1040 Sr Printable Form: A Comprehensive Guide for Taxpayers

Navigating the complexities of tax filing can be daunting, especially when it comes to understanding the intricacies of various tax forms. One such form that plays a crucial role for senior citizens is the 1040 Sr Printable Form. Designed to simplify the tax filing process for individuals aged 65 and above, this form offers a tailored approach to reporting income, deductions, and credits.

In this comprehensive guide, we will delve into the ins and outs of the 1040 Sr Printable Form, providing clear explanations, step-by-step instructions, and practical tips to ensure accurate and efficient tax filing. Whether you are a seasoned taxpayer or filing your taxes for the first time, this guide will empower you with the knowledge and confidence to complete the 1040 Sr Printable Form with ease.

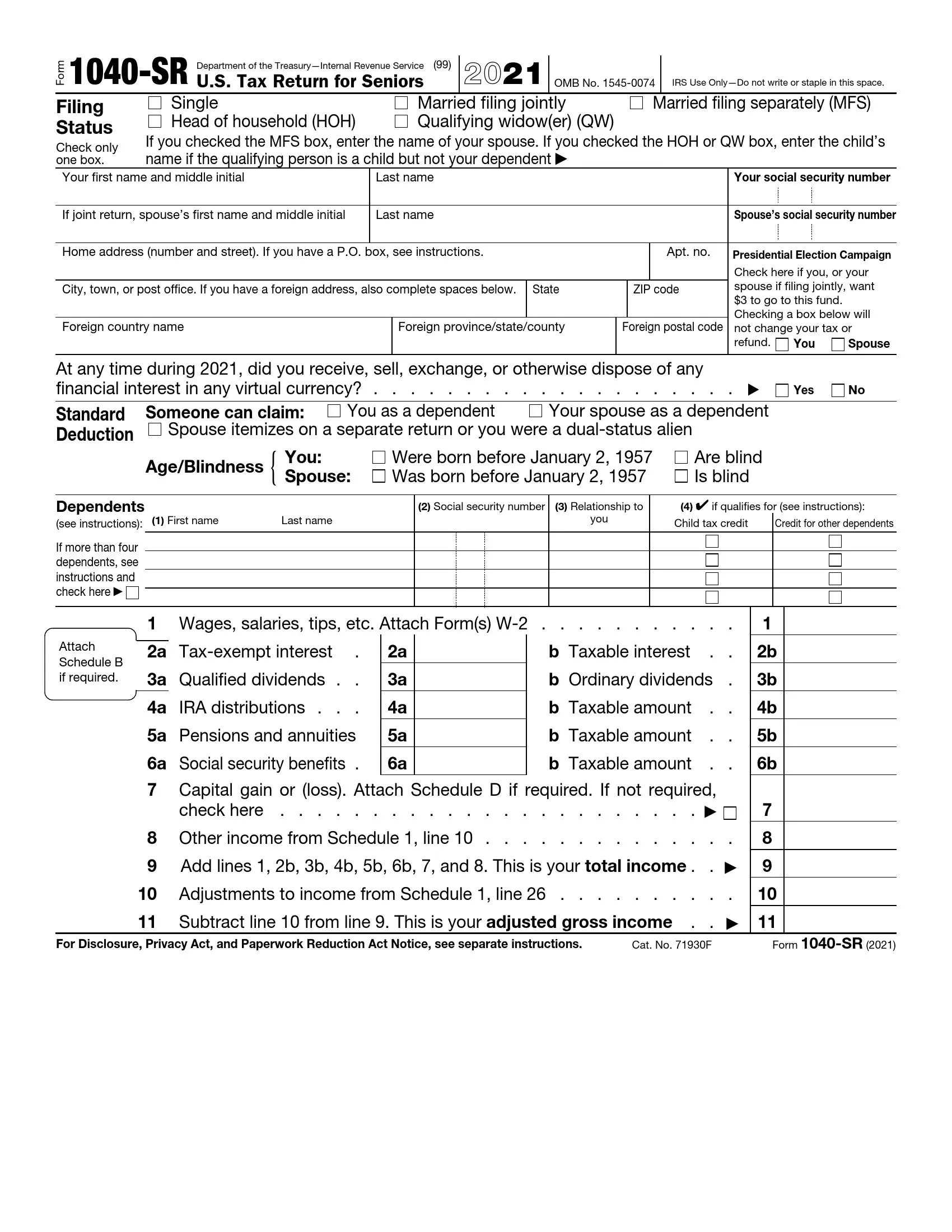

Form Overview

The 1040 Sr Printable Form is a tax form used by senior citizens and retirees in the United Kingdom to file their annual tax returns. It is designed to help them accurately report their income, deductions, and credits, and calculate their tax liability.

