1099 Printable Form 2023 PDF: A Comprehensive Guide

Navigating the world of 1099 forms can be a daunting task, especially with the introduction of the 2023 updates. Whether you’re a seasoned professional or just starting out, this guide will provide you with a comprehensive understanding of the 1099 Printable Form 2023 PDF, its significance, and the various aspects of its usage.

From the benefits of using a printable 1099 form in PDF format to the step-by-step instructions on how to print and file it, this guide covers everything you need to know. We’ll also explore the key features of the 2023 1099 form, showcase real-world examples, and address frequently asked questions to ensure you’re fully equipped to handle your 1099 responsibilities.

Printable 1099 Form PDF

Innit, a 1099 form PDF is the way to go if you’re a bit of a geezer or bird who needs to file your taxes like a pro. It’s like having a peng ting on your side, helping you get the job done without any hassle.

Benefits of Printable 1099 Form PDF

- Blag a bargain: No need to fork out a pretty penny for a 1099 form. Just print it off and you’re sorted.

- Keep it tidy: No more losing track of your 1099s. Keep ’em all safe and sound in one place.

- Sorted in a jiffy: Fill in your 1099 form online or offline, then print it off whenever you’re ready.

Getting Your Printable 1099 Form PDF

- Government website: Head over to the HMRC website and grab yourself a free PDF.

- Tax software: If you’re using tax software, it might have a built-in option to print 1099 forms.

- Online services: There are plenty of online services that let you download and print 1099 forms.

Printing Your 1099 Form PDF

- Open the PDF: Find the 1099 form PDF you downloaded and open it up.

- Choose your printer: Make sure your printer is turned on and connected to your computer.

- Print away: Click the print button and watch your 1099 form come to life.

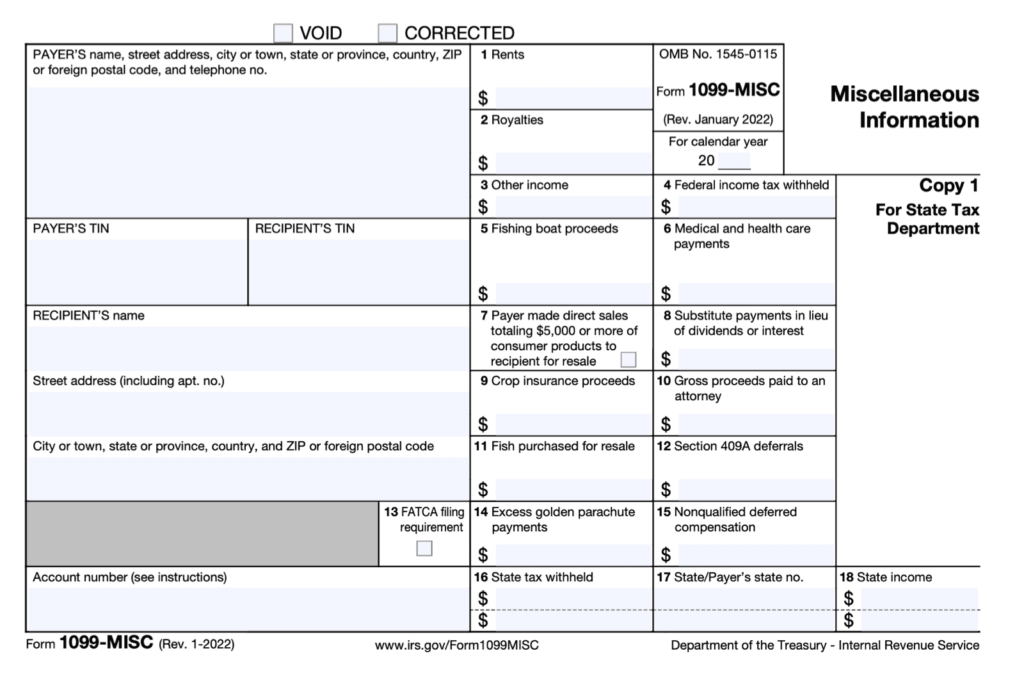

1099 Form 2023

The 1099 form is a tax document that reports income earned by individuals who are not employees. It is used by businesses to report payments made to independent contractors, freelancers, and other self-employed individuals.

The 1099 form has been updated for the 2023 tax year. The most significant change is the addition of a new box, Box 14, which is used to report income from state and local income tax refunds.

Using the Correct 1099 Form

It is important to use the correct 1099 form for the 2023 tax year. The different types of 1099 forms are:

- 1099-NEC: Nonemployee Compensation

- 1099-MISC: Miscellaneous Income

- 1099-INT: Interest Income

- 1099-DIV: Dividend Income

- 1099-R: Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- 1099-S: Proceeds from Real Estate Transactions

The table below provides a summary of the different types of 1099 forms and their uses:

| Form | Use |

|---|---|

| 1099-NEC | Report payments to nonemployees for services performed |

| 1099-MISC | Report miscellaneous income, such as rent, prizes, and awards |

| 1099-INT | Report interest income |

| 1099-DIV | Report dividend income |

| 1099-R | Report distributions from pensions, annuities, and other retirement accounts |

| 1099-S | Report proceeds from real estate transactions |

1099 Form Examples

Filling out a 1099 form accurately is crucial for tax reporting and compliance. To help you understand the process, let’s explore real-world examples, provide a fillable PDF template, and highlight common mistakes to avoid.

