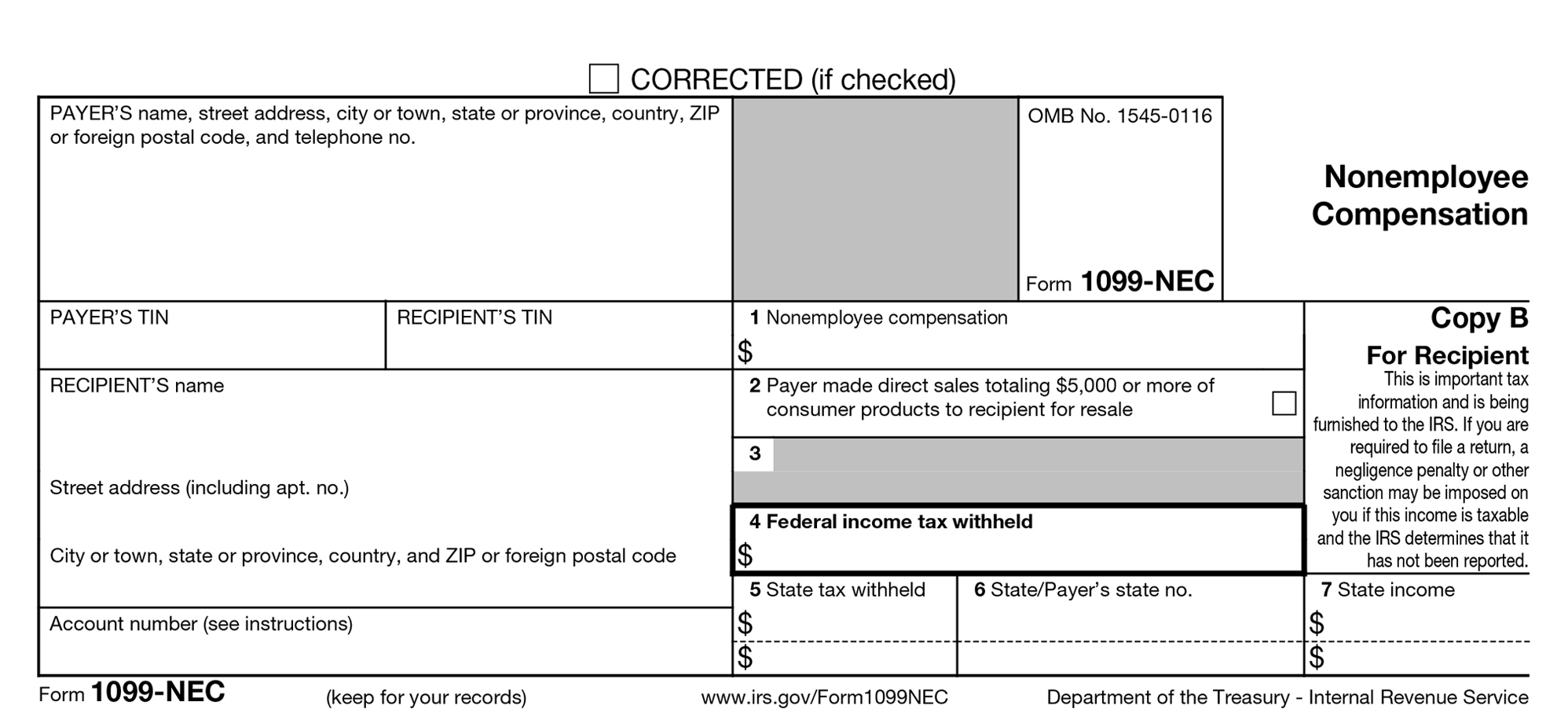

1099-NEC Printable Form: A Comprehensive Guide to Understanding and Completing It

Navigating the complexities of tax reporting can be daunting, but understanding the 1099-NEC Printable Form is a crucial step for businesses and individuals alike. This form serves as a vital tool for reporting nonemployee compensation, and its accurate completion ensures compliance with tax regulations.

In this comprehensive guide, we will delve into the purpose, significance, and intricacies of the 1099-NEC form. We will provide step-by-step instructions on how to fill it out, discuss reporting requirements, and explore potential penalties for non-compliance. Additionally, we will address frequently asked questions to empower you with the knowledge necessary to navigate the 1099-NEC reporting process seamlessly.

Understanding 1099-NEC Printable Form

The 1099-NEC form is a tax document that reports income earned by nonemployees, such as independent contractors and freelancers. It’s important because it helps the recipient track their income and file their taxes accurately.

