the information you need before you start, including your Social Security number, name, address, and employer information.

- Follow the instructions on the form carefully.

- Be accurate and complete when filling out the form.

- If you make a mistake, cross it out and write the correct information next to it.

- Sign and date the form before sending it in.

Example of a Completed W2 Form

Here’s an example of a completed W2 form:

Submitting Your W2 Form

Once you’ve completed your W2 form, you can mail it to the address provided on the form. You can also submit it electronically through the IRS website.

Filing the 2023 W2 Form

Filing your 2023 W2 form is crucial to ensure you fulfill your tax obligations accurately and on time. Understanding the deadlines and methods for filing is essential.

Filing Deadlines

- Paper Filing: April 18, 2024

- Electronic Filing: April 30, 2024

Filing Methods

You can file your W2 form using the following methods:

- Mail: Send the completed form to the Social Security Administration’s designated address.

- Online: Use the IRS’s “Fireside” application to file electronically. IRS’s “Fireside” application

- Tax Software: Utilize tax software that supports W2 filing, such as TurboTax or H&R Block.

W2 Form for Non-Employees

The W2 form is not just for employees. It is also used to report income for non-employees, such as contractors and freelancers.

Non-employees are responsible for completing their own W2 forms and submitting them to the IRS. The requirements for completing a W2 form for non-employees are similar to those for employees. However, there are some important differences.

Specific Requirements for Non-Employees

- Non-employees must enter their name and address in the “Name” and “Address” fields.

- Non-employees must enter their Social Security number in the “Social Security Number” field.

- Non-employees must enter the amount of income they earned from the business in the “Wages, Tips, Other Compensation” field.

- Non-employees must enter the amount of federal income tax withheld from their income in the “Federal Income Tax Withheld” field.

- Non-employees must enter the amount of Social Security tax withheld from their income in the “Social Security Tax Withheld” field.

- Non-employees must enter the amount of Medicare tax withheld from their income in the “Medicare Tax Withheld” field.

Examples of W2 Forms for Non-Employees

The following are examples of W2 forms for non-employees:

- Form W-2 for Independent Contractors

- Form W-2 for Freelancers

- Form W-2 for Gig Workers

Troubleshooting Common W2 Form Issues

![]()

Mistakes on W2 forms can lead to delays in processing and even penalties. Here’s how to identify and resolve common errors:

Incorrect Taxpayer Information

- Check for typos in the employee’s name, address, and Social Security number.

- Verify that the employee’s name matches the name on their Social Security card.

Mismatched Income and Withholding

- Compare the amounts reported in boxes 1, 3, and 5 to the employee’s pay stubs.

- Ensure that the amounts withheld for federal and state income taxes, Social Security, and Medicare are accurate.

Missing or Incorrect Forms

- Make sure you have all the required copies of the W2 form.

- Verify that the forms are complete and signed by both the employer and employee.

Filing Deadlines

- File your W2 forms by the due date, which is typically January 31st.

- Late filing can result in penalties and interest charges.

Resources for Assistance

- Contact the IRS at 1-800-829-1040 for assistance with W2 form issues.

- Visit the IRS website at www.irs.gov for more information and resources.

Questions and Answers

Q: What is the deadline for filing my 2023 W2 form?

A: The deadline for filing your 2023 W2 form is April 18, 2024.

Q: Can I file my W2 form electronically?

A: Yes, you can file your W2 form electronically through the IRS website or using tax preparation software.

Q: What information should I include on my W2 form?

A: Your W2 form should include your personal information, such as your name, address, and Social Security number, as well as information about your earnings and tax withholdings.

Q: What if I make a mistake on my W2 form?

A: If you make a mistake on your W2 form, you can correct it by filing an amended return using Form W-2c.