Real-World Examples

- Freelance Writer: A writer receives a 1099-MISC for $10,000 from a publishing company for writing articles.

- Independent Contractor: A plumber receives a 1099-NEC for $20,000 from a construction firm for completing plumbing work.

- Dividend Income: An investor receives a 1099-DIV for $5,000 from a company in which they hold shares.

Fillable PDF Template

To make the process easier, we’ve created a fillable PDF template that can be used for various income types. This template includes all necessary fields, ensuring accurate and consistent reporting.

Common Mistakes to Avoid

- Mixing up 1099 Types: Ensure you use the correct 1099 form based on the income type.

- Incorrect Taxpayer ID: Verify that the recipient’s Taxpayer Identification Number (TIN) is accurate.

- Missing or Incomplete Information: Fill out all required fields, including the payer’s and recipient’s information.

- Miscalculating Income: Carefully calculate the total income earned and reported on the form.

- Late Filing: File 1099 forms by the IRS deadlines to avoid penalties.

1099 Form Filing Methods

Yo, if you’re a self-employed baller or biz owner, you need to know your options for filing them 1099 forms. Whether you roll with electronic filing or stick to the old-school paper method, we’ve got the lowdown on the pros and cons of each.

Electronic Filing

Filing your 1099 forms electronically is like sending a text message—it’s quick, easy, and you can do it from your couch. Plus, you get a confirmation right away, so you know you’re sorted.

But hold up, there are some drawbacks. You’ll need to use IRS-approved software, which can set you back a few quid. And if you’re not tech-savvy, it might feel like trying to decipher hieroglyphics.

Paper Filing

Paper filing is the OG way to do it, but it’s a bit more of a faff. You need to print out the forms, fill ’em in by hand, and then snail mail them to the IRS. It’s like writing a letter to your gran—it takes time and effort.

On the bright side, paper filing is free and you don’t need any fancy software. Just make sure your handwriting is legible, or the IRS might think you’re trying to pull a fast one.

Step-by-Step Guide to Electronic Filing

If you’re feeling brave and want to give electronic filing a go, here’s a step-by-step guide to help you out:

- Get yourself some IRS-approved software. There are plenty of options out there, so shop around.

- Create an account and enter your business info.

- Import your 1099 data or enter it manually.

- Review your forms and make sure everything’s kosher.

- Submit your forms and get that confirmation email.

Easy peasy, lemon squeezy.

1099 Form Deadlines

The 1099 forms are important tax documents that report income earned by individuals who are not employees. These forms must be filed with the IRS and the recipient by certain deadlines. Missing these deadlines can result in penalties and interest charges.

Important Deadlines

The filing deadlines for 1099 forms vary depending on the type of form. The following table summarizes the important deadlines for different types of 1099 forms:

| Form Type | Deadline for Recipient | Deadline for Payer |

|—|—|—|

| 1099-NEC | January 31 | February 28 |

| 1099-MISC | January 31 | February 28 |

| 1099-INT | January 31 | February 28 |

| 1099-DIV | January 31 | February 28 |

| 1099-R | January 31 | February 28 |

Consequences of Missing Deadlines

If you miss the filing deadlines for 1099 forms, you may be subject to penalties and interest charges. The penalties can be significant, so it is important to file your forms on time.

The IRS can impose a penalty of $50 per form for each month that the form is late, up to a maximum of $250,000. The IRS can also charge interest on the unpaid taxes.

FAQ Section

What are the benefits of using a printable 1099 form in PDF format?

Using a printable 1099 form in PDF format offers several advantages, including convenience, accuracy, and security. PDFs are widely compatible with various software and devices, allowing for easy access and sharing. They also provide a reliable and tamper-proof format, ensuring the integrity of the data.

Where can I obtain a printable 1099 form PDF?

You can obtain a printable 1099 form PDF from the IRS website or through reputable online resources. Make sure to select the correct form type based on your specific income type and tax year.

What are the key features of the 2023 1099 form?

The 2023 1099 form includes several updates, such as revised instructions and clarifications for various income types. It also incorporates changes related to the American Rescue Plan Act of 2021. Using the correct 1099 form for the 2023 tax year is essential for accurate reporting.

What are the common mistakes to avoid when filling out a 1099 form?

Common mistakes to avoid when filling out a 1099 form include using an incorrect form type, entering incorrect or incomplete information, and missing filing deadlines. Carefully review the form instructions and ensure all fields are filled out accurately and completely.

What are the different methods available for filing 1099 forms?

You can file 1099 forms electronically or by paper. Electronic filing offers convenience and efficiency, while paper filing may be suitable for smaller volumes. The IRS provides specific instructions for both methods.