The form consists of several sections, including personal information, income, deductions, credits, and tax calculation. Each section is clearly labeled and provides detailed instructions on how to complete it.

Eligibility Requirements

To be eligible to file the 1040 Sr Printable Form, you must meet the following requirements:

- You must be a UK resident.

- You must be 65 years of age or older by the end of the tax year.

- You must have a valid National Insurance number.

Income Reporting

Get ready to spill the beans on all the loot you’ve raked in this year, bruv. The 1040 Sr Printable Form wants the lowdown on every penny you’ve earned, no matter how you got your hands on it.

Types of Income

The taxman wants to know about all the different ways you’ve been lining your pockets, like:

- Wages, salaries, tips, and bonuses: The bread and butter, mate. Every quid you’ve earned from your 9-to-5 or side hustle.

- Self-employment income: If you’re your own boss, you’ll need to tot up all the dough you’ve made from your business.

- Investment income: Dividends, interest, and capital gains from your stocks, bonds, and other investments.

- Other income: Anything else that doesn’t fit into the above categories, like lottery winnings or prize money.

Calculating Self-Employment Income

If you’re self-employed, you’ll need to figure out your net income. That’s your total income minus all the expenses you’ve incurred in running your business. Don’t forget to include things like rent, utilities, and supplies.

Reporting Income from Investments

For investment income, you’ll need to report the total amount you’ve received in dividends, interest, and capital gains. You’ll also need to provide information about the source of the income, like the name of the company or mutual fund.

Deductions and Credits

Deductions and credits can reduce your taxable income, which can lower your tax bill. The most common deductions and credits include:

Itemized Deductions

Itemized deductions are expenses that you can deduct from your taxable income. To claim itemized deductions, you must itemize your deductions on Schedule A (Form 1040). Some common itemized deductions include:

- Medical expenses

- State and local income taxes

- Property taxes

- Mortgage interest

- Charitable contributions

The eligibility criteria and calculation methods for each deduction vary. For more information, refer to the instructions for Schedule A (Form 1040).

Tax Credits

Tax credits are dollar-for-dollar reductions in your tax bill. Unlike deductions, which reduce your taxable income, tax credits reduce your tax liability directly. Some common tax credits include:

- Earned income tax credit

- Child tax credit

- Adoption credit

- Saver’s credit

The eligibility criteria and calculation methods for each tax credit vary. For more information, refer to the instructions for Form 1040.

Tax Calculations

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png?w=700)

Calculating your tax liability involves several steps:

Step 1: Determining Taxable Income

Your taxable income is your total income minus allowable deductions and exemptions.

Step 2: Tax Rate Determination

Once you have your taxable income, you need to find the applicable tax rate based on your income level and filing status.

Step 3: Tax Liability Calculation

To calculate your tax liability, multiply your taxable income by the applicable tax rate.