The 1099-NEC form reports income from self-employment, such as:

- Freelance writing

- Consulting

- Photography

- Music lessons

Individuals and businesses that typically receive a 1099-NEC form include:

- Independent contractors

- Freelancers

- Sole proprietors

- Partnerships

- LLCs

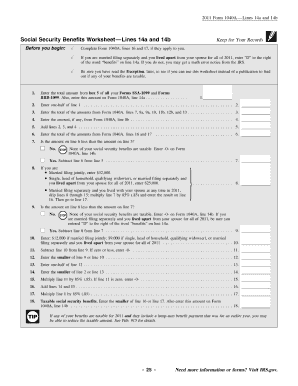

Completing the 1099-NEC Printable Form

Yo, it’s time to fill out your 1099-NEC form, bruv. This form is used to report income from nonemployee compensation, like when you’re self-employed or a freelancer. Don’t fret, mate; it’s not as daunting as it sounds. Let’s break it down, shall we?

Recipient Information

First up, you’ll need the recipient’s info. That’s the person or business you did the work for. Make sure you have their name, address, and taxpayer ID number.

Payer Information

Next, it’s your turn. Fill in your info as the payer, including your name, address, and taxpayer ID number.

Income Details

Now for the juicy bit: the income details. Enter the amount of income you paid to the recipient. This should be the total amount before any deductions.

Obtaining the Form

Need a 1099-NEC printable form? No worries, fam. You can download it from the IRS website or request a copy from your tax software provider.

Reporting Requirements for 1099-NEC Income

Innit, reporting 1099-NEC income is a bit of a drag, but it’s crucial to stay on top of it to avoid any tax headaches. Here’s the lowdown on what you need to know.

Deadlines

The deadline for businesses to send out 1099-NEC forms to recipients is January 31st of the year following the tax year. Recipients have until April 15th to file their tax returns, including their 1099-NEC income.

Reporting on Tax Returns

When you file your taxes, you’ll need to report your 1099-NEC income on Schedule C of your Form 1040. Make sure you include the full amount of income you earned, even if you didn’t receive a 1099-NEC form.

Penalties and Consequences for Non-Compliance

Failing to comply with the 1099-NEC reporting requirements can lead to severe consequences for both businesses and individuals. The penalties for non-compliance include fines, interest charges, and potential criminal prosecution.

Businesses that fail to file 1099-NEC forms on time may be subject to fines of up to £100 per form, with a maximum penalty of £500,000. Additionally, they may be required to pay interest on any unpaid taxes, which can accumulate quickly.

Individuals who fail to report 1099-NEC income on their tax returns may be subject to penalties and interest charges. The penalties for underreporting income can range from 20% to 75% of the unpaid tax, depending on the severity of the violation.

Tips for Avoiding Penalties and Ensuring Compliance

- Keep accurate records of all payments made to non-employees.

- File 1099-NEC forms on time, by January 31st of the following year.

- Use e-filing services to streamline the filing process and reduce the risk of errors.

- Consult with a tax professional if you have any questions or concerns about 1099-NEC reporting requirements.

Common Questions and Resources

If you have any queries or require further information regarding the 1099-NEC printable form, check out the following resources:

Frequently Asked Questions

- What is a 1099-NEC form?

It’s a tax document that reports nonemployee compensation. - Who needs to file a 1099-NEC form?

Businesses that pay independent contractors over $600. - What information is included on a 1099-NEC form?

The payer’s and recipient’s information, as well as the amount of nonemployee compensation paid. - When is the deadline to file a 1099-NEC form?

January 31st (February 28th if filing electronically).

Helpful Resources

- IRS website: https://www.irs.gov/forms-pubs/about-form-1099-nec

- Instructions for Form 1099-NEC: https://www.irs.gov/pub/irs-pdf/i1099nec.pdf

- Frequently Asked Questions about Form 1099-NEC: https://www.irs.gov/newsroom/heres-what-you-need-to-know-about-the-new-form-1099-nec

FAQ Corner

What types of income are reported on the 1099-NEC form?

The 1099-NEC form reports nonemployee compensation, which includes payments made to individuals who are not considered employees for tax purposes. This can include payments for services such as freelance work, consulting, and independent contracting.

Who typically receives a 1099-NEC form?

Individuals and businesses that make payments to nonemployees, such as independent contractors and freelancers, are required to issue 1099-NEC forms to those individuals.

Where can I obtain a 1099-NEC printable form?

You can download a printable 1099-NEC form from the IRS website or obtain it from tax software providers.

What are the penalties for failing to file the 1099-NEC form on time?

Penalties for late filing of the 1099-NEC form can range from $50 to $270 per form, depending on the length of the delay.