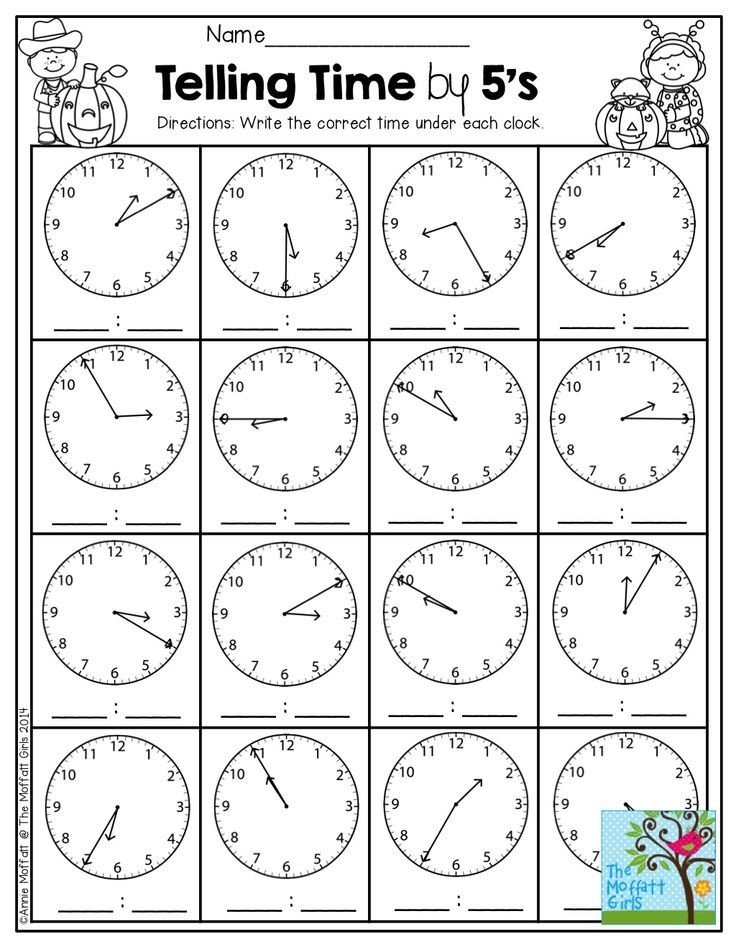

Filing s

Filling in your 1040 SR form can be a daunting task, but it doesn’t have to be. Follow these step-by-step s to make the process a breeze.

Once you’ve gathered all the necessary documents, you can start filling out the form. Start by filling in your personal information, such as your name, address, and Social Security number. Then, you’ll need to report your income from all sources, including wages, salaries, tips, and self-employment income.

Filing Options

You can file your 1040 SR form electronically or by mail. If you file electronically, you can use the IRS e-file system or a tax software program. If you file by mail, you can download the form from the IRS website or get a copy from your local IRS office.

Deadlines

The deadline for filing your 1040 SR form is April 15th. If you file electronically, you have until October 15th to file. If you file by mail, you have until April 15th to file.

Assistance

If you need help filling out your 1040 SR form, you can get assistance from the IRS. You can call the IRS at 1-800-829-1040 or visit the IRS website at www.irs.gov.

Common Errors and Troubleshooting

Innit, filling out a tax return can be a right mare, especially if you’re not clued up on the rules. Here’s a heads-up on some of the most common cock-ups people make, along with some tips on how to avoid ’em.

If you do end up getting stuck, don’t panic. There are loads of resources available to help you out. You can find answers to your questions on the HMRC website or by calling their helpline.

Mistakes to Watch Out For

- Not declaring all your income. This is a big no-no and could land you in hot water with the taxman.

- Claiming deductions you’re not entitled to. Only claim deductions for expenses that are actually allowed under the rules.

- Making mistakes in your calculations. Double-check your figures before you submit your return.

- Not filing on time. This could result in penalties and interest charges.

Related Forms and Publications

Filing the 1040 Sr Printable Form might involve other tax forms or require you to refer to IRS publications for more info. Here’s a list of what you need to know.

If you need to file additional schedules or forms with your 1040 Sr, make sure you have the following:

- Schedule A (Form 1040), Itemized Deductions

- Schedule B (Form 1040), Interest and Ordinary Dividends

- Schedule C (Form 1040), Profit or Loss from Business

- Schedule D (Form 1040), Capital Gains and Losses

- Schedule E (Form 1040), Supplemental Income and Loss

- Schedule F (Form 1040), Profit or Loss from Farming

- Schedule H (Form 1040), Household Employment Taxes

- Schedule SE (Form 1040), Self-Employment Tax

For more information and guidance on the 1040 Sr Printable Form, check out these IRS publications:

- Publication 17, Your Federal Income Tax

- Publication 525, Taxable and Nontaxable Income

- Publication 536, Net Operating Losses

Frequently Asked Questions

What are the eligibility requirements for filing the 1040 Sr Printable Form?

To be eligible to file the 1040 Sr Printable Form, individuals must be 65 years of age or older by the end of the tax year.

What types of income need to be reported on the 1040 Sr Printable Form?

All sources of income, including wages, self-employment income, investment income, and pension distributions, must be reported on the 1040 Sr Printable Form.

What are some common errors to avoid when filling out the 1040 Sr Printable Form?

Common errors include miscalculating income, overlooking eligible deductions and credits, and making mistakes in transferring information from other tax